24-hour time frame

In the past few weeks, we have questioned that the US economy continues to "feel good," as Fed Chairman Jerome Powell assured us in a recent speech. However, recent macroeconomic reports from across the world have indeed confirmed that most of the key indicators have increased compared to the previous period. Thus, these indicators can now begin to pull up and the rest, which cause the greatest number of questions. Last week, business activity indices in the US services and manufacturing sectors showed an increase, two labor market reports significantly exceeded expert forecasts, wages remained at a good level, and only the unemployment rate rose slightly to 3.6%, which, however, did not change the general picture of things. Thus, industrial production, GDP and inflation are still indicators that raise certain questions. However, the first indicator may begin to increase in the coming months, as business activity in this industry has recovered. On the other hand, inflation is already at a value of 2.3% y / y and the questions on it are only in what period of time the indicator will be able to maintain such values. The Fed wants to see inflation at around 2% over a long period of time. The most questionable indicator of GDP, which has been slowing down in the past year and a half and is now 2%. It can be recalled that the US dollar was growing "leaps and bounds' for the entire previous week, and next week, important data will be published in the United States, which will support the US currency again in case that it is strong. Moreover, several more or less important reports will be published in the European Union.

On Monday, the calendar of macroeconomic events of the European Union will be completely empty. There will be absolutely nothing to pay attention to, so we believe that this is a good day and a good opportunity for the euro / dollar pair to roll back a bit and begin an upward correction.

On Tuesday, Fed Chairman Jerome Powell will make a speech at the US Congress on economics and monetary policy. If we are wondering whether the topic of monetary policy will be affected before each speech of the head of the Central Bank, then in this case, it will be affected with a probability of 100%. As usual, Powell's rhetoric will be of great importance to the dollar, although after the latest macroeconomic reports it is unlikely to be a "dovish". Most likely, Powell will note the "good" state of the economy again, the strength of the labor market (especially against the background of ADP and NonFarm Payrolls reports), as well as a good state of inflation. And, of course, he is unlikely to avoid global risks, such as the "coronavirus". Thus, we potentially believe that Powell's speech may provide little support to the dollar.

On Wednesday, Jerome Powell will make another speech all in the same Congress, during which he, for example, can discuss the topic of lowering / raising rates in 2020 and the issue of completing the Fed's securities buyback program ("non-QE"). Also on this day, industrial production for December in the European Union will be published with a forecast of -0.8% y / y. Even if this forecast just comes true, it is still negative for the euro. However, it can be assumed that industrial production in the Eurozone will decrease much more than by 0.8%, bearing in mind a similar report in Germany, which showed a decrease of 6.8% y / y. Naturally, this is another factor potentially putting pressure on the euro.

On Thursday, we will find out the final January inflation figures for Germany and the United States. In Germany, the consumer price index may accelerate to 1.7% y / y, in the United States - up to 2.5%. From the point of view of forecasting, Thursday will be the most difficult day, since it is extremely difficult to predict what the real value of the CPI will be. Perhaps, American inflation will not reach the value of 2.5% y / y and on this day, the euro will receive a slight delay.

Well, data on retail sales will be published on the last trading day in the United States, as well as the most important indicator of industrial production for January. It can be recalled that the last value of production was also negative, but it may recover in January due to increased business activity in this sector. Thus, in general, almost all the news from overseas may turn out to be positive, which may provoke new purchases of the American dollar by traders. In this regard, the euro currency can only hope that the statistics from overseas will not be as strong as we expect, and the "paradoxical situation". Quotes of the EUR / USD pair are now only 60 points from two-year lows, so theoretically, traders can stop buying the dollar at any time, despite the macroeconomic background.

Trading recommendations:

The trend for the euro / dollar pair remains downward. Thus, on the 4-hour timeframe, it is recommended to continue to consider short positions until signals about the beginning of an upward correction appear, which is also very likely in the following week. On a 24-hour timeframe, the pair may also begin to adjust, but it will be much more difficult to "catch" the correction here.

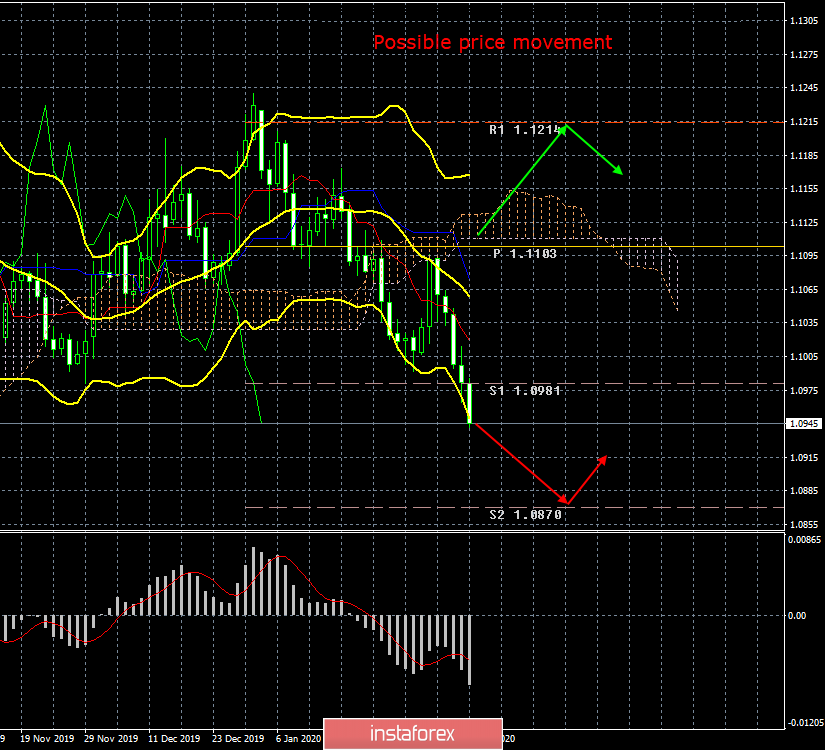

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română