The markets are waiting for the US employment data for January. However, they are likely to provoke only a short-term surge in the EUR/USD quotes, and are unlikely to change the current balance of power in the main currency pair. If the Fed is willing to tolerate inflation above the 2% target, then an increase of 0.4% m/m in the average wages of PCE's leading indicator will not lead to an increase in the Federal funds rate. On the other hand, everyone is aware of the slowdown in the non-farm payrolls. Other drivers will affect the euro and the dollar, and the impact of which will contribute to the fall of the pair below the base of the 10th figure.

Personally, I have the beginning of 2020 associated with deja vu. Just like at the start of 2019, Bloomberg experts issued "bullish" forecasts for EUR/USD. This is due to the traditionally weak first quarter for US GDP, the de-escalation of the trade conflict between Washington and Beijing, the ECB's unwillingness to weaken monetary policy, and the Fed's intention to pause in the process of monetary restriction. In fact, because of the fiscal stimulus and the lack of cold weather, the US economy has done well. The ceasefire agreement between US and China was not signed until the end of 2019, and the European Central Bank, amidst a slowdown in the eurozone economy, not only reduced deposit rates, but also revived the QE. As a result, if it were not for the rapid rally in October to December, the euro would have lost 6% of its value against the US dollar.

The Euro zone economy has been severely affected by the trade wars, slowing global demand and GDP, declining growth in international trade, and a significant deterioration in business activity in the manufacturing sector. Judging by the decline of rates in the US debt, the worst is yet to come for the purchasing managers' indices, so the risks of EUR/USD is continuing.

Treasury yields and the global PMI:

The coronavirus and the trade war between Washington and Brussels could take the euro down. Despite Britain's exit from EU, uncertainty still remains over the European currency, due to the terms given to the companies from England regarding their access to enter the European Union's market. If the US GDP supported the fiscal stimulus at the beginning of 2019, then the start of 2020 will be supported by last year's cycle of Fed's monetary easing.

Thus, the EUR/USD is at the risk of sinking much deeper than the current levels, and rewriting the multi-year lows. The pair's ability to restore its lost positions, or at least repeat the October-December rally, will depend on the answer to two questions: How quickly will it be possible to deal with the coronavirus? Will the US-EU trade war start?

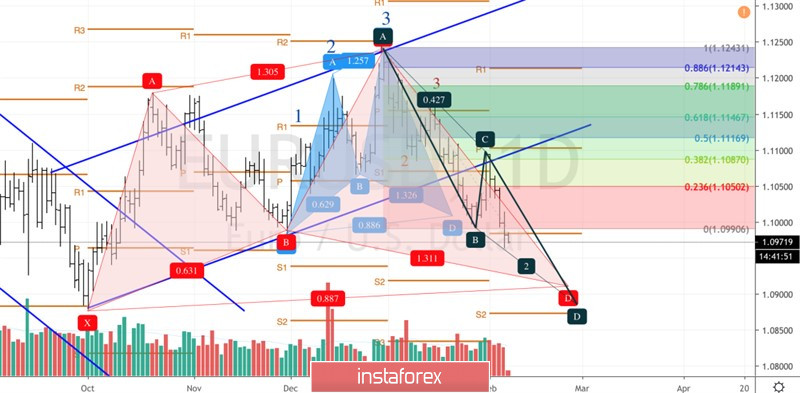

In the daily chart of EUR/USD, the pair continues its downward movement, which started due to the combination of the "Three Indians" and the 1-2-3 patterns. After clearly working out the child "Shark" pattern and transforming it into 5-0, the quotes were sent to the targets of 88.6% and 200% for the parent "Shark" and AB=CD patterns. They correspond to the area of 1.088-1.091.

EUR/USD, daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română