Economic calendar (Universal time)

One could say that there are few important indicators in the economic calendar, if not for one circumstance. Today is the first Friday of the month, which means its Nonfarm time. The reaction to the publication of the expected data today can be very unpredictable. Everything can go relatively calmly, and maybe, conversely, be accompanied by sharp fluctuations and impressive price changes.

13:30 unemployment rate (USA)

13:30 change in the number of employees in the non-agricultural sector (USA)

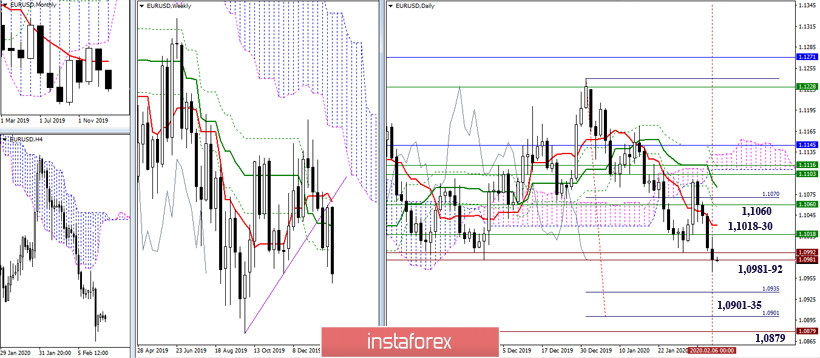

EUR / USD

The end of the first week of February is getting near. The players on the downside did an excellent job. Now, for the emergence of further bearish prospects, it is important to maintain positions and gain a foothold below the supports that were formed by the minimum extremes of the past 1.0981 and 1.0992. In the form of subsequent bearish prospects in this situation, the daily target for the breakdown of the cloud (1.0901-35) and the minimum extremum (1.0879), which separates the pair from the restoration of the monthly downward trend, appear. Today, resistance can be identified in the areas 1.1018-30 (weekly Fibo Kijun + daily Tenkan) and 1.1060 (weekly Kijun + daily Fibo Kijun).

At the moment, the main advantages are on the downside of the players. The weakening factor is the pair's presence in the zone of growing correction. The reference points for correction are 1.0987 (central Pivot level). The euro has already risen into the zone of influence of which, and 1.1034 (weekly long-term trend), the level of R1 (1.1009) can act as an intermediate resistance on this path. If the correction is completed and the decline continues, intraday supports are the classic Pivot levels S1 (1.0959) - S2 (1.0937) - S3 (1.0909).

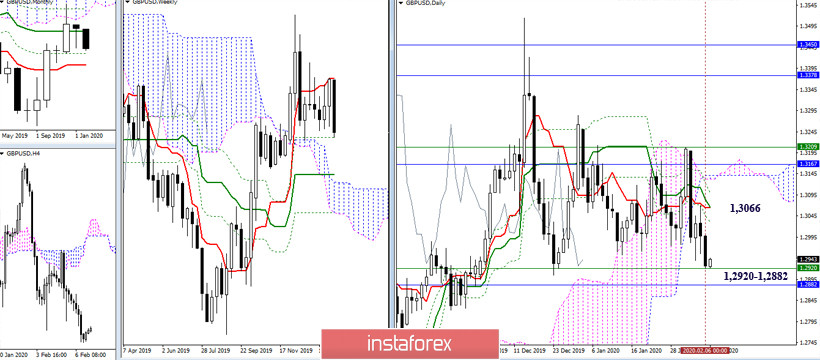

GBP / USD

By the end of the week, the bears that have been dominating recently went down to the key supports of 1.2920 – 1.2882 (weekly and monthly kijuna Fibo). These supports are the lower limit of the current consolidation zone, so for further bearish plans and prospects, it is important to break through the levels encountered and secure the consolidation below. In the role of the nearest resistance, in the case of the formation of another rebound and return to the consolidation zone, the daily cross acts today, uniting Tenkan and Kijun at 1.3066.

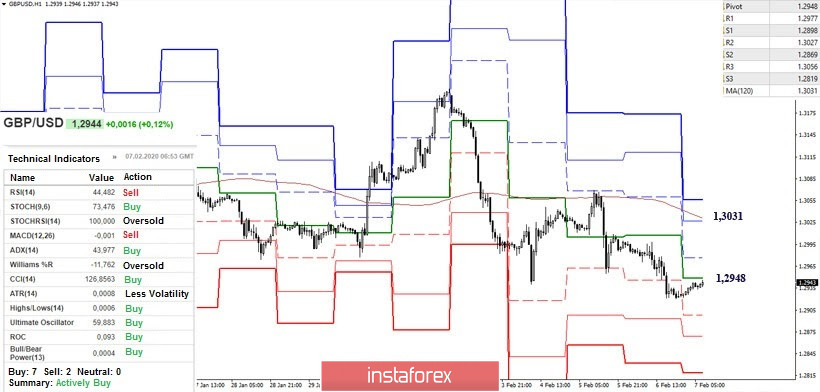

The met support of the higher halves led to a slowdown and the emergence of an upward correction on H1. Thus far, players on the increase have managed to climb to the first most important resistance of the lower halves – 1.2948 (the Central Pivot level of the day). Now, consolidation above will contribute to the development of the emerging upward correction. The main reference point will be the resistance of the weekly long-term trend. At the time of analysis, the weekly long-term trend is around 1.3031. The intermediate resistance on the rise to the moving average is located at 1.2977 (R1). If the correction is completed and the downward trend is restored on H1, 1.2898 – 1.2869 may be supported. These classic Pivot levels are reinforced by support for the higher halves (1.2882), as well as 1.2819 (S1).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română