The US dollar grew once again against euro, pound, and other world currencies, due to a good data on the US economy. However, traders should not relax, as today is a very important day, since reports on the US unemployment rate, as well as the number of people employed in the non-agricultural sector will be released. These reports will indicate the state of the economy.

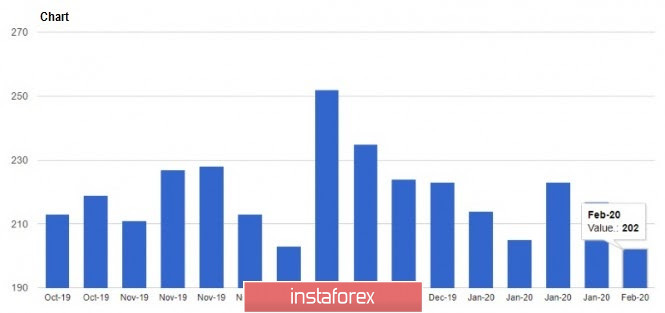

The dollar was supported by yesterday's weekly data from the US Department of Labor regarding the number of Americans who applied for unemployment benefits for the first time. The number of initial applications for unemployment benefits for the week of January 26 to February 1 decreased by 15,000, and amounted to 202,000. Economists had expected the number of applications to be 215,000. Meanwhile, for the week of January 19 to 25, the number of applications was revised upwards, and amounted to 217,000. As for the number of secondary applications for the week of January 19 to 25, it increased by 48,000, and amounted to 1.751 million.

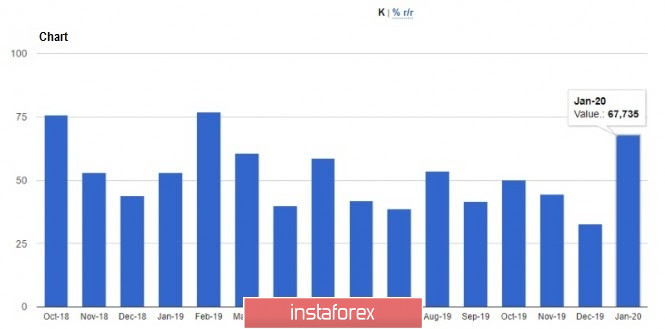

However, it should be noted that in January 2020, the number of layoffs in the United States increased by 106%, and amounted to 67,735. This is the highest level recorded since February 2019. A report by Challenger, Gray & Christmas, Inc., also indicated that compared to the same period in 2019, the number of job cuts increased by 28%. However, the technology sector suffered the most, and companies reported a dismissal of 13,869 workers. At the same time, in the retail sector, 10,444 employees were laid off.

An important report on the number of people employed in the US non-agricultural sector will be released today. The number of non-agricultural jobs is expected to increase by 163,000 in January, up from its record of 145,000 in December. However, if the data turns out to be worse, the pressure on the US dollar may return, because even with a value of 163,000, there is still a slowdown, since the average value from the past year was 174,000. Moreover, its average value last 2018 was 210,000 jobs per month. Given that the unemployment rate is almost at its historical lows, any report shifting to the negative side can significantly harm the upward trend of the dollar. Nevertheless, the overall state of the labor market, which still indicates stability in the economy, will support the US dollar in the long run.

The US labor productivity continues to show growth. According to the data, as compared to the previous quarter, labor productivity outside of US agriculture increased by 1.4% per annum in the 4th quarter of 2019. Economists had expected a growth of 1.6%.

Meanwhile, during an appearance on Fox Business yesterday, US Treasury Secretary Steven Mnuchin said that the removal of import duties in China is part of the trade agreement, and the remaining duties should encourage the said country to reach a second-phase agreement. As for the situation with the coronavirus, Mnuchin believes that it does not create any special problems on the economy. On the other hand, GDP growth is expected to be below 3% in 2020, due to problems at Boeing, which is slightly below economists' forecasts.

As for the technical picture of EUR/USD, today's data on the US labor market will directly affect the pair. Buyers of risky assets need to regain the resistance of 1.0990, because if the week closes above this range, we can expect an upward correction to the area of 1.1025 and 1.1070. If the US data is better than economists' forecasts, euro may fall to the support area of 1.0960. Its breakdown will increase the pressure on the trading instrument, and lead to new lows in the area of 1.0940 and 1.0900.

AUD/USD

The pressure on the Australian dollar returned, after the Reserve Bank of Australia once again indicated the possibility of lowering interest rates in the near future. Even though the economic outlook has improved due to a slight increase in global growth, there are still significant areas of uncertainty, such as trade disputes and the coronavirus.

The Central Bank expects a stronger consumption growth this year and a faster inflation over the next couple of years. However, this does not exclude the issue that the regulator will not resort to lowering the interest rates, since lowering them can contribute to more household debt, which is already huge at the moment. Moreover, low rates will return the demand for mortgages, which will negatively affect prices, leading to another surge in the price of residential and commercial real estate.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română