To open long positions on GBPUSD, you need:

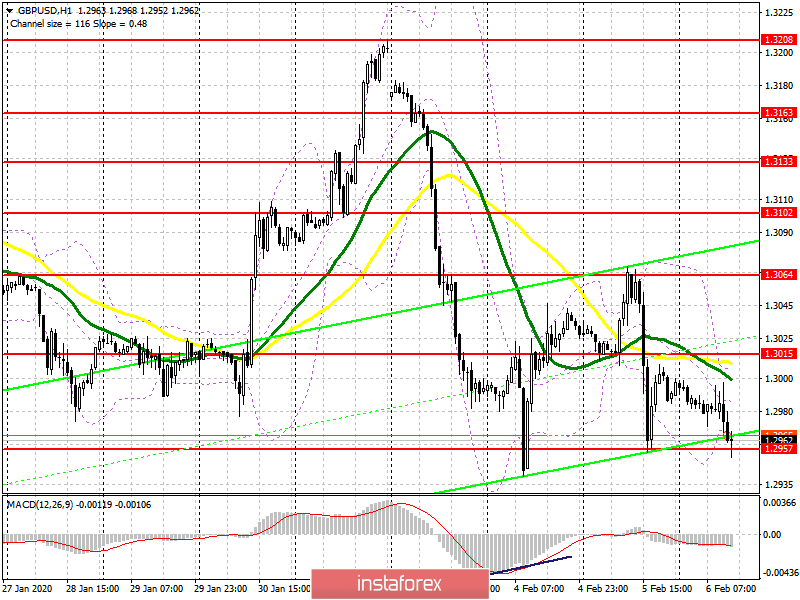

In the morning, I paid attention to the support of 1.2979, however, building illusions from it was a very bad idea but hopes remained. Now, when the bulls missed this level, a new major downward wave may be formed. It remains only to close the day below 1.2957 and update the minimum of yesterday's North American session. In this situation, it is better not to rush with purchases from the area of 1.2939. A more optimal option would be to form a false breakdown, which will give some confidence to the bulls, however, it will not be the right decision to count on a rebound of more than 20-30 points. Larger long positions can be viewed at the December lows around 1.2896 or buy the pound for a rebound from the support of 1.2845. The option of GBP/USD growth in the second half of the day and the formation of the lower border of the side at yesterday's minimum in the area of 1.2957 is not excluded, which will preserve the chance of the pound's recovery in the short term. However, it will be possible to talk about the return of real buyers only after fixing above the minimum of 1.3015.

To open short positions on GBPUSD, you need:

After the news that the EU may weaken the London financial market by changing the MiFID II on financial instrument markets, the bears continue to control the market and have already reached the minimum of yesterday. But it seems that it is at this level of 1.2957 that further bearish momentum needs new sellers. Only a real breakout and consolidation below the range of 1.2957 will open a direct road to the area of the lows of 1.2896 and 1.2845, where I recommend fixing the profits. However, we can expect such a powerful decline in the GBP/USD only if there is another negative information about the course of trade negotiations between the UK and the EU. In the scenario of the pound returning to the resistance of 1.3015, you can only open short positions from there if a false breakdown is formed, but you can safely sell the pair for a rebound from the maximum of 1.3064.

Signals of indicators:

Moving averages

Trading is below the 30 and 50 daily averages, which indicates a further decline in the pound in the short term.

Bollinger Bands

A break in the upper border of the indicator at 1.3015 will resume the bullish trend, and if the lower border of the indicator breaks in the area of 1.2957, we can expect a further decline in the pound to the December lows.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română