A series of positive statistics for the United States, as well as the confident pace of the S&P 500 index made investors doubt the prospects of reducing the gap in the growth of the American and European economies. This dropped the EUR / USD pair below the base of the 10th figure.

According to the ADP report published yesterday, employment in the US private sector increased by 291 thousand last month, which was much higher than the preliminary estimate of 157 thousand. This January increase in jobs was the largest since May 2015.

Meanwhile, the report of the Institute for Supply Management (ISM) on the index of activity in the US services sector expanded from December's 54.9 points to 55.5 points last month. This is the highest recorded since August 2019.

In addition, on Wednesday, the US Department of Commerce reported that last year, the country's trade deficit fell for the first time in six years (by 1.7%, to $ 616.7 billion). It seems that Donald Trump's protectionist policy is producing results.

Against this background, the USD index reached the highest values since the beginning of December near 98.25, and the EUR/USD pair closed below 1.1000 for the first time since October.

On the other hand, the data released on Wednesday for the Euro zone was mixed. While the index of activity for the service sector and the composite PMI for January were revised upward, the retail sales in the region fell sharply in December. Moreover, the comments made by ECB chief Christine Lagarde yesterday were not encouraging. She said that climate change will affect the monetary policy, and the coronavirus epidemic increases the level of uncertainty. In addition, the market interpreted the tone of the ECB's statements last meeting as "dovish", so concerns about Lagarde's comments increased. The 1.10 level was broken, and the next stop for EUR/USD may be 1.0925.

Meanwhile, the British currency has come under the influence of mixed factors: on the one hand, there's positive statistics on the United Kingdom, while on the other, there's fears that the hostile relations between UK and EU will weaken the country's economy next year.

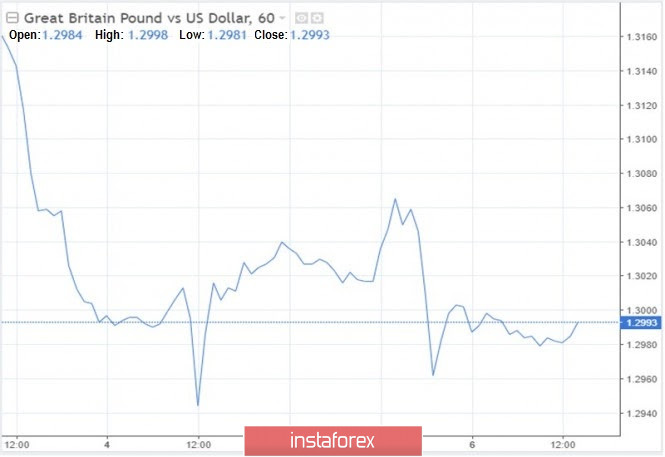

The GBP/USD pair tried to recover on Wednesday, and even tested the local high at $1.3070. However, the positive mood of traders quickly disappeared, and the British currency re-entered the red zone, ending yesterday at $1.2992. Today, the GBP/USD pair is trading at the level of 1.2990.

Pound's growth on Wednesday was due to the unexpectedly strong data on the services sector of the United Kingdom, as well as the overall improvement in the global market sentiment. Everything, however, was spoiled by the news that EU wants to rewrite the MiFID 2, in order to use it to restrict the activities of the financial sector in London.

"It is now clear that both Europe and Britain have no time for ceremonies. We believe that the pound will remain as the main indicator of risk in this regard, " said Ned Rumpeltin of Toronto-Dominion Bank.

The pound is trying to grow this year, but so far, it has been unsuccessful. Investors fear that things will be so bad in the British economy, that the local Central Bank will have to stimulate it. As soon as these concerns subsided amidst the release of positive statistics for the United Kingdom, the threat of a chaotic Brexit loomed again on the horizon, pushing the pound backwards. The British currency is likely to move in this circle for a long time, until the EU-UK trade relations are clarified. The deadline for concluding a trade deal between the parties is the end of 2020.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română