Yesterday was a rare day, as the market behaved strictly in the logic of the published macroeconomic data. We have rarely seen such exemplary market behavior in recent years, so this situation is unusual, unfamiliar and uncomfortable. I want to find some kind of conspiracy, secret meaning, or something like that, which is actually quite possible if desired. After all, the Senate fully acquitted Donald Trump, and considered the charges against him untenable. In short, the Republicans who control the majority of Senate seats refused to dismiss their only candidate in the upcoming presidential election, which was quite predictable. Despite that, the situation is a good news for the markets, because the American political system, which is characterized by incredible stability, has survived. If the impeachment took place, then Donald Trump would become the first President of the United States to find himself in the dock. What would investors who are used to the transparency and stability of the system think, if the President of the United States was sent to prison? Moreover, the most important thing is that in the case of an impeachment, sharp changes in Washington's economic policy will be possible. Thus, if desired, the strengthening of the dollar can be explained by the decision of the Senate, although it does not fit into the behavior of major currencies, and does not coincide in time.

\

\

The first thing that catches our eyes is that at the beginning of the trading day, the pound and the euro were moving in completely different directions. If this was caused by the failed impeachment of Donald Trump, the movement should have been in the same direction. What perfectly explains what happened is the published macroeconomic data.

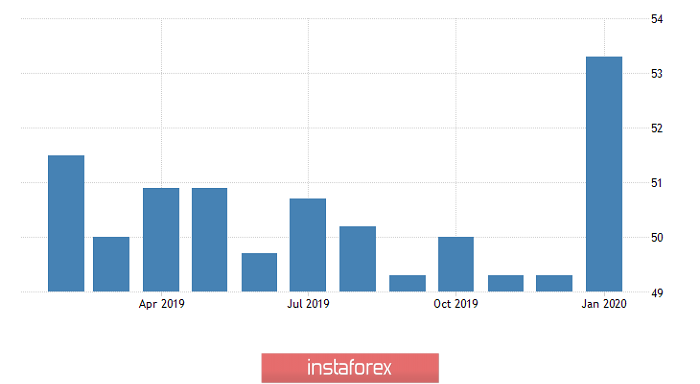

Pound's growth was due to the much stronger than expected final data on business activity indices. In particular, it is the increase of the index of business activity in the service sector from 50.0 to 53.9, instead of 52.9. Largely due to this, the composite index of business activity was able to grow from 49.3 to 53.3 instead of 52.4. Moreso, the main thing is not even that the indexes were better than forecasts. It is because the composite index rose above the 50.0 point mark, which is a kind of border separating economic growth from stagnation.

Composite index of business activity (UK):

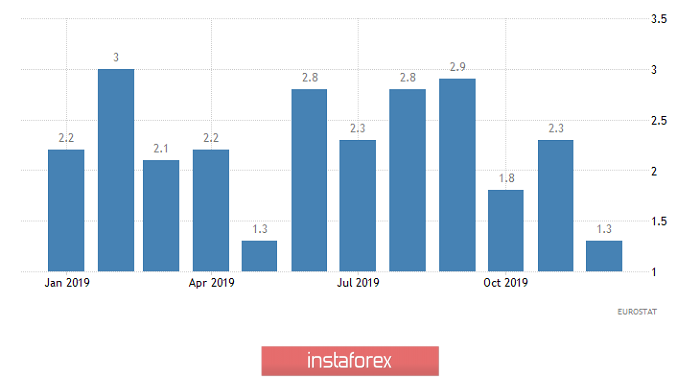

Another thing is the single European currency, which, despite the generally good data on business activity indices, was steadily losing its positions. Although the index of business activity in the service sector fell from 52.8 to 52.5, what we were waiting for is a decrease to 52.2. Moreover, the composite index of business activity, which should have remained unchanged, rose from 50.9 to 51.3. Despite that, the most interesting thing is that when these data were published, the single European currency stood still. The market was waiting for data on retail sales, which when published, caused the collapse of the single European currency. It was incredibly unexpected and disappointing, as everyone expected retail sales to accelerate from 2.3% to 2.5%. Instead, it slowed to 1.3%. In addition, retail sales decreased by 1.6% for the month, which is an extremely significant slowdown, telling us that the prospects for rising inflation, which until recently seemed so real, are turning out to be false. In line with this, the most remarkable thing about this story is that the euro began to decline even before the publication of retail sales data, and stopped as soon as they became known. This raises a number of unpleasant questions for Eurostat about the ability of its employees to keep their mouths shut, especially when communicating with friends from large banks.

Retail sales (Europe):

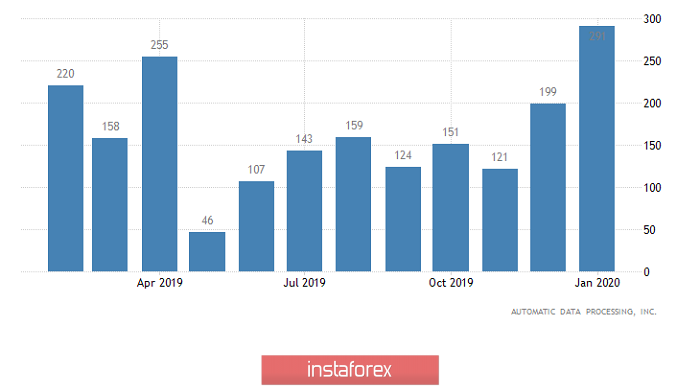

When the US session opened, not only did the euro rush down with renewed vigor, but the pound followed as well. Naturally, I would like to point that the whole scenario is caused by the Senate vote on Trump's impeachment, however, the vote took place after the publication of all American statistics, and the dollar strengthened precisely during their publication. More precisely, it strengthened during the publication of only one indicator - the employment data from ADP. This same employment increased not only by 142 thousand, but by 291 thousand. That is almost twice as much. Moreover, at the same time, employment increased by 199 thousand in the previous month, meaning that the rate of employment growth did not slow down, but accelerated. This is the largest increase in employment since 2015, so it is not surprising that investors were extremely happy. In addition, business activity indexes showed a slightly larger increase than expected, particularly the index of business activity in the service sector, which was supposed to grow from 52.8 to 53.2, but rose to 53.4. The composite index of business activity also increased to 53.3 instead of 52.7 to 53.1.

Change in employment from ADP (United States):

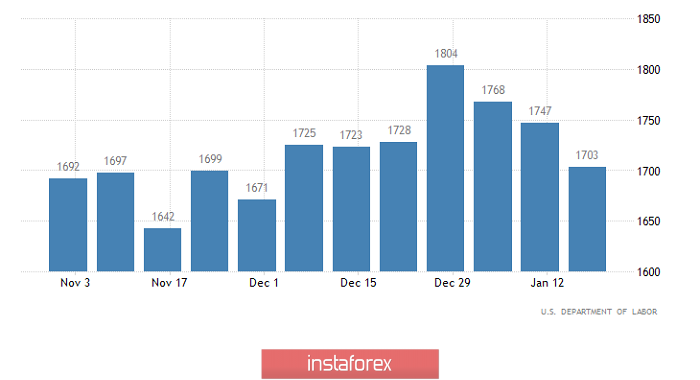

should be reduced by 5 thousand, due to a decrease of 8 thousand in the number of repeated applications for unemployment benefits. On the other hand, the number of initial applications for unemployment benefits may increase by 3 thousand. However, let's not forget that investors will remain cautious ahead of the publication of the US Department of Labor's report, especially since the latest indirect data clearly told us that its content will not coincide with the forecasts.

Number of repeated applications for unemployment benefits (United States):

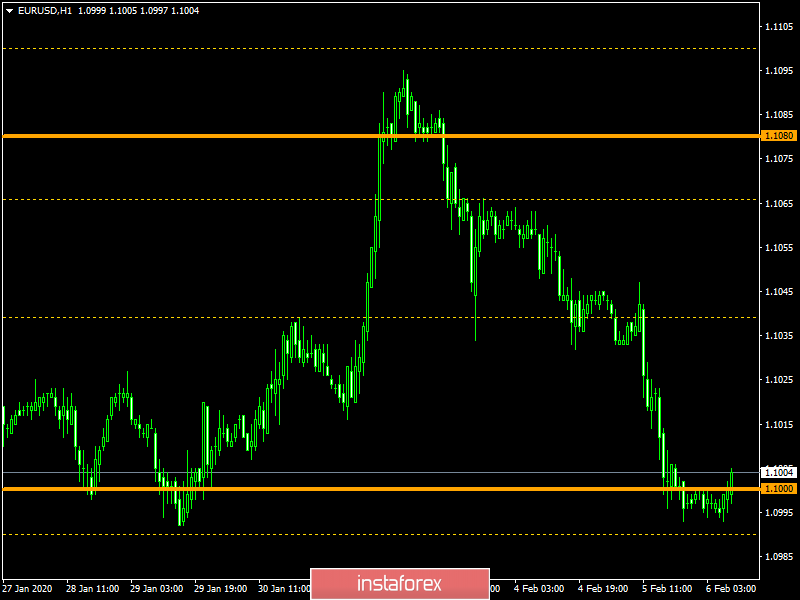

The EUR/USD currency pair has maintained a downward interest over the past days, eventually descending to the area of the psychological level of 1.1000. A temporary fluctuation along the values of 1.0990 and 1.1040 may happen.

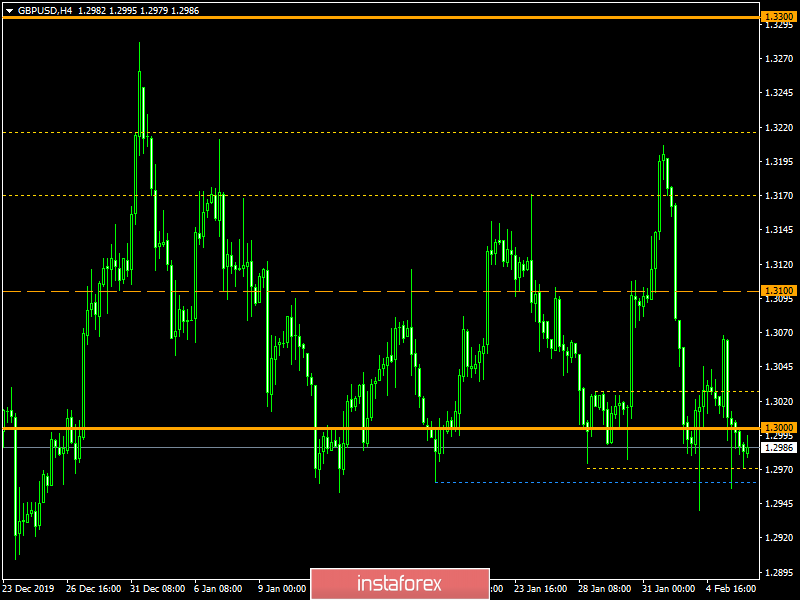

The GBP/USD pair once again went to storm the area of the psychological level of 1.3000. However, the attempt to break through it was not successful, so as a result, a slowdown was recorded. A temporary fluctuation along the 1.3000 coordinate, where the reference values are 1.2960 and 1.3055, may happen.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română