US exchanges closed with strong growth both on the positive news of ADP and ISM, as well as on reports that a research group at a Chinese university found effective drugs to fight coronavirus. The Dow Jones index increased by 1.68%, the S&P 500 by 1.13%, Asian indices are adding steadily on Thursday morning, Shanghai Composite by 1.56%, and Nikkei 225 by 2.57%.

On the other hand, oil quotes add more than 2% on expectations of the decision of the OPEC and technical committee, which may announce the approval of a decision to limit production today. The panic is surely disappearing, despite the fact that it is still a long way from actually stopping the epidemic.

The US Senate acquitted Donald Trump on both counts and the impeachment process has been completed. This decision was expected, given the predominance of Republicans in Congress. Nevertheless, the dollar gets support, because the decision reduces the level of uncertainty.

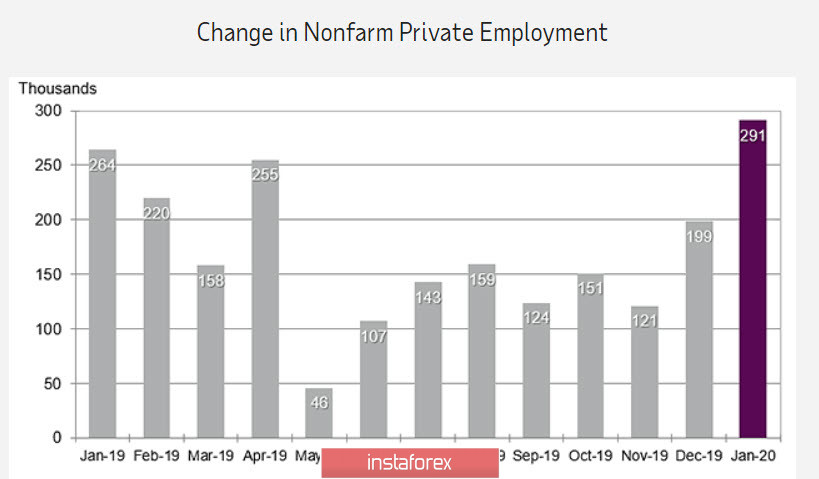

The January ADP report on employment in private business turned out to be unexpectedly strong, with growth of 291 thousand, which was significantly higher than the forecast of 156 thousand, and this is the highest monthly increase since the pre-crisis 2006.

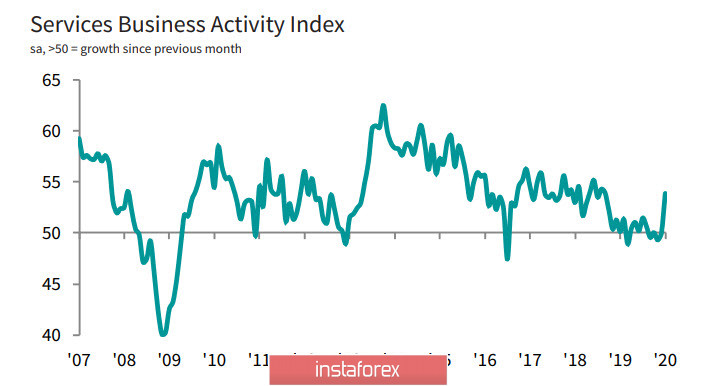

In the services sector, the increase was 237 thousand, and one could expect a strong reaction of the dollar, since the chances that the non-farm Friday report will also be higher than forecasts. However, the market reaction turned out to be restrained, despite the fact that the ISM service sector report also exceeded forecasts and amounted to 55.5p against 54.9p in December. The thing is that the increase in the ISM index is mainly due to the growth of business activity (growth of 60.9p) and new orders (56.2p), but with regard to employment, this subindex decreased by 1.7p and amounted to 52.1p.

The contradiction between the ADP report, which showed strong employment growth in the services sector, and ISM, whose trend looks exactly the opposite, did not give the dollar bulls a clear reason to go on the attack. Still, you have to wait for the Friday report to assess the dynamics of the labor market, which means that the trend towards range trading may turn out to be stronger than the trend in the next two days.

Reducing the panic is in the hands of risky assets, but real appreciation of commodity currencies has not yet been observed. Such caution may indicate that the current growth of optimism is temporary, and there are no real prerequisites in order to exclude the global economy from sliding into recession.

EUR/USD

The euro declined again to the support zone of 1.0980 / 98, as the positive from Markit reports, which showed a slight increase in business optimism in January, is clearly not enough to resume growth. The general decrease in tension generally plays against the dollar, but the euro cannot take advantage of this because it does not have its own impulse due to the lack of important economic news.

The technical view of EUR/USD remains bearish. The rapid growth towards the trend line broken at the level of 1.1090 on January 23 unexpectedly ended with a pullback. Meanwhile, support 1.0980 / 98 is the last barrier before lowering to the September low of 1.0880.

GBP/USD

The pound tried to recover some of the losses after the publication of the PMI Markit indices, which showed the maximum increase in activity since September 2018.

At the same time, a 7.3% failure in automobiles indicates a still low consumer confidence. Nevertheless, the January data should be considered satisfactory. The decision of the Bank of England to leave the rate unchanged seems reasonable.

Technically, the pound has little chance of resuming growth if the risk appetite in global markets develops. In this case, we can expect growth in the zone 1.3130 / 50 in order to update the maximum of January 31. Support zone is at 1.2940 / 60, if there are signs of a return of panic, then an attempt to pass below the support zone will be almost certain.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română