The impeachment of Donald Trump is over. The Senate's vote yesterday completed the process of the US President's impeachment. Trump was acquitted by the Senate in the first and second articles. Democrats voted against Trump unanimously, while the Republicans voted in favor of Trump almost unanimously (except for MITT Romney). As a result, the accusations of the president exceeding his powers, as well as the attempt to influence the country's policy through Ukraine President Volodymyr Zelensky is now closed.

However, even before the results of the vote came out, the US dollar significantly strengthened its position against the euro and the pound, after reports indicating a reduction in the US foreign trade deficit, as well as an increase in the number of jobs in the private sector came out. The deficit decreased for the first time since 2013.

According to the US Department of Commerce, the foreign trade deficit for 2019 decreased by 1.7%, amounting to 616.8 billion US dollars. Meanwhile, trade deficit in goods fell by 2.4% last year, and amounted to 886.0 billion dollars. A sharp reduction in imports against the backdrop of trade duties, as well as a trade war with China, allowed such results to be achieved. On the other hand, exports have declined, so the trade deficit with China fell by 17.6%, and amounted to 345.62 billion dollars. The exports of goods to China decreased by 11.3%, whereas imports of Chinese goods decreased by 16.2%.

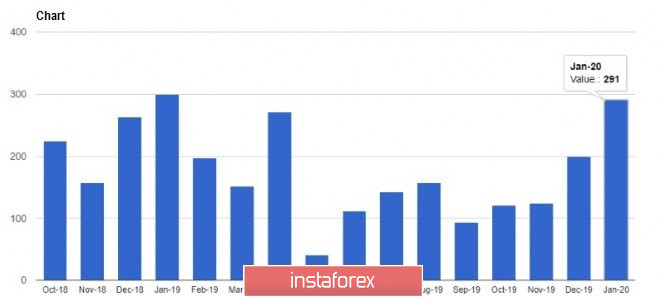

US dollar purchases marked the release of the report on the number of jobs in the US private sector. According to the data, the number of jobs in January of this year increased by 291,000 at once, exceeding all the forecasts of economists. ADP noted that the growth was mainly due to the small and medium-sized companies. Economists, on the other hand, forecasted that the number of jobs will rise by 150,000. In detail, the number of jobs in small companies increased by 94,000 at once, while the increase in medium-sized companies was 128,000. These increases were directly related to the mild weather conditions in the winter. ADP believes that the base rate of job growth corresponds to low stable unemployment, and is close to 125,000 per month.

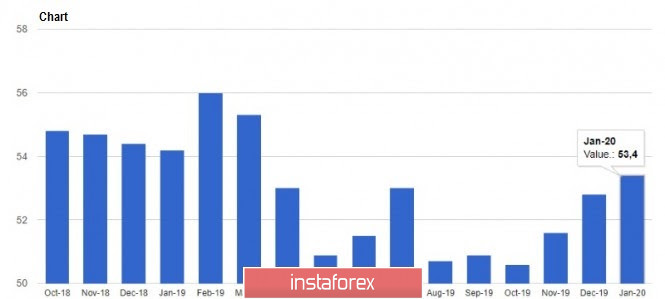

Another good report for the US economy are the indicators of activity in both the private sector and the service sector. According to IHS Markit, the final purchasing managers' index (PMI) for the services sector rose to 53.4 points in January 2020, compared to 52.8 points in December 2019. Despite the fact that the index increased mainly due to the increased customer demand, the expectations of companies remained unchanged.

The Institute for Supply Management (ISM) also published its data yesterday regarding the PMI index for the non-manufacturing sector of the United States. It also rose to 55.5 points in January this year, against 54.9 points in December. Meanwhile, the employment sub index fell to 53.1 points, as did the price sub index, which fell to 55.5 points in January. On the other hand, business activity and the sub index of new orders increased significantly to 60.9 and 56.2 points respectively.

The speech of Fed representative Mary Daly did not interest the market. During an interview on CNBC, Daley said that the Fed's rate cuts in 2019 allow the US economy to cope with uncertainty, which is why US GDP growth in 2020 will remain at a level above 2%. Moreover, the Fed representative expects a gradual increase of 2% in inflation, which will allow making adjustments to the monetary policy.

As for the technical picture of the EUR/USD pair, the euro stopped at 1.0990, which is expected. If the bulls fail to hold this area, it is likely that the pressure on risky assets will resume with a new force, leading to an update of the lows in the area of 1.0965 and 1.0940. However, if the consolidation around 1.0990 confirms a large limit player, then a rebound up to the area of 1.1025 and 1.1050 resistances will happen.

GBP/USD

The pound did not enjoy a good report on the services sector, which should've supported the British economy at the beginning of this year. It disregarded the revision of January's purchasing managers' index (PMI) of the UK services sector from a preliminary value of 52.9 points to 53.9 points. Economists had expected the indicator to remain unchanged.

Instead, the pound was pressured by the news that EU may weaken the London financial market by changing the MiFID II directive on financial instrument markets. We are talking about the abolition of benefits provided for UK under MIFID II. Let me remind you that this kind of relief was introduced during the financial crisis, precisely to protect the interests of investors. If the EU takes this step, the entire financial sector will be under attack, as the changes will affect the accounting and trading of stocks, derivatives and commodities. The real importance of this problem is shown by the fact that the change in the directive will have a serious impact on companies such as Lloyds Banking Group and the Royal Bank of Scotland Group.

As for the technical picture of the GBP/USD pair, it is still very dangerous to talk about an upward correction of the pound. Today, all attention is focused on the level of 1.2970, in the area where the lower border of the current upward channel passes. If the price breaks this level, the trading instrument will collapse to the lows of 1.2900 and 1.2850, since the area of 1.2940 is unlikely to be able to resist the pressure of large sellers. Talks of an upward potential will be possible, only after the bulls regain the resistance of 1.3025, which in the future may lead to a repeat test of the highs of 1.3070, and an update of the 1.3140 area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română