Hello, dear colleagues!

Those who read yesterday's review of euro/dollar will remember that the main trading idea for the pair was recognized as sales when rising to the price zone of 1.1085-1.1095. Unfortunately, the price did not reach the designated area for sales, showing the maximum values of the session on February 4 at 1.1063.

Well, bearish sentiment for the pair is still strong, and yesterday's decline finds its continuation at the beginning of today's session. However, the most important events, and therefore price movements, are yet to come. Before proceeding to technical analysis and considering options for opening positions, let's list the most important macroeconomic data that can influence the price dynamics of euro/dollar today.

The eurozone will publish retail sales data for December at 11:00 (London time).

ECB President Christine Lagarde is scheduled to speak at 13:15 (London time).

There are also some macroeconomic statistics from the US today. At 14:15 (London time), data from ADP on changes in the number of employees will be released. Let me remind you that this data is considered to be a leading indicator of Friday's nonfarm, so traders should pay attention to them. At 14:30 (London time), the US will present data on the trade balance. Markit's business activity index for services will be released at 15:45 (London time).

Now let's look at the charts of the euro/dollar currency pair and see what changes yesterday's trading day brought.

Daily

Yesterday's trading closed under the Tenkan line of the Ichimoku indicator, which could not provide support or at least stop the decline. At the moment, the euro/dollar is trading near 1.1035, showing its readiness to continue the downward trend. In this case, as noted yesterday, the pair is likely to head to the area of the current key support level of 1.0992 and may try to break it. If the bears succeed, their control over the pair will become even more palpable.

The ascending scenario involves another rise to the green support line and an attempt to gain a foothold above it, breaking through the 89 exponential moving average, which is at 1.1089. Here, it should be noted that a little higher, 50 MA passes at 1.1094, and the resistance level at 1.1095. Thus, you understand that the task of the euro is not easy. From this, we can conclude that in today's trading, the euro/dollar is expected to decline or trade sideways. I do not think that players will be able to raise the price above 1.1095 and close the auction there.

H4

In this timeframe, the situation has not changed much. The pair is still trading in a descending channel with the following parameters: 1.1237-1.1172 (resistance line) and 1.0992 (support line).

Along with the situation, the trading plan that has been calculated based on the H4 chart pattern has not changed. Sales look technically correct from the 200 exponential moving average, which is located directly below the channel's resistance line, at 1.1083. In addition to the 200 EMA and the upper border of the descending channel, the green support line passes just above, the fate of which is not yet fully clear for its breakdown. Here lies the horizontal resistance level of 1.1095, and even slightly higher is the symbolic mark of 1.1100.

In my opinion, for all of the above to be broken, a strong catalyst is needed for the growth of the pair. For example, Friday's weak data on the US labor market. Without a strong and meaningful driver, it will be very difficult to breakthrough. That is why the main trading idea, according to the 4-hour chart, continues to be sales after growth in the area of 1.1085-1.1095. Purchases, in my opinion, represent certain risks right now, but those who wish can try to open long positions on euro/dollar when prices fall in the area of 1.1035-1.1015.

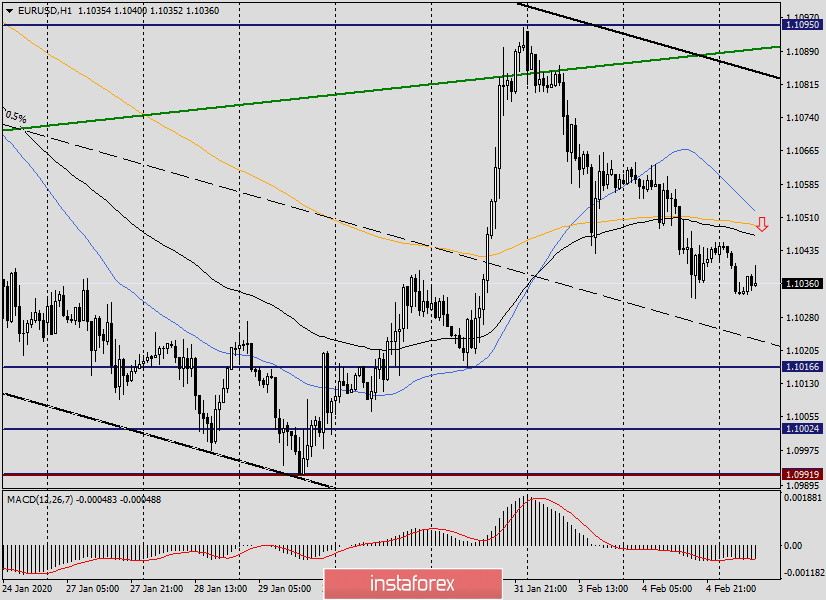

H1

So we finally got to the hourly chart. Here, the nearest sales can be immediately distinguished from the price zone of 1.1047-1.1052, where the used moving averages of 89 EMA, 200 EMA, and 50 MA have accumulated in a dense redoubt.

Purchases, as already noted, are riskier, but those who wish can try them after the euro/dollar drops to the price zone of 1.1035-1.1015.

I note that I still expect the end of the current week for EUR/USD on a major note. I dare to assume that the main events will take place on Friday at 14:30 (London time) after the publication of data on the US labor market. I expect that after these data, the pair will show a fairly good strengthening. And there, who knows what the market will show.

All the best!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română