EUR/USD

Analysis:

The direction of the short-term euro trend coincides with the bearish wave formation algorithm of December 31. It completes a larger bearish design. The hidden correction is nearing its end in the wave structure and the bearish section from January 31 has a reversal potential.

Forecast:

There is a high probability of the beginning of the decline in the impulse type. A corrective stop is expected today before the price breaks further down. A short-term rise is possible no further than the resistance zone. The active phase of decline is likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 1.1080/1.1110

Support:

- 1.1030/1.1000

- 1.0940/1.0910

Recommendations:

Purchases on the euro market in the coming sessions are unpromising. We recommend that you pay full attention to finding the best entry points for short positions.

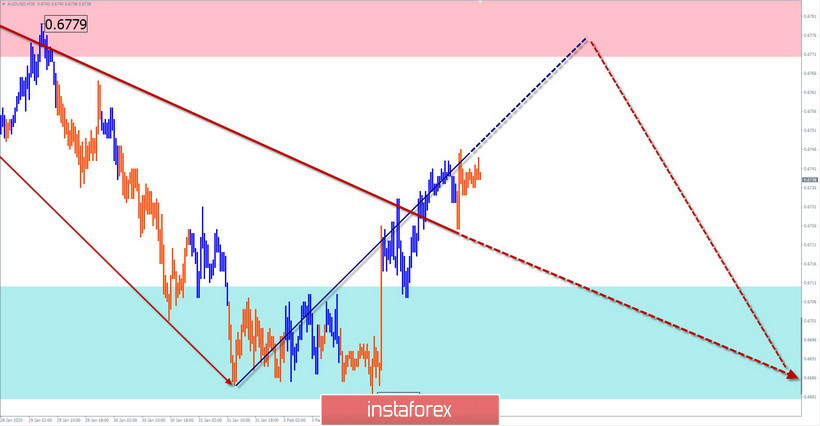

AUD/USD

Analysis:

The final part of the medium-term downward wave has been developing on the Australian dollar chart since the beginning of this year. The preliminary calculation allows you to wait for a decrease within 2 price figures to the nearest target zone. In recent days, an intermediate correction is formed.

Forecast:

Today, we expect the end of the price rise that began in recent days, the formation of a reversal and the beginning of a decline in the pair's exchange rate. Going beyond the designated price range in the next day is unlikely.

Potential reversal zones

Resistance:

- 0.6770/0.6800

Support:

- 0.6710/0.6680

Recommendations:

Trading transactions on the pair's market today are only possible within the intraday framework. When purchasing, you should reduce the lot as much as possible. It is recommended to focus on selling the tool.

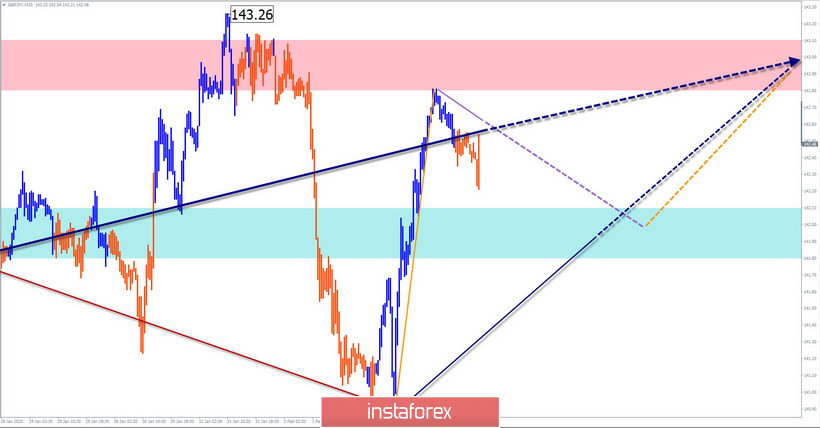

GBP/JPY

Analysis:

The pair's chart continues to form a sideways price corridor. The wave corrects the first section of the trend decline that began in December and it is entering the final phase.

Forecast:

In the coming day, the price is expected to move in the range between the nearest zones. A short-term break of the lower support border is not excluded. The start of price growth can be expected by the end of the day.

Potential reversal zones

Resistance:

- 142.80/143.10

Support:

- 142.10/141.80

Recommendations:

Until the end of the current corrective wave, sales of the pair are quite risky. Today, the optimal tactic in the pair's market will be short-term purchases with a reduced lot.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the tool's movements in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română