EUR/USD

Yesterday, factory orders in the United States for December came out with good data - an increase of 1.8% against expectations of 0.7%. And earlier on Monday, the ISM Manufacturing PMI for January showed an increase to 50.9 from 47.2 in December. Thus, the American industry was completely "rehabilitated" for Friday's failed Chicago PMI (falling from 48.9 to 42.9). The euro fell by 15 points yesterday.

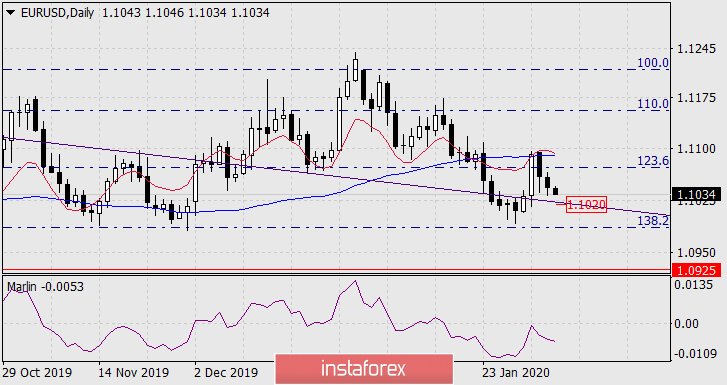

On the daily chart, the price is expected to approach the first target of 1.1020 - the embedded line of the price channel. Fixation under it opens the second target of 1.0925 - the lows of September 3 and 12 last year.

On the four-hour chart, the price is supported by the balance line. The price is in no hurry to break through to the target level, which allows the MACD line to adapt to the current decline. The line, price, and target level can meet at the same point. The coincidence of technical lines on the daily and four-hour charts will strengthen the level (1.1020), and a correction is likely from it. The transition of the signal line of the Marlin oscillator to the zone of ownership of the "bears" indicates that this goal is likely to be achieved soon.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română