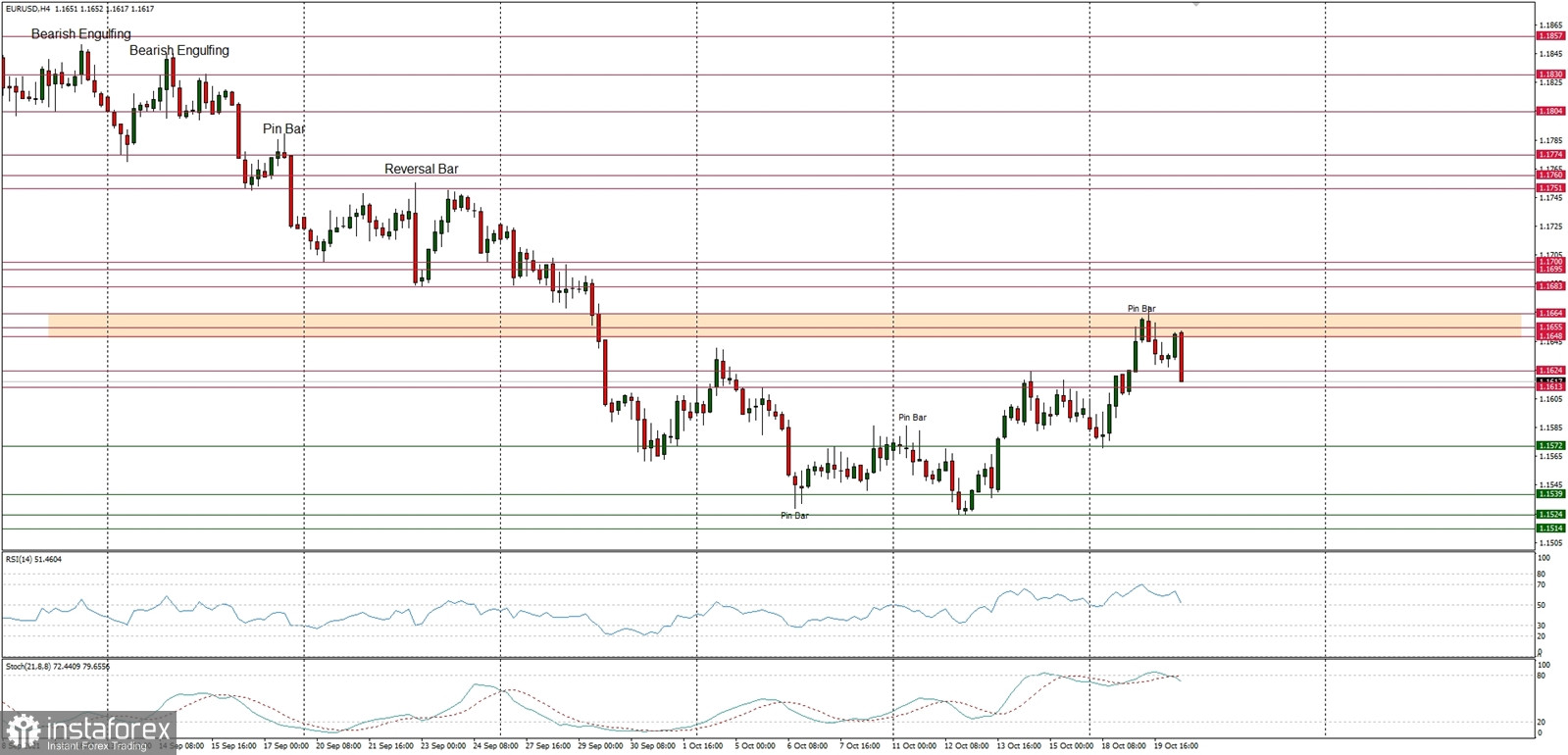

Technical Market Outlook:

The EUR/USD pair has been seen testing the key short-term supply zone located between the levels of 1.1648 - 1.1665, bit the bullish attempts to break through had been capped at the top of the rally. Moreover, there is a Pin Bar candlestick pattern made around the level of 1.1664 as well,so it looks like the market might resume the down move soon. In a case of a failure to break through this zone, there is a possible down move continuation towards the level of 1.1628 (intraday technical support), 1.1624 (technical support) or 1.1572 (the key short-term technical support). Despite the overbought market conditions the momentum remains strong and positive, so it supports the short-term bullish outlook as well.

Weekly Pivot Points:

WR3 - 1.1742

WR2 - 1.1684

WR1 - 1.1640

Weekly Pivot - 1.1582

WS1 - 1.1545

WS2 - 1.1479

WS3 - 1.1445

Trading Outlook:

The market is in control by bears that pushed the prices towards the level of 1.1562, which is the lowest level since November 2020. The next target for bears is seen at the level of 1.1497. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1909 and 1.2000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română