Crypto Industry News:

Shares of the ProShares Bitcoin Strategy exchange fund, the first BTC-related ETF to trade in the US, initially rose 3% when trading started, and recently climbed 1.6% to $ 40.63 on its debut on Tuesday in the stock market New York.

The fund operates under the symbol BITO and is linked to Bitcoin futures contracts traded on the Chicago Mercantile Exchange.

ProShares filed for a BTC ETF last summer after SEC chairman Gary Gensler made it clear his preference for a bitcoin fund linked to the futures market rather than the cryptocurrency itself. Other Bitcoin ETF futures trading is expected to start soon.

While the fund's approval was pending, Bitcoin's price spiked upwards above $ 60,000 for the first time in nearly six months. Bitcoin's price has remained more or less stable over the past 24 hours on Tuesday at around $ 61,862 at the time of writing.

Technical Market Outlook:

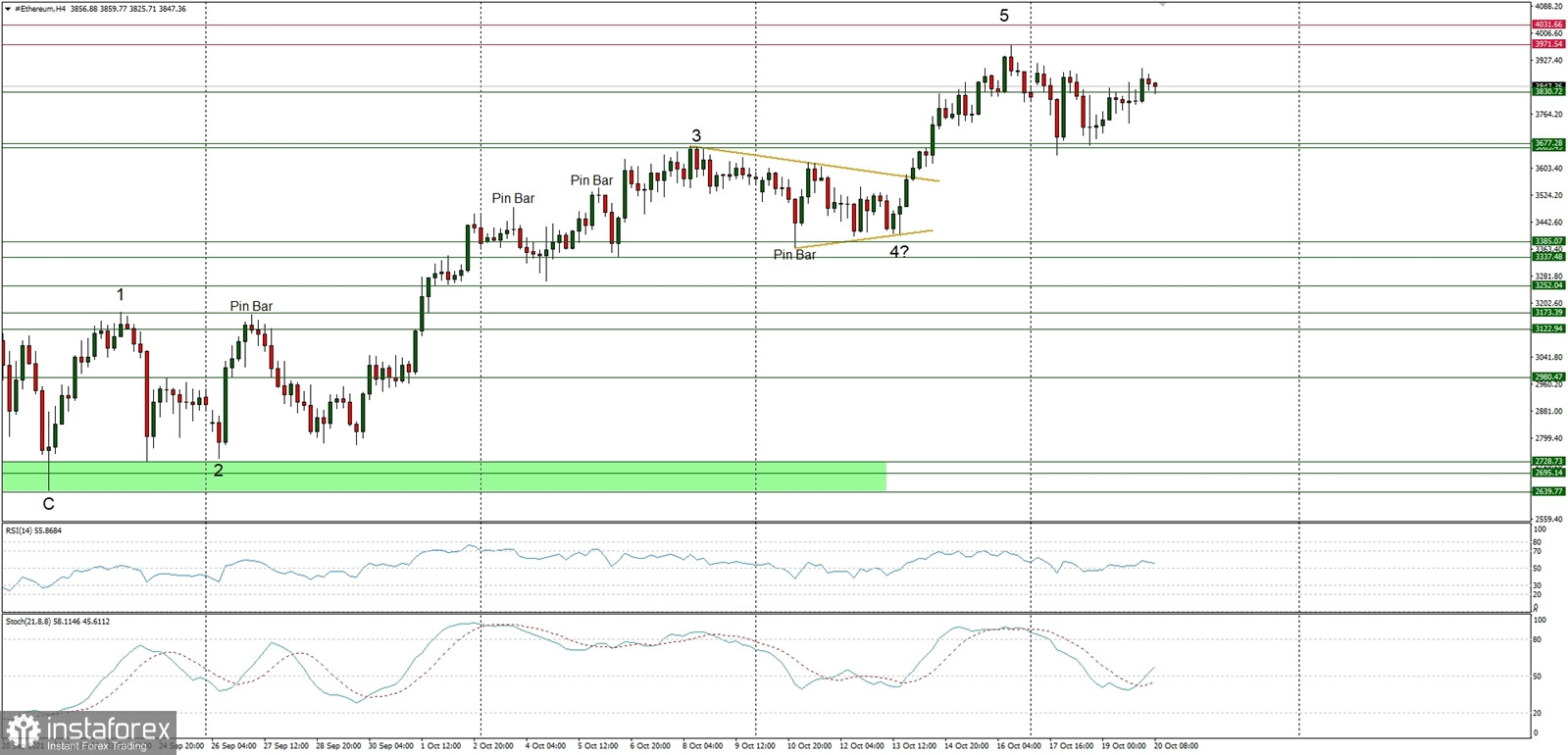

The ETH/USD pair has bounced from the technical support located at the level of $3,677, but there is no significant increase in the momentum (RSI indicator) as the price is moving towards the level of $4,000 again. This might be the last wave in the impulsive cycle, the wave 5 of the overall wave progression, so a some kind of correction might be expected soon. The momentum is strong and positive, so the bulls might risk to push the prices towards the level of $4,000 before any meaningful correction will occur, but any breakout below $3,677 will be a negative in the short-term.

Weekly Pivot Points:

WR3 - $4,596

WR2 - $4,262

WR1 - $3,971

Weekly Pivot - $3,631

WS1 - $3,394

WS2 - $3,073

WS3 - $2,777

Trading Outlook:

Ethereum have started the next wave up and violated the long-term target at the level of $3,550. The next long-term target for ETH is seen at the level of $4,394. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română