Economic calendar (Universal time)

The most important events of today's economic calendar are expected today from overseas (USA).

15:00 pending real estate sales index

15:30 crude oil reserves

19:00 interest rate decision

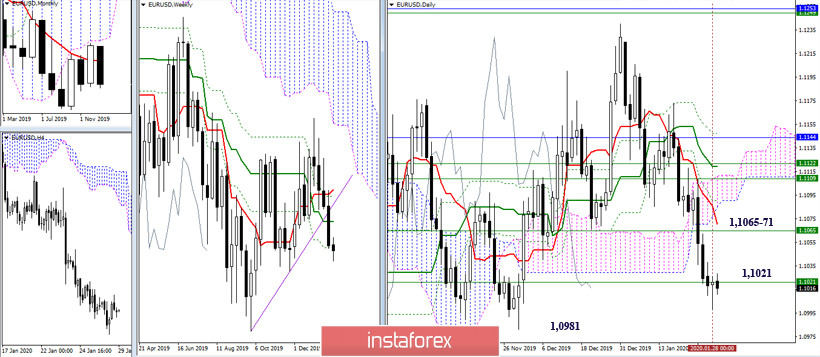

EUR / USD

There is a new attempt and a new daily minimum. There is only a little bit left before the downward benchmark, in the form of the minimum extreme of 1.0981 weeks. Nevertheless, we observe another return and development in the attraction zone of the weekly Fibo Kijun (1.1021) again. Therefore, it is possible that the players on the downside still will not be able to move through the significant support they met. If so, they will be forced to retreat, at least for a retest of the levels completed on the eve. In this case, the nearest strengthened resistance awaits the pair in the region of 1.1065-71 (daily Tenkan + weekly Kijun).

We observe the development of an upward correction. Important levels in the lower halves in this direction today are 1.1015 (central Pivot level) and 1.1043 (weekly long-term trend). On the other hand, updating the last low (1.0998) will restore the downward trend and will return relevance to the support of the classic Pivot levels 1.0987 (S2) - 1.0976 (S3) within the day.

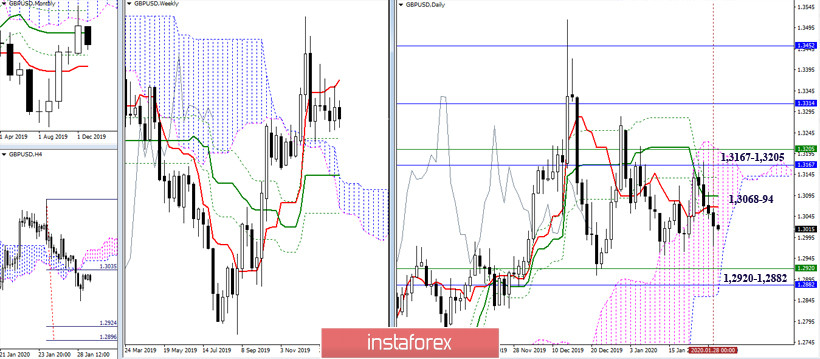

GBP / USD

Yesterday, the players on the decline continued to decline, but did not reach the minimum of the last week and the nearest minimum extremum (1.2961-53), and even more so did not consolidate below. As a result, consolidation and development in the zone of uncertainty continues. The situation in its conclusions and expectations has not changed. The role of significant supports continues to belong to the area 1.2920 - 1.2882 (Fibo Kijun of the month and weeks + the lower border of the daily cloud), and resistance can be noted in the areas of 1.3068-94 (daily cross) and 1.3167 - 1, 3205 (monthly Kijun + weekly Tenkan + upper border of the daily cloud).

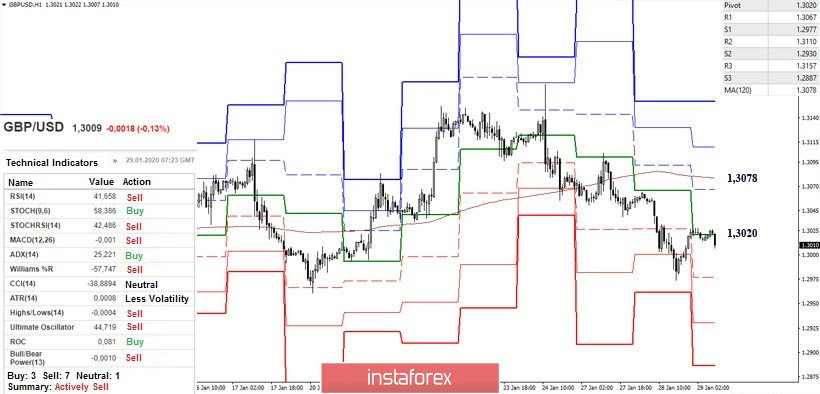

In the lower halves, the pair is in the zone of upward correction with the bearish main advantage, testing at the moment the first key resistance level of 1.3020 (central Pivot-level of the day). Further, the interests of players to increase will be directed to the weekly long-term trend, which is now located at the level of 1.3078. At the same time, consolidation above can make its own adjustments to the distribution of forces in the lower halves and form new upward orientations.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română