Hello, dear colleagues!

According to the results of yesterday's trading, the main currency pair of the Forex market euro-dollar showed an upward trend. This is not surprising, however, the main events of today are still ahead.

Yesterday, a two-day meeting of the US Federal Reserve's Open Market Committee began and the results of which will be announced to market participants today, at 20:00 (London time). Also, the accompanying FOMC statement will be announced at the same time, and a press conference will be held at 20:30 (London time) by Federal Reserve Chairman Jerome Powell. I assume that this event will have an impact on the direction of the dynamics of the US currency. Since no other changes are expected and the refinancing rate is likely to remain at 1.75%, it is Powell's entry that may shed light on further steps in the Fed's monetary policy and trigger a particular reaction from investors.

The dynamics of the US currency across the entire spectrum of the market will most likely depend on the rhetoric of the speech of the head of the US Central Bank. We are waiting for this important event, however, I want to warn you that trading on such important data is associated with increased risks! Therefore, those who are new to the market and (or) can not withstand such high emotional and psychological loads, it is better to stay out of the market and calmly observe all that is happening from the outside. Let me remind you that being out of the market is also a position.

Despite the importance of today's decision and the Fed's press conference, it is not necessary to dwell only on this event, so I will outline other rather interesting and important data that we will have to read today. However, I would like to note that there may not be any particularly strong reaction, so it is not advisable to focus only on the Fed. Here are other events that will arrive during today's trading day.

Eurozone: at 10:00 (London time) - a change in the volume of private-sector lending and the M3 monetary aggregate.

Germany: at 08:00 (London time) - the consumer confidence index from GfK.

USA: at 14:30 (London time) - trade balance; at 16:00 (London time) - pending home sales; at 16:30 (London time) - change in oil reserves according to the Ministry of Energy; at 20:00 (London time) - the Fed's decision on rates and accompanying statement of the Federal Open Market Committee of the Fed; at 20:30 (London time) - press conference of the Federal Reserve System of the United States.

Well, now it's time to go to the charts of the main currency pair and see what changes have occurred there in anticipation of the most important events of today.

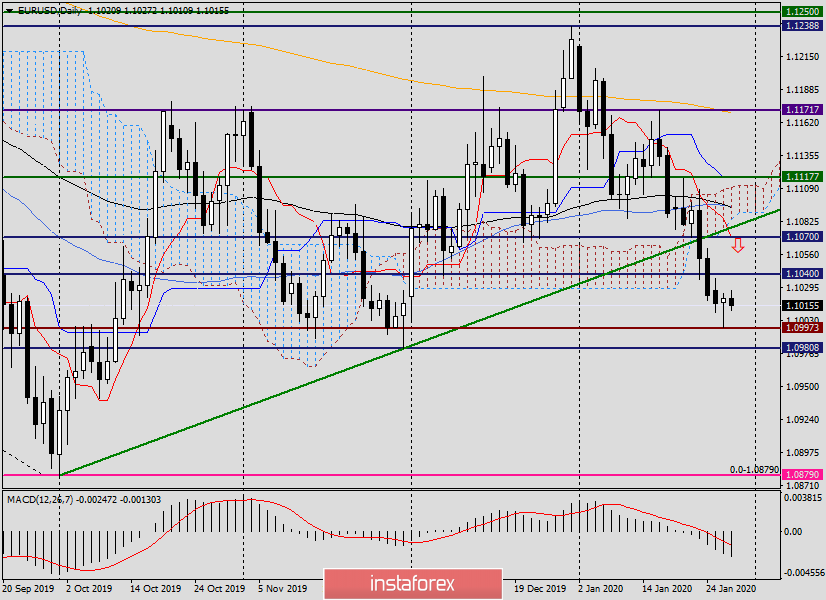

Daily

Despite the previous downward trend, yesterday, the EUR/USD pair grew and formed the bullish hammer reversal candlestick or just a hammer, but with a bullish body.

On any other day, it would be possible that this reversal pattern would be worked out and the euro-dollar would rise. But today, because of the importance and significance of events, anything can happen. The quote can grow, and quite significantly. This will happen if investors are disappointed with the text of the accompanying FOMC statement, and (or) the tone of the speech of the head of the Fed, Jerome Powell, which will be too soft. And here it is not superfluous to remind dear readers that US President Donald Trump is still not happy about the Fed's monetary policy, which is too strict in his opinion.

But since we are looking at the technical picture for EUR/USD, after yesterday's reversal hammer candle, today's growth looks quite real.

If this happens, we will see a pullback to the broken support levels of 1.1040 and 1.1070, where we should look at the euro sales. The price zone near 1.1070 looks particularly good for opening short positions on EUR/USD. First, the price is more attractive, and secondly, in addition to the horizontal support line, which was broken, there is the Tenkan line of the Ichimoku indicator, as well as the green support line of 1.0879-1.0981, which are quite capable of providing strong resistance and turning the quote in the south direction.

Regarding specific trading ideas, I think I will focus on selling after the growth to 1.1070. For those who share this point of view, I suggest setting a sell limit of 1.1068 (sl 1.1118/tp 1.0998). I believe that this is quite enough for today.

Good luck and big profits!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română