To open long positions on EURUSD, you need:

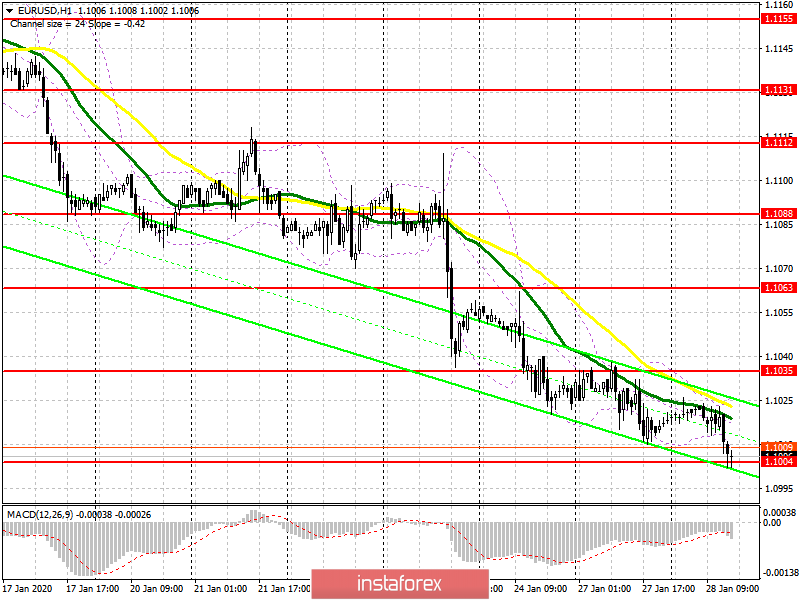

The lack of fundamental data in the first half of the day and a good report on the growth of orders for durable goods in the US has led to the strengthening of the dollar against the euro and test a significant support level 1.1004, to which I drew attention in the morning forecast. Although the technical picture has not changed, you can count on purchases from the level of 1.1004 only if a false breakout is formed. Larger players will show themselves after the test of the lows of 1.0982 and 1.0964, which can be updated after the release of the report on consumer confidence in the United States. Weak indicators, on the contrary, will lead to the closure of several long positions in the US dollar and the correction of EUR/USD to the resistance area of 1.1035, where I recommend fixing the profits. An equally important task for the bulls will be to consolidate above the level of 1.1035, which will open a direct road to the highs of 1.1063 and 1.1088.

To open short positions on EURUSD, you need:

Sellers came close to the support of 1.1004, however, they failed to break below this level the first time. However, as you can see on the chart, there is no special activity and volume surge, so we can talk about a further decline in EUR/USD in the case of a good report on consumer confidence in the United States, which will be published at the North American session. In this case, you can expect to update the lows of 1.0982 and 1.0964, where I recommend fixing the profits. In the scenario of the pair's growth in the second half of the day against the background of closing long positions in the dollar after a weak report, you can count on short positions after updating the resistance of 1.1035 and forming a false breakout there or sell immediately for a rebound from the highs of 1.1063 and 1.1088.

Indicator signals:

Moving Averages

Trading is conducted below the 30 and 50 moving averages, which keeps the chance of a decline in the euro.

Bollinger Bands

Volatility remains extremely low, which does not give signals to enter the market.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA Period 12. Slow EMA Period 26. SMA Period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română