To open long positions on EURUSD you need:

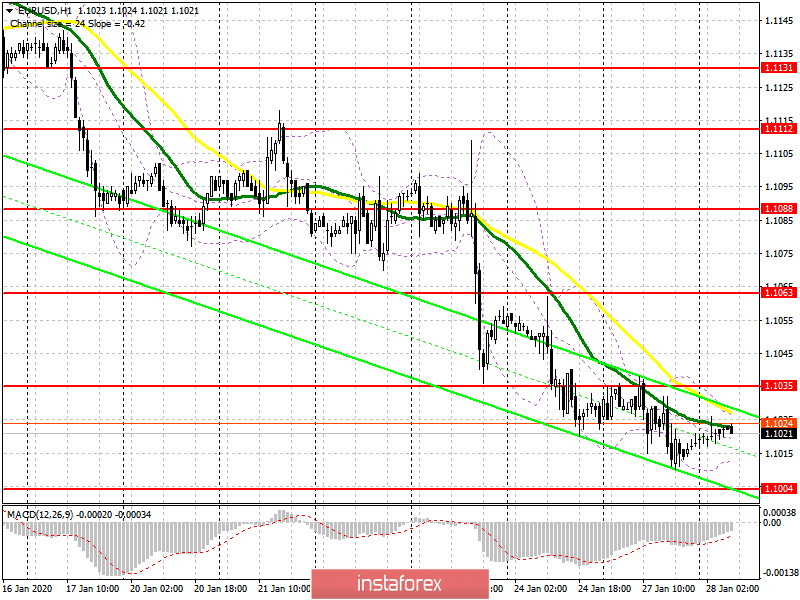

The situation has not changed from a technical point of view. A weak report on the real estate market in the United States did not make it possible for buyers of the US dollar to maintain a downward trend in the pair, which put traders in an even greater impasse. No one wants to take risks before tomorrow's Federal Reserve meeting. At the moment, the buyer's task for the euro is to return to the resistance of 1.1035, since this will provide bulls with confidence and lead to a larger upward correction to the areas of 1.1063 and 1.1088, where I recommend taking profit. However, given the lack of important fundamental statistics today in the morning and low volatility, pressure on the euro may persist, therefore, if the pair goes down, it is best to look at long positions after the support update 1.1004, or buy immediately for a rebound from the lows 1.0982 and 1.0964.

To open short positions on EURUSD you need:

Bulls are fighting back against the sellers and do not let EUR/USD reach support at 1.1004, the breakout of which would mean the resumption of a downward trend. Today, the bears need to keep the pair below the level of 1.1035, and the formation of a false breakout will increase the pressure on the euro, which will maintain a downward momentum and lead to an update of the low of 1.1004. Consolidating below this range is a more important task, which will quickly push the pair to the area of 1.0982, where I recommend taking profits. If there is no activity on the market in the direction of selling the euro in the morning, I recommend postponing short positions until an update of resistance at 1.1063 is renewed, or then selling immediately for a rebound from a high of 1.1088.

Signals of indicators:

Moving averages

Trade is conducted below 30 and 50 moving average, which indicates the preservation of the market on the side of sellers.

Bollinger bands

Volatility is very low, which does not provide signals on entering the market.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română