Hello, dear colleagues!

Recently, a new type of coronavirus in China has become one of the main global topics. It all started in the largest transport artery in China, the city of Wuhan. According to some unconfirmed data, the epidemic began as a result of eating exotic animals. However, according to another version, this story is seen as an American trace.

The Chinese authorities have taken this issue seriously. Twenty provinces of China have declared a state of emergency. Another characteristic example that highlights the seriousness of the Chinese leadership's response to the fight against coronavirus was the construction of a hospital with a thousand beds for those infected with this virus. The construction period and commissioning of this medical facility is 6 (six) days! Judging by the incredible amount of equipment and human resources on the construction site, the incredibly fast deadlines look quite real. The Chinese can do a lot.

But is the coronavirus so terrible and its danger on a global scale not exaggerated? Perhaps this question remains open for now. At the moment, 4515 people have become ill with a new type of coronavirus, and 106 people have died from it in China. At the same time, for comparison, many more people who were not vaccinated died of measles last year than they currently do from the coronavirus. On the other hand, in modern conditions, such viruses constantly mutate, which significantly complicates and increases the time to create the necessary vaccine.

Why all this narrative? First, this problem is reflected in the world's trading platforms, including the foreign exchange market. Secondly, the USD/JPY pair is characterized as a tool that reacts to global economic, political and all other shocks occurring in the world. The reason for this reaction is clear, the Japanese yen is a safe-haven currency and is in high demand in times of various global crises and shocks. In turn, the US dollar is the main reserve currency of the world, which, depending on the situation, can also serve as a protective asset. However, it is worth recognizing that the reaction of market participants to various kinds of shocks and cataclysms has been different recently, and it is not at all a fact that the Japanese yen is preferred as a protective asset.

Before proceeding to the weekly USD/JPY chart, let me remind you of the significant macroeconomic events of the current trading week.

Japan: Wednesday, 06:00 (London time) - consumer confidence index; Friday, 00:30 (London time) - unemployment rate, consumer price index in the Tokyo region, at 00:50 (London time) - retail sales and industrial production.

A lot of interesting and quite important statistics are planned from the US, but the main event of the whole week, in my opinion, will be an extended meeting of the Fed with a press conference of the head of this department, Jerome Powell, which is scheduled for Wednesday, at 20:30 (London time).

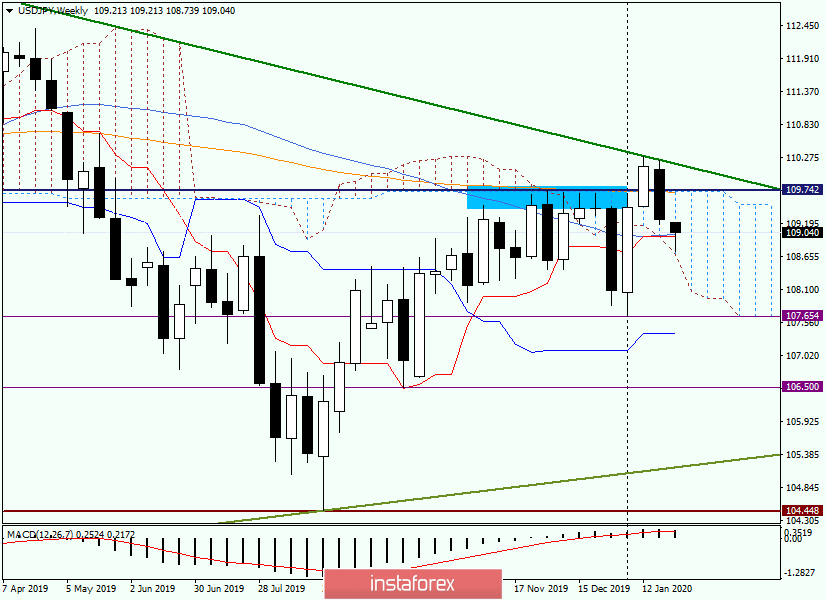

Weekly

At the end of last week, the dollar-yen pair declined and ended trading within the Ichimoku indicator cloud. At the beginning of this week, the bears on the pair tried to continue the pressure, but at the time of writing, the quote found a strong support near the 50 simple moving average and the Tenkan line. From the price zone of 108.74, where the lower border of the Ichimoku cloud passes, there is a strong rebound up, and it is not yet clear how events will develop further.

I have a bearish view on the USD/JPY pair, but I will refrain from specific trading recommendations at the moment. One of these days, we will return to the consideration of this interesting currency pair, and, perhaps, then there will be interesting and reasonable trading ideas.

Have a nice day!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română