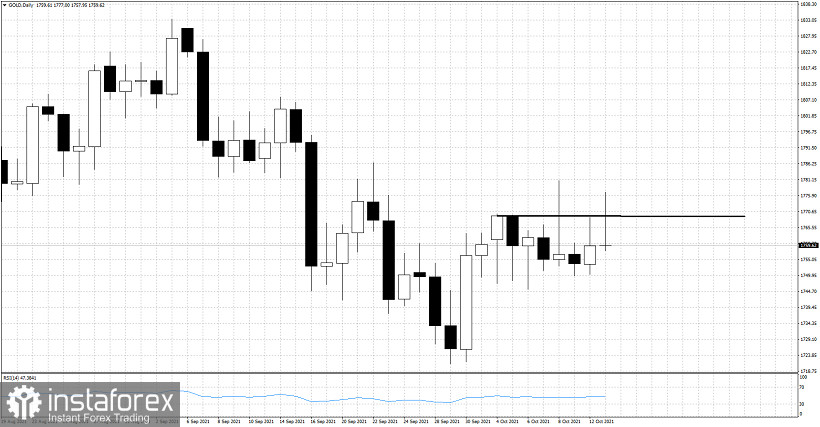

Gold's inability to push above $1,770 is a warning signal for bulls. Price so far has made more than 4 attempts to push above $1,770. Twice price managed to trade close to $1,780 but sellers stepped in and price closed near the daily lows forming a long upper tail (shadow).

Gold price today rose up to $1,777 but price is back towards $1,760. A daily close around current levels will provide a negative candlestick pattern. The long upper tail in today's candlestick is a bearish signal. Support at $1,750-45 remains intact. However with current price action, the chances of seeing a break below $1,745 increase. Bulls need to recapture $1,770 and stay above it in order to continue higher towards $1,800. The chances of this happening are slim, but bulls remain alive as long as price holds the short-term support.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română