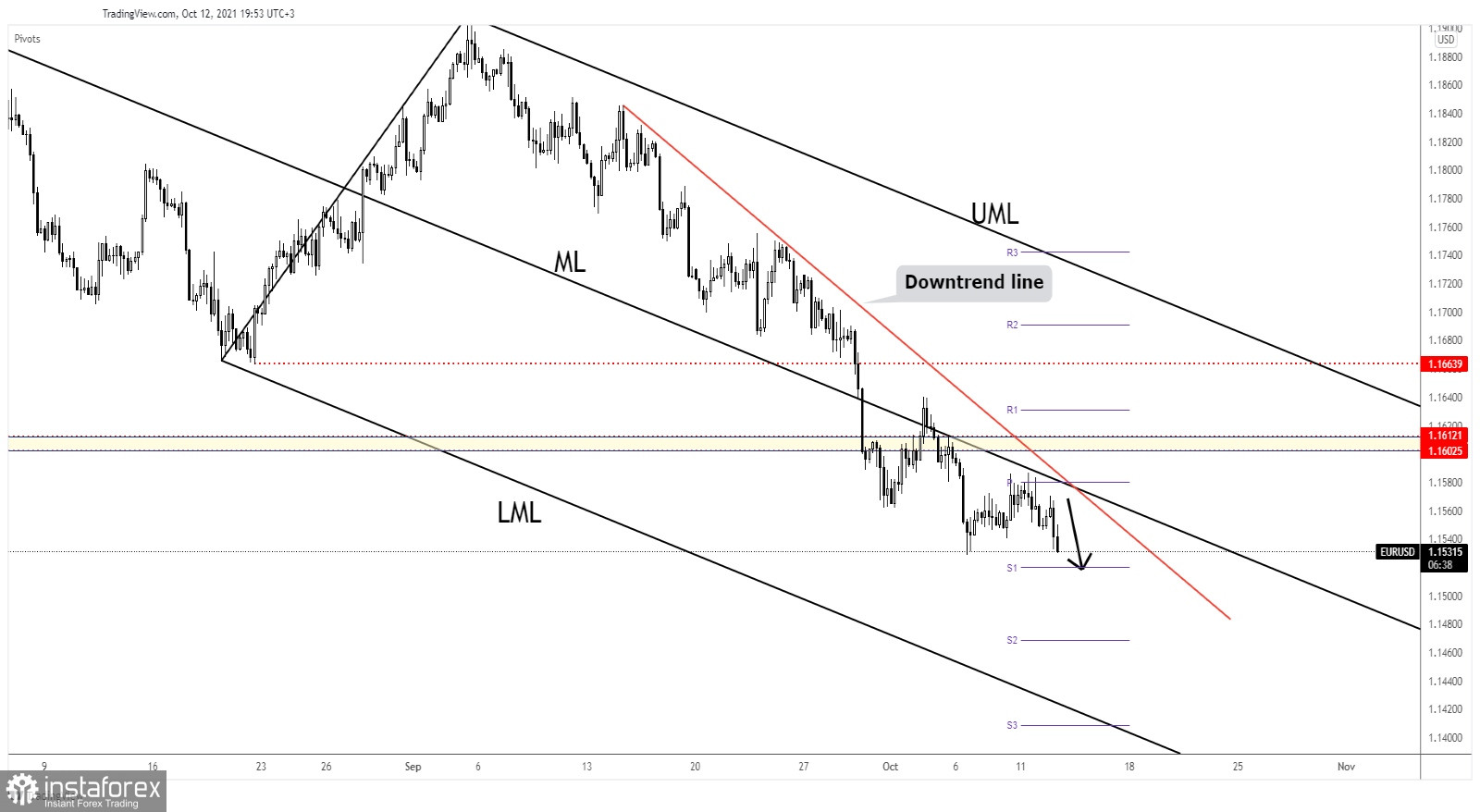

The EUR/USD pair resumed its drop as the Dollar Index has climbed to 94.53 registering a fresh high. The pair is traded at 1.1528 level above 1.1525 today's low. DXY's upside continuation should force the pair to drop towards new lows.

As you already know, the Euro has come under pressure amid the Euro-zone ZEW Economic Sentiment which was reported at 21.0 points below 27.9 points expected. At the same time, the German ZEW Economic Sentiment dropped from 36.5 to 22.3 below 23.7 points estimated.

EUR/USD bearish outlook

The EUR/USD pair is close to reaching the weekly S1 (1.1520) level which is seen as static support. The pair registered a new lower low signaling that sellers are very strong and could lead the price towards new lows.

Its failure to retest the Descending Pitchfork's median line (ML) or the downtrend line signaled strong selling pressure. As you already know from my analysis, the bias remains bearish as long as EUR/USD stays below these upside obstacles.

EUR/USD outlook

EUR/USD could extend its decline below the 1.15 psychological level if the pair makes a valid breakout below the 1.1520 weekly S1. The major downside target is represented by the Descending Pitchfork's lower median line (LML).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română