Crypto Industry News:

Bitmain, a Chinese cryptocurrency mining hardware maker, was forced to cease operations in China from October 11 under a ban imposed by local authorities.

In addition to banning crypto operations in China altogether, the company has decided to stop shipping cryptocurrency mining platforms in response to the government's carbon neutrality policy.

While the company has yet to disclose its aid plan to existing customers in China, Bitmain will continue to provide Antminer cryptocurrency mining platforms to users around the world, including Taiwan and Hong Kong.

To counteract a temporary slowdown in the Chinese market, Bitmain increased its production capacity for Antbox mobile mining containers. In November, the company will host the World Digital Mining Summit 2021 in Dubai, where it will discuss green energy opportunities "primarily from clean energy projects in Yunnan, Xinjiang," and other Chinese provinces.

Despite the recent ban on crypto activities in China, Bitcoin mining operations are on the way to full recovery as Chinese miners and investors relocate to friendly regions.

Technical Market Outlook:

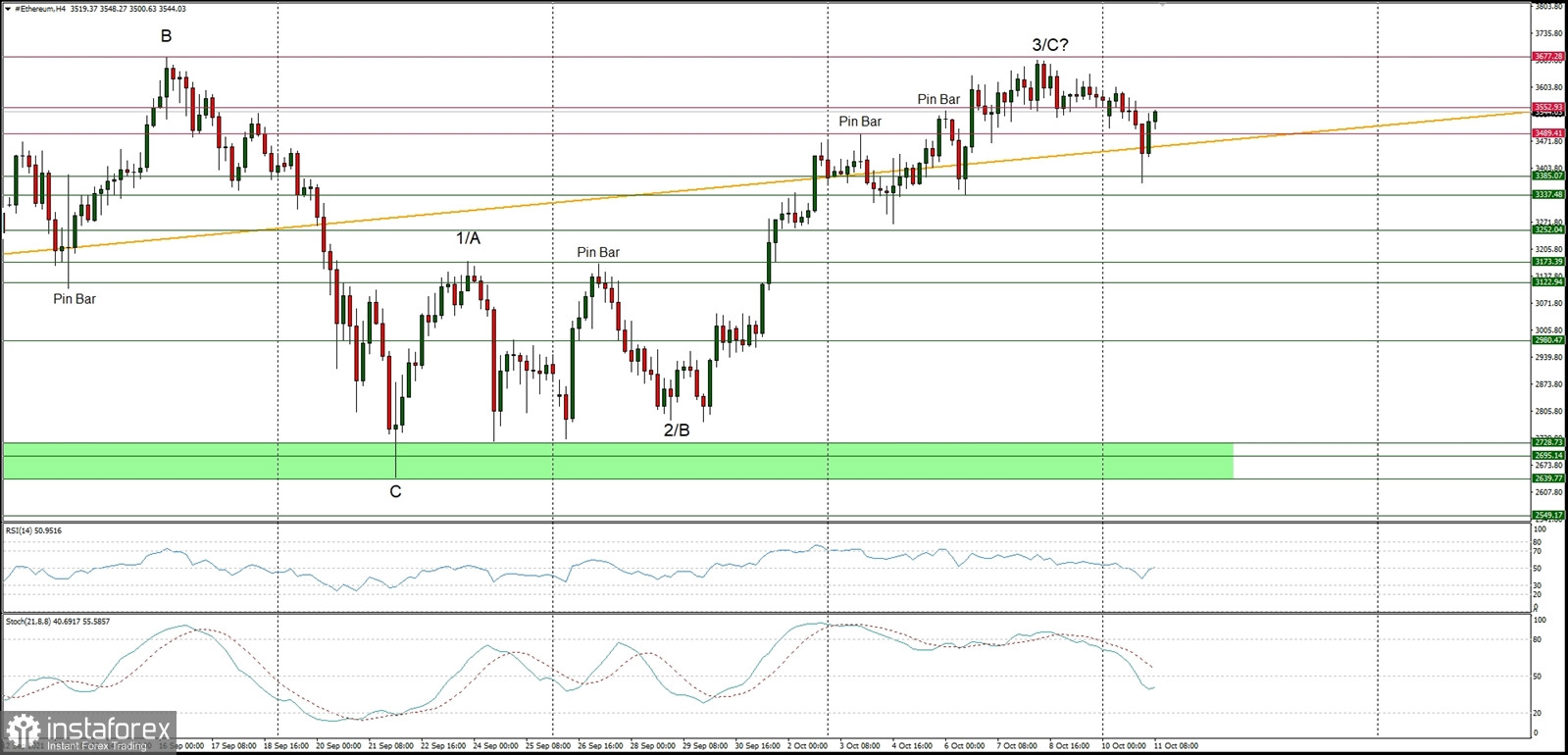

The ETH/USD had pulled-back towards the technical support located at the level of $3,385 and bounced right back up during the weekend. There is a clear Bullish Engulfing pattern at the end of the pull-back and the bulls are back in control of the market. The next target is located at $3,677 and then at $3,830. The momentum is back into the positive zone, but is not that strong yet, so a more complex and time-consuming correction in a potential wave 4 is still possible.

Weekly Pivot Points:

WR3 - $4,097

WR2 - $3,885

WR1 - $3,704

Weekly Pivot - $3,473

WS1 - $3,298

WS2 - $3,083

WS3 - $2,876

Trading Outlook:

Ethereum have started the next wave up and violated the long-term target at the level of $3,550. The next long-term target for ETH is seen at the level of $4,394. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română