Crypto Industry News:

The Ukrainian parliament adopted the long-awaited law on virtual assets in early September, when lawmakers approved it in the second and final reading. Laws to regulate cryptocurrency activities in the country passed its first reading last December, before being revised and re-presented to the Verkhovna Rada of Ukraine in June this year.

In order to enforce the new regulations, the authorities in Kiev must amend the Tax Code and persuade the president to sign the law on virtual assets. However, Volodymyr Zelensky decided to return him to the Ukrainian deputy and demand some changes.

In addition to introducing key legal definitions relating to cryptocurrencies, such as "financial virtual assets", the document also sets out obligations between government institutions that are to oversee the circulation of digital assets under the jurisdiction of Ukraine. For example, if the assets are collateralized by currencies, they will be regulated by the National Bank of Ukraine, and if the underlying asset is a security, the National Securities and Exchange Commission will have the task.

The Act "On Virtual Assets" also provides for the establishment of a new regulatory body for the cryptocurrency market, reporting to the executive. This, according to Zelensky, "will require significant expenditure from the state budget," the press release explained. The reasons for the request for further amendments to the act were also given.

The newly adopted law recognizes virtual assets as intangible goods and divides them into two main categories: secured and unsecured. Cryptocurrencies will not be accepted as legal tender in Ukraine, and their direct exchange for other goods or services will not be allowed.

Technical Market Outlook:

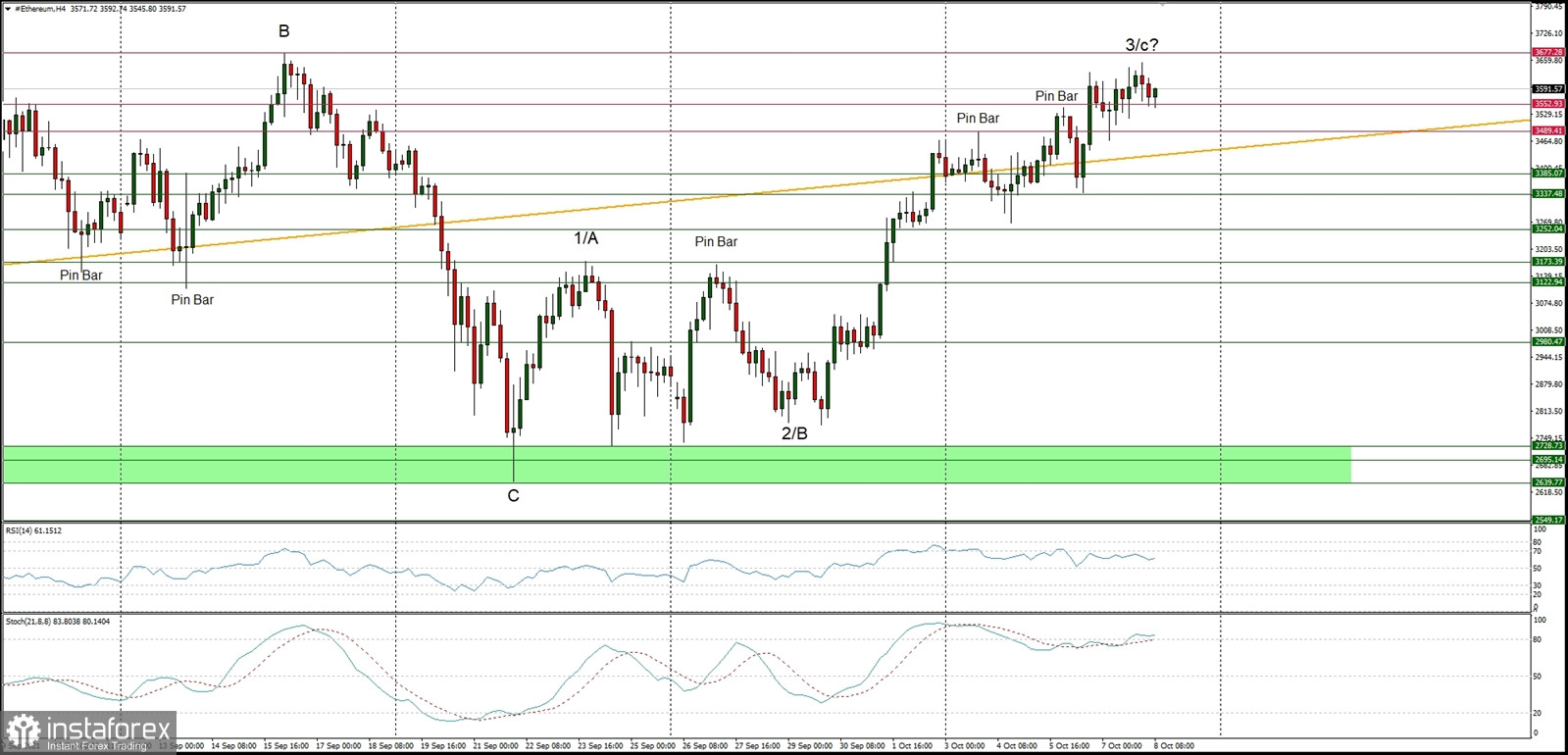

The ETH/USD pair has been consolidating the recent gains around the level of $3,600 in extremely overbought market conditions. The bulls are not that keen to continue the rally straight away, so the short-term pull-back might occur soon. The key short-term technical support is located at the level of $3,489 and the next target for bulls is seen at the level of $3,677. Please notice the bearish divergence between the price and the momentum oscillator supports the short-term bearish view and even a deeper corrective cycle towards the level of $3,252.

Weekly Pivot Points:

WR3 - $4,444

WR2 - $3,970

WR1 - $3,761

Weekly Pivot - $3,277

WS1 - $3,057

WS2 - $2,590

WS3 - $2,360

Trading Outlook:

Ethereum have started the next wave up and violated the long-term target at the level of $3,550. The next long-term target for ETH is seen at the level of $4,394. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română