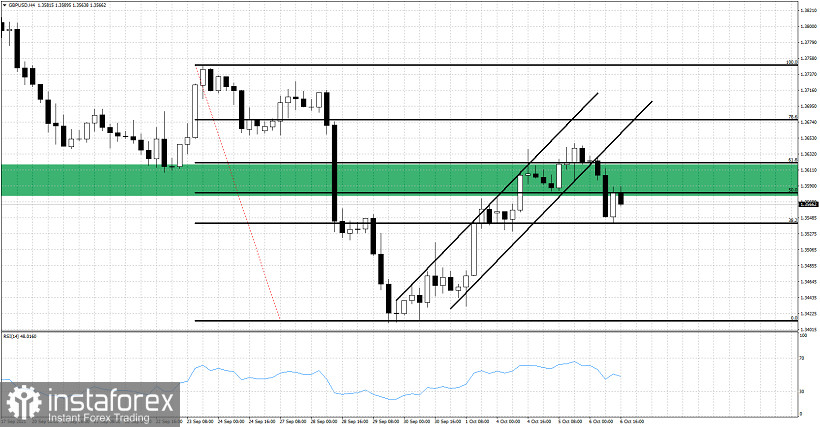

In our last post we saw GBPUSD trading above 1.3620 and the major Fibonacci resistance and the important horizontal resistance area. However at the end of the day bears made a comeback and price closed right at the resistance. Today price has provided a sign of weakness. What sign is that?

Green rectangle- resistance area

Black upward sloping lines - bullish channel

Black horizontal lines - Fibonacci retracement

GBPUSD has broken out of the bullish channel and got rejected at the horizontal resistance area and the 61.8% Fibonacci retracement. Bulls want to see price make a higher low and then break above the recent highs and stay above the green rectangle. Bears on the other hand are happy with the rejection at the Fibonacci resistance and the exit out of the channel. However in order to regain full control of the trend bears will need to push price below recent lows at 1.3410.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română