EUR/USD rebounded but you should keep in mind that this could be only short-lived. The price could only test and retest the immediate resistance levels before dropping deeper. It has bounced back only because the DXY was into a corrective phase in the short term.

Today, the US has reported positive economic figures, so the DXY could end its correction soon. On the other hand, the Euro-zone data have come in mixed today. The German Final Manufacturing PMI dropped from 58.5 to 58.4 points, even if the specialists have expected to see the indicator at 58.5 points. Furthermore, the German Retail Sales increaed by only 1.1% versus 1.6% expected, while the Euro-zone Final Manufacturing PMI was reported at 58.6 points below 58.7 expected.

The Euro received a helping hand from the Euro-zone CPI Flash Estimate which has increaed by 3.4% exceeding the 3.3% growth expected, while the Core CPI Flash Estimate has come in line with expectations.

EUR/USD Below Resistance!

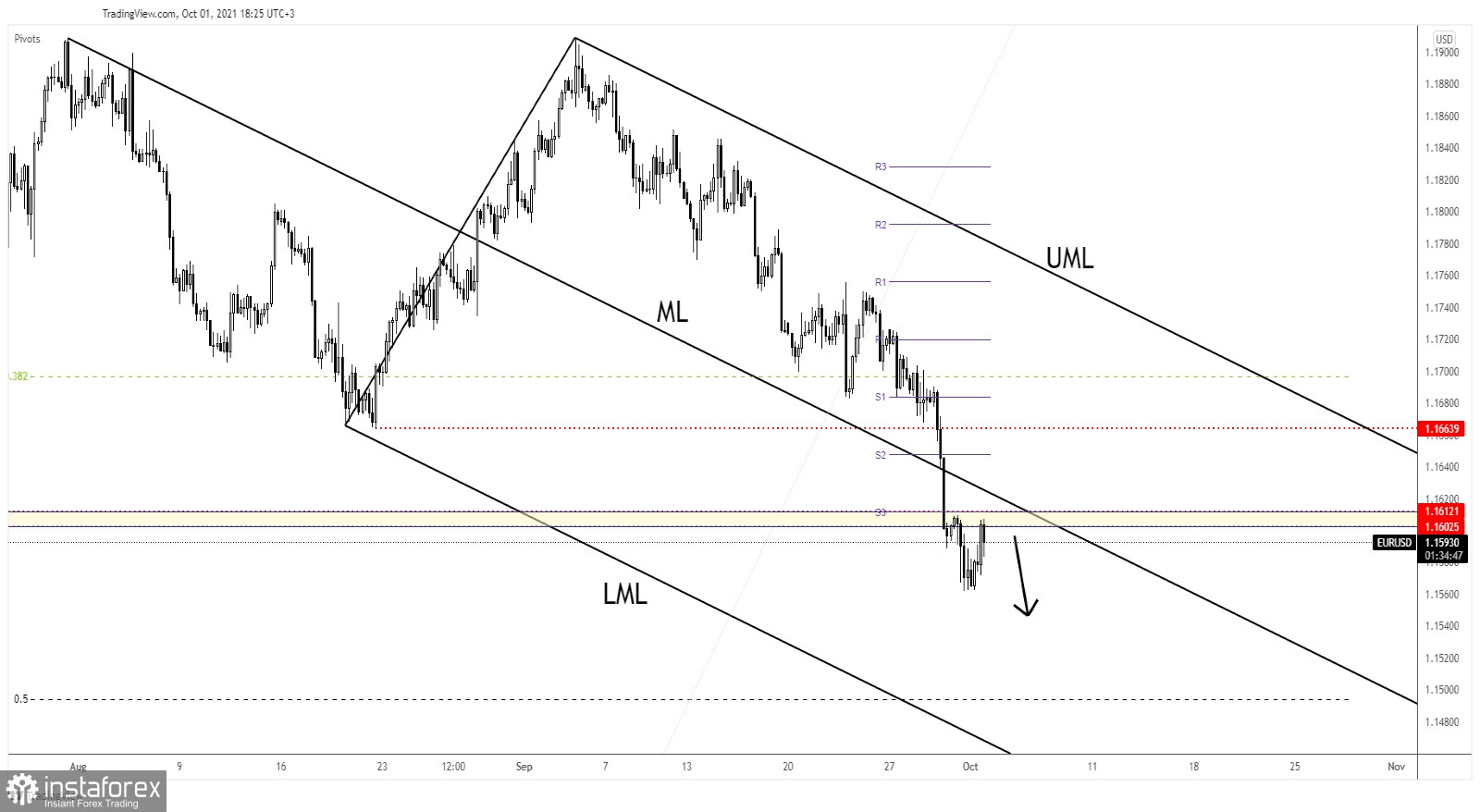

EUR/USD increaed as much as 1.1607 today but now is traded at 1.1596 level. As you can see on the H4 chart, the 1.1602 - 1.1612 area is seen as a resistance zone. The support has turned into resistance, so a bearish pattern here may signal a new leg down.

The median line (ML) of the descending pitchfork is seen as a dynamic resistance. Failing to reach it or making a false breakout through this level could announce a potential drop.

EUR/USD Forecast!

The outlook is bearish as long as it stays under the descending pitchfork's median line (ML). A false breakout above it could bring a new selling opportunity. Also, a new lower low, dropping and closing below 1.1562 yesterday's low could activate a larger downside movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română