To open long positions on EURUSD you need:

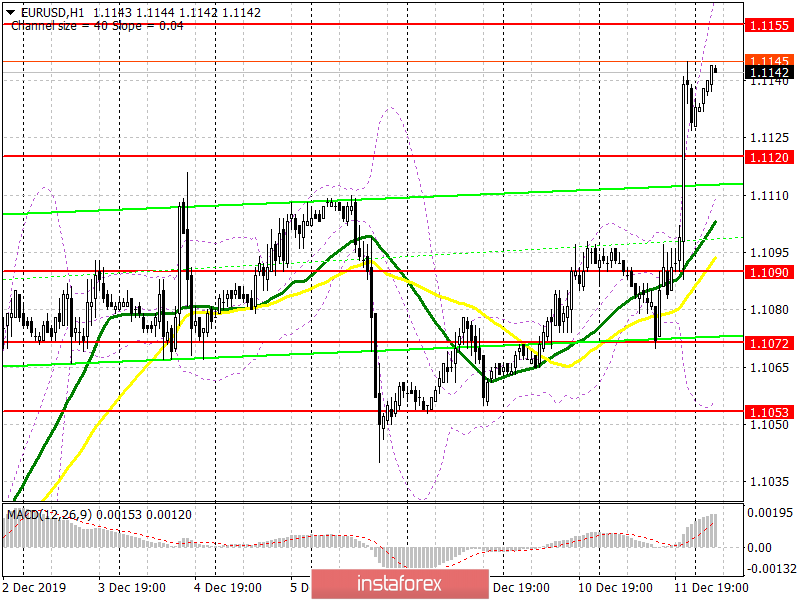

The euro strengthened its position against the US dollar after yesterday's decision by the Federal Reserve to leave interest rates unchanged at 1.75%. The regulator's forecast for the next year was more important, which led to a weakening dollar, since the central bank does not plan to return to increasing the interest rates. As for the further growth prospects of EUR/USD, the bulls need to cling to the resistance of 1.1155, which will lead to the renewal of highs in the areas of 1.1180 and 1.1226, where I recommend taking profits. The European Central Bank's decision on interest rates will be published today, which may put pressure on the euro. Therefore, in the scenario of a downward correction in the morning, I recommend that you return to long positions only after a false breakout in the region of 1.1120, or buy the euro immediately to rebound from a low of 1.1090.

To open short positions on EURUSD you need:

Sellers will wait for the assessment of further economic prospects from the European Central Bank, and expect an unsuccessful consolidation above the resistance of 1.1155, which will raise the pressure on the euro and lead to a return to the support area of 1.1120. It is from this level that the further growth of EUR/USD depends. If the bears manage to gain a foothold below this range, then the pressure on the euro will increase, which will update the lows of 1.1090 and 1.1072, where I recommend taking profits. If the ECB rate remains unchanged, EUR/USD may continue to rise above the resistance of 1.1155. In this scenario, I recommend to open short positions immediately on the rebound from the highs of 1.1180 and 1.1226.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 moving average, which keeps the chance to continue the upward trend in the euro.

Bollinger bands

Growth may be limited by the upper level of the indicator in the region of 1.1170. In case the euro falls, the lower boundary of the indicator in the area of 1.1070 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română