In this article, we will analyze the technical picture and trading ideas for one of the most popular and favorite pairs of the currency market - USD/JPY. Although, to be honest, on the eve of such an important event as the Fed's decision on rates and the press conference of the head of this department, Jerome Powell, it is quite difficult. In general, as you know, forecasts are an ungrateful thing, because it is not a fact that they will come true. Nevertheless, we will try to figure it out.

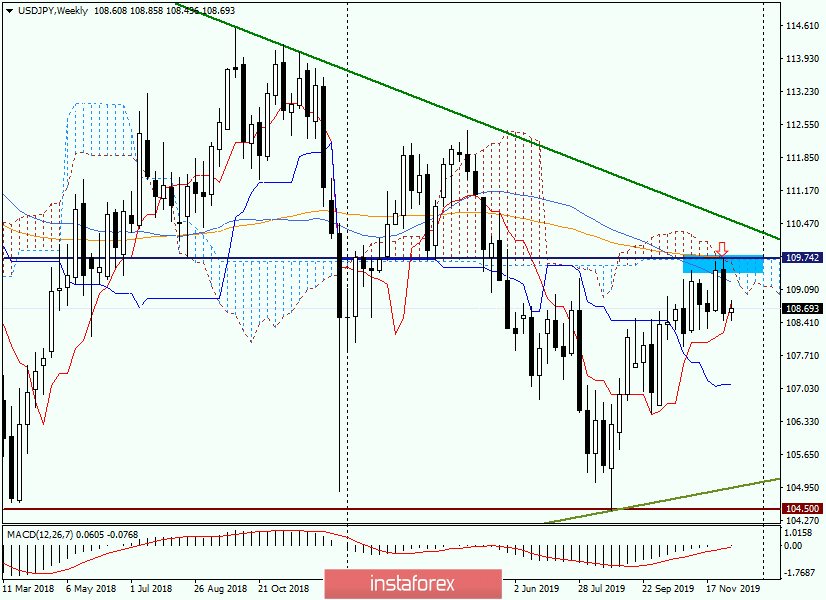

Weekly

So, as you can see on the weekly chart, the previously exposed arrow on the decline was very useful and, as they say, worked. It was in the designated price zone that the pair met strong resistance and turned to decline.

The reason for this was technical factors in the form of a 144-exponential moving average, a resistance level of 109.73 and the lower boundary of the Ichimoku indicator cloud. These resistances were so strong that the bulls on USD/JPY abandoned attempts to continue the rise of the rate and gave up the reins of the market to their opponents - the bears.

However, as I have repeatedly stressed in previous articles, today may be the most important day at the trading on December 9-13 and will determine the closing price. In other words, depending on the reaction of market participants to the FOMC's updated economic forecasts and Jerome Powell's rhetoric during his press conference, the situation could change dramatically. I do not exclude that with a positive scenario for the US dollar, the long tail of the weekly candle will remain at the bottom and the dollar/yen will end the current five-day trading with an increase.

At the moment, we see a small bullish candle with the same small white body. This factor indicates a wait-and-see position of market participants, which is quite understandable and logical.

I believe that the main activity and good price movements will begin after the publication of the US consumer price index at 14:30 (London time). At 20:00 (London time), the Fed will announce its decision on the main interest rate, which is likely to remain unchanged. The crowning glory of today at 20:30 (London time) will be the FOMC press conference, which will be held by Federal Reserve Chairman Jerome Powell. It seems that it is precisely the tonality of the speech by the head of the Fed that will have a decisive influence on the course of trading.

I would like to remind you that the USD/JPY pair reacts very strongly to such important events from the US. Well, as for the weekly price chart, the nearest target of possible growth will be the mark of 109.24, where the 55 simple moving average is located. A stronger strengthening of the US currency will send the quote to the area of 109.73-109.75, where the past and the year before highs, as well as 144 EMA.

In the case of negative reaction of investors to Powell's performance, the pair risks falling first to 107.90, and then to 107.10, where the Kijun line of the Ichimoku indicator passes.

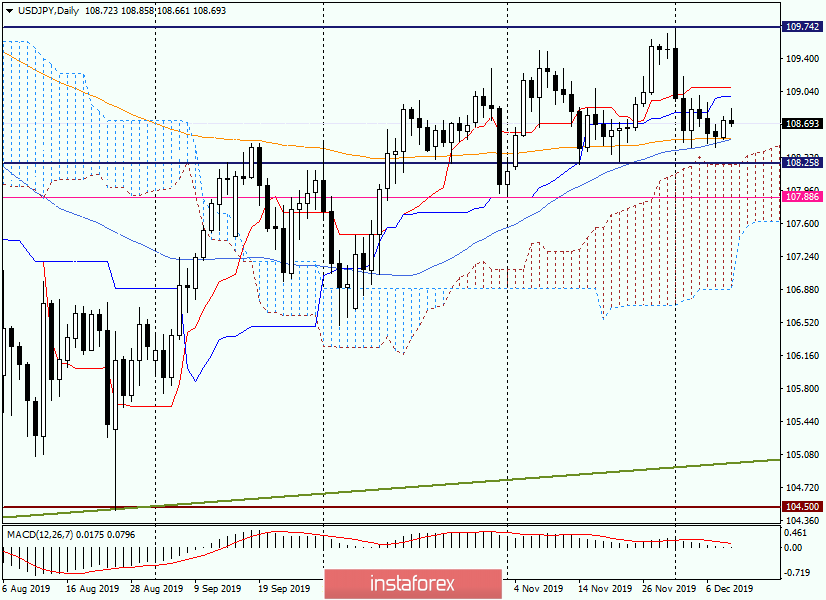

Daily

On the daily chart, the pair was locked between 55 MA with 144 EMA, which can provide support, and Kijun and Tenkan lines, whose function will be to restrain a possible rise and provide resistance.

I want to emphasize right away that at such important events as of today's, the price in most cases leaves the chosen range, so trading with the indicated support and resistance is already extremely risky. As an option, those who wish can work for a break up of 109.10 by placing buy stop orders or use sell stop for a break of 108.50. But the goals are small!

However, this trading idea may not be successful, as the market often changes direction during the speech of important monetary officials, and especially the head of the Federal Reserve.

Cautious and unwilling traders should risk closing all open transactions (who has them) today and staying out of the market. Aggressive and risky, I can recommend purchases from current prices and (or) with a decrease in the price zone of 108.50-108.00.

Early sales from the price range of 108.90-109.20. At more attractive prices, I recommend considering short positions from a strong technical zone of 109.70-110.20. That's all for now. I wish you success!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română