There are some miracles that are just happening, because even though the market does not pay attention to macroeconomic statistics at all, regardless of what data is published, it reacts to such data that no one usually looks at. This is exactly what happened yesterday, when the single European currency suddenly reacted to quite specific data from the United States. In fact, the growth of the single European currency coincided with the moment of publication of data on labor productivity and labor costs. Therefore, investors were frightened by the fact that the growth rate of labor productivity outside agriculture in the third quarter, which is by 2.5%, gave way to a decline of 0.2%. Moreover, the situation is aggravated by labor costs. The growth rate of which increased from 2.4% to 2.5%. In other words, labor productivity is declining, and labor costs are increasing.

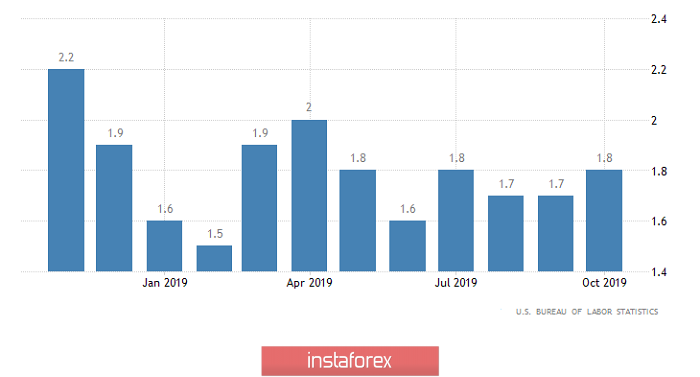

Formally, the main event of today is the last meeting of the Federal Committee on Open Market Operations this year. However, they do not expect anything from it, since Jerome Powell said even earlier that the Federal Reserve is taking a break in terms of making changes in monetary policy. However, data on inflation in the United States will be published a few hours before, which may show its acceleration from 1.8% to 2.0%. The increase in inflation, and up to the target levels that the Federal Reserve System has long established, may become a reason for the regulator to seriously think about raising the refinancing rate. Of course not now, but somewhere in the spring of next year. And here, it is extremely important that inflation will be published before how to conclude the meeting of the Federal Open Market Operations Committee. Thus, it is likely that inflation will be reflected in the final press release of the Federal Reserve, which will be a direct indication of the increase in the refinancing rate in the foreseeable future. Well, this is a positive factor for the dollar.

From a technical point of view, the market has a slight overbought single European currency. Now, if inflation forecasts in the United States are confirmed, then this will be an occasion to eliminate existing imbalances. The resistance level is at around 1.1040, which can not be overcome yet. However, attempts will be made to do so.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română