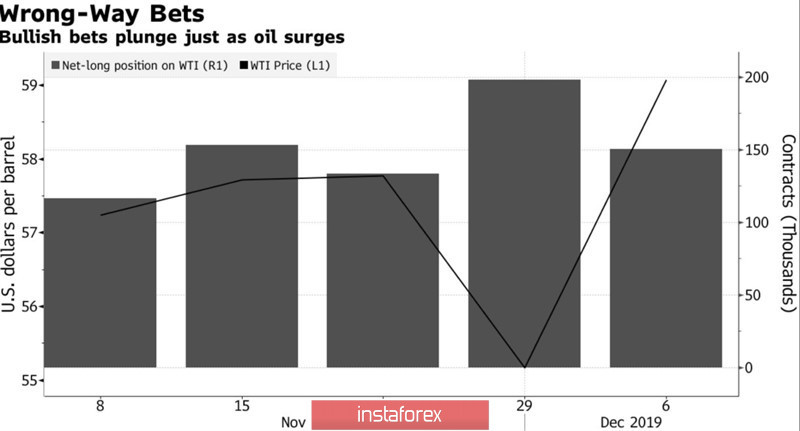

The market knows how to punish self-confidence. According to the results of the week, by December 3, speculators reduced their long positions in WTI by 12%, while shorts increased by 46%. Brent net longitude fell 5.3%. Apparently, players expected that OPEC would not be able to give the market what it wants. They were mistaken. Saudi Arabia managed to convince other oil producers of a deeper section than 1.2 million bpd. The cartel and Russia were able to prolong the Vienna agreement in the amount of 1.7 million bpd. Considering the fact that Riyadh is ready to expand it by another 400 thousand bpd individually, the final scale is approaching 2.1 million bpd. This is serious. Oil increased, and speculators realized that they were in a hurry.

Dynamics of oil prices and speculative positions by WTI

According to Bloomberg's insider, Saudi Arabia has planned its budget for 2020 based on the cost of the North Sea grade at $66 per barrel and is making huge efforts to balance the oil market. Moreover, on the nose of the initial placement of equity securities of the local company Aramco. Riyadh plans to sell a 1.5% stake and raise about $25.6 billion. If everything works out, this IPO will become the largest in the world. The current record holder, the Chinese company Alibaba, which operates in the field of Internet commerce, managed to place $25 billion worth of securities in 2014.

2.1 million bpd is a pretty decent figure in order to balance the market. Shale production in the United States increases by approximately the same amount in 2019, and its growth rate is likely to decline in 2020, which increases the chances of Brent and WTI rallies. Moreover, next year, due to the termination of the trade war between the US and China and the orderly Brexit, global demand may provide support to the bulls on black gold. While Washington and Beijing are trying to create the impression that the negotiations are moving in the right direction, however, whether this is so or not, it will be possible to say on December 15. An agreement is already close if the United States does not raise tariffs by $156 billion in Chinese imports. On the contrary, the increase in duties will raise the likelihood of an escalation of the conflict, which will negatively affect oil.

The US dollar should also contribute to determining the future dynamics of Brent and WTI. In 2019, it found support in the inflow of capital to the United States and in the growth of US stock indexes due to a strong economy, the weakening of the Federal Reserve's monetary policy and belief in the end of the trade war. In 2020, political risks will increase in connection with the presidential election in the United States, which will increase the volatility of the S&P 500 and raise the chances of capital outflow from the United States. As a result, the US currency will not feel as confident as it did in 2018-2019, which will support black gold.

Technically, Brent quotes going beyond the descending trading channel and the upper boundary of the green triangle creates the prerequisites for continuing the upward campaign in the direction of the target by 88.6% according to the Double Peak pattern. It is located near the mark of $73 per barrel. To implement this scenario, the bulls must hold quotes of the North Sea variety above support by $64.4-64.8.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română