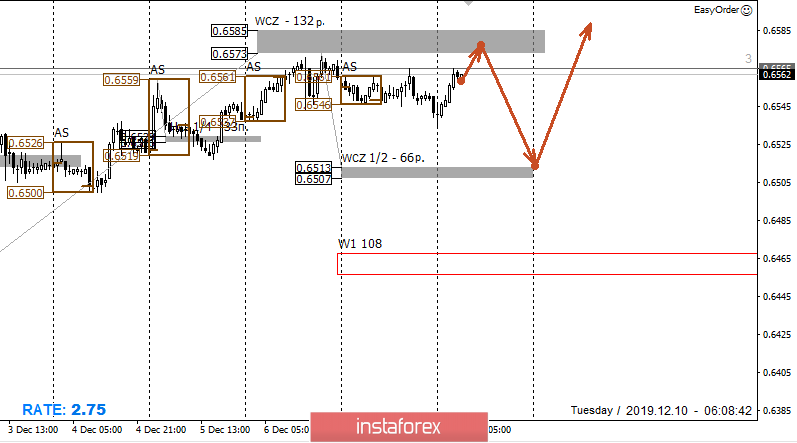

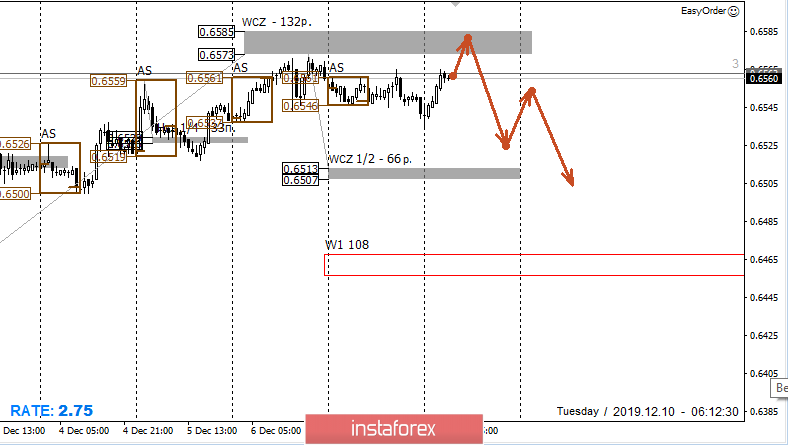

The pair tested the weekly control zone 0.6585-0.6573 at the end of last week. Now, for further growth, consolidating above the specified zone will be required. Otherwise, a reversal pattern will be formed. Growth remains a priority, so holding purchases and opening new ones is the basis of intraday trading. At the same time, there is a high probability of the formation of a local accumulation zone between two significant zones.

It is important to understand that the probability of updating the December maximum is 75%. For this reason, any purchases below yesterday's low will be profitable in the medium term.

Meanwhile, working in the direction of the decline will be possible if the test of a weekly control zone will lead to the appearance of a large offer and the formation of a false breakdown pattern. In this case, sales will come forward. The main objective of the reduction will be the Weekly Control Zone 1/2 0.6513-0.6507. Reaching this zone will allow you to fix part of the sales and transfer the rest to breakeven.

Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone that reflects the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română