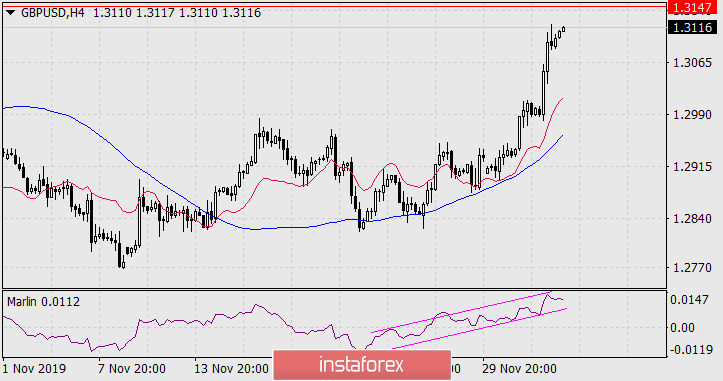

GBP/USD

Yesterday, the British pound overcame the October 21 high and as a result accelerated growth, almost reaching the upper limit of the price channel (1.3147). If the channel wall is overcome, the next pound target will be the Fibonacci reaction level of 200.0% at the price of 1.3206 (near the January high), then growth may follow to the level of 223.6% at the price of 1.3352 (February high). A price reversal downward from the nearest target of 1.3147 is possible according to the peculiarity of the boundary of the price channel that has been going on since July 2014 - the channel is quite long and stable.

A price breakthrough, if it does, is most likely not going to happen on the first try. Therefore, the situation will remain difficult for several more days. When the price falls below the MACD line (below 1.2825) it will be possible for us to confidently believe that attacks on the boundary of the price channel have been stopped.

A strong upward trend is observed on the four-hour chart, but there are already early signs that it's fading, this is the intention of the Marlin oscillator signal line to go down from its own channel. With the departure of the signal line to the zero line, the growing potential will significantly weaken.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română