Gold has grown by 15% since the beginning of the year due to a protracted trade dispute between China and the United States, an increase in the likelihood of a recession in the US economy and the associated reduction in the federal funds rate by 75 bp. Is it any wonder that after these factors were back in the game, the precious metal jumped 1.1% on December 3? US President Donald Trump claims that he is in no hurry to sign a trade agreement with China and is ready to wait until the presidential election. If uncertainty drags on, there will be a resurgence in demand for safe haven assets!

According to US Secretary of Commerce Wilbur Ross, if the agreement is not signed before December 15 or by this time there will be significant progress in relations between Washington and Beijing, the White House will introduce tariffs on $156 billion-worth of Chinese imports. The markets have already set up that this will not happen, so the rhetoric of the president and his team forced speculators to curtail long positions in the S&P 500, which led to the development of a correction in the stock index and supported the bulls in XAU/USD. Gold tends to grow during periods of uncertainty, which suppresses global risk appetite.

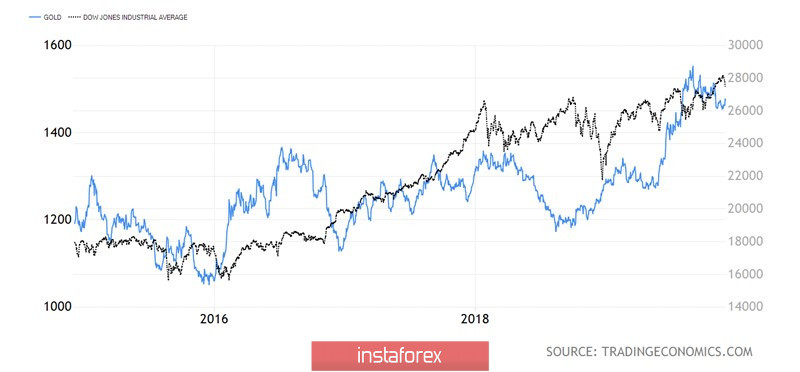

The dynamics of gold and the Dow Jones

The USD index also went down at the same time as the US stock market. The outperforming S&P 500 over foreign counterparts and the associated inflow of capital to the United States in 2019 contributed to the strengthening of the US dollar, so it is not surprising that the pullback of the stock index weakened its position.

Along with uncertainty surrounding the trade wars, the XAU/USD bulls have a helping hand in increasing the likelihood of federal rate cuts and disappointing US statistics. The index of purchasing managers in the US manufacturing sector is in the critical zone below 50, which indicates the problems of the sector, for the fourth consecutive month and the balance of foreign trade in services continues to deteriorate due to the strong dollar and high US prices for medicine and education. As a result, rumors of a recession are beginning to spread around the market, which faithfully served gold for most of this year. CME derivatives expect the federal funds rate to drop from 1.75% to 1.5% in July 2020, although a week ago it was about November.

Thus, the main advantages of the precious metal are back in the game, and if the United States impose duties on $156 billion in Chinese imports from December 15, the S&P 500 will continue to adjust, and the probability of the Federal Reserve's monetary expansion next year will increase, its quotes will easily return above the psychologically important level of $1,500 for an ounce.

Technically, the initial goal of the bulls is to consolidate within the range of the previous consolidation $1475-1515. It will turn out - you can think about going down a trading channel abroad and about activating the Expanding Wedge reversal pattern. A successful assault on resistance by $1515-1520 will increase the risks of implementing the target by 161.8% according to the Crab pattern. It is located near the mark of $1560 per ounce.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română