The euro remained to trade in a range paired with the US dollar, and yesterday's inflation data and statements by the US president on duties against France did not scare away buyers of risky assets, forcing them to take a wait-and-see position. Buyers of the euro believe that next year the actions of the European Central Bank will produce results that will lead to an increase in inflation and the economy, but it is still very early to talk about the formation of a medium-term upward trend in the euro. The focus today will shift to data on services in the eurozone, the UK, and the US.

According to the data, the eurozone producer price index in October this year rose by only 0.1% compared to September and fell by 1.9% compared to October 2018. The data completely coincided with economists' forecasts. As for the core index, which does not take into account volatile categories and energy, producer prices fell by 0.1% in October this year but rose by 0.3% year-on-year. This means that the jump in energy prices has seriously affected the result, which is not as good as many expected.

Yesterday's statements by Donald Trump and criticism of France did not impress traders, who are already accustomed to such statements regarding China. Trump criticized a new tax on digital services imposed by France recently and said he did not want France to tax American companies, threatening retaliatory duties. Trump also expressed hope that he will be able to settle everything with the French leader since there is a good trade turnover between the two countries and the current minor differences should not spoil it.

As for negotiations with China, Donald Trump does not have a deadline for concluding a trade agreement with China, and the idea of waiting for a deal before the election is quite appropriate. Of course, it is unlikely that this issue will be so protracted, although there has been no progress recently, and the negotiations are again put on pause.

As for the fundamentals of the American economy, the data released yesterday were not of great importance. According to a report by the Retail Economist and Goldman Sachs, the US retail sales index for the week of November 24-30 fell by 5.9% but rose by 2.0% over the same period last year. According to Redbook, US retail sales in the first 4 weeks of November rose by 0.4% and 5.3% compared to last year. Between November 24 and 30, sales jumped by 8%.

Yesterday, an indicator of business conditions in the city of New York was also published, which rose again in November. According to the Institute for Supply Management (ISM), the index of current business conditions in November 2019 returned to the level of 50 points and amounted to 50.4 points in November against 47.7 points in October. Index values above 50 indicate an increase in business activity. The report indicated that several managers surveyed expressed cautious optimism.

As for the technical picture of the EURUSD pair, it remained unchanged. The bulls still rested against the resistance of 1.1095 and cannot get above this range. Only its breakthrough will provide risk assets with new momentum, which will lead to the renewal of highs in the area of 1.1131 and 1.1180. If the pressure on the euro returns, and for this, sellers of risky assets only need to push the trading instrument below the support of 1.1060, we can expect the EURUSD to fall to the lows of 1.1030 and 1.1000.

GBPUSD

The British pound is trying to maintain the bullish momentum that was formed yesterday after the publication of regular opinion polls and data on the construction sector, the index of which showed growth.

According to the Kantar report, the ruling Conservative Party of Great Britain increased its margin from the Labor Party to 12 points, which supports the pound, as it changes for the better the attitude of investors to risk.

As noted above, the report on the construction sector in the UK has also supported the pound. According to IHS Markit, the purchasing managers' index for the UK construction sector rose to 45.3 points in November this year from 44.0 points in October. However, it should be noted that the index remained below the level of 50, which indicates a reduction in the activity.

As for the technical picture of the GBPUSD pair, the breakdown of the resistance of 1.3010 will provide the market with new buyers of the pound, able to reach the highs around 1.3070 and 1.3130. A weak report on the services sector could quickly push the pound lower to the support of 1.2940, where the bulls will again begin to show activity. However, a more powerful level for purchases is seen in the area of 1.2890.

AUDUSD

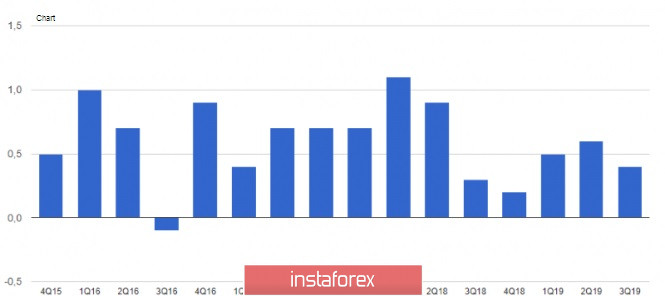

The Australian dollar fell sharply against the US dollar after today's report, which indicated that Australia's GDP growth in the 3rd quarter did not show sufficient acceleration, while many economists were counting on a larger jump after a series of interest rate cuts by the country's central bank. According to the Australian Bureau of Statistics, GDP growth in the 3rd quarter was only 0.4% compared to the previous quarter and 1.7% compared to the same period the previous year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română