4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - sideways.

The moving average (20; smoothed) - up.

CCI: 86.4982

The second trading day of the week for the EUR/USD pair was held in very calm trading. We still believe that the strong pull of the European currency on Monday was the result of a whole group of different factors. Perhaps even under the pressure of several factors, both technical and political, and economic, market participants lost their nerve, and they rushed to the market. However, on Tuesday, the pair returned to its usual course of trading with minimal volatility. Important macroeconomic publications yesterday were neither in the States nor in the European Union. At the moment, the pair is already inclined to a downward correction, which can be the beginning of a new downward trend, since the previous local peak was not updated by the bulls. Thus, soon, today and tomorrow, we expect the currency pair to decline to the moving average line, followed by overcoming it.

The fundamental background continues to boil down to the actions and statements of American President Trump. Recall that as recently as yesterday, Trump imposed duties on imports of aluminum and steel from Brazil and Argentina, and these countries joined the list of countries objectionable to America. At this time, Donald Trump is in London for the NATO summit and has already managed to quarrel with French President Emmanuel Macron, who inadvertently stated that "NATO's brains are dead." Trump also reminded the French leader that NATO needs France more than other countries, and America - less than others. Also, Trump called on Paris to lift all kinds of trade barriers, including a digital tax against American companies. On July 11, the French Senate passed a law on taxation of large companies that provide digital services. This law applies to any company whose turnover exceeds 750 million euros in the world and 25 million euros in France. It is not surprising that some American companies fall under this law, which Trump does not like again, who only miraculously refrained from once again reminding that "America is treated unfairly." But Trump did not forget to warn France that if this tax is not abolished for American companies, the States will impose duties on French imports totaling $2.4 billion. The list of duties includes dairy products, sparkling wines, cosmetics, bags, and porcelain. Some French goods will rise in price in the States by 100%. According to US trade representative Robert Lighthizer, "EU countries are using protectionist policies that are aimed at American companies and the States will fight this." "Lighthizer's decision should give a signal to France and warn other countries that are preparing similar measures against American companies. We will not tolerate taxes that discriminate against our businesses," Matt Schruers said, head of the Computer and Communications Industry Association.

Thus, as we all see, there is no question now that the trade wars (and they can be spoken of in the plural) ended. This means that conflicts will escalate further, as neither side of the negotiation process will make concessions just like that. Of course, so far the China-US trade war, which has the greatest impact on the world economy, is causing the most anxiety. However, the mutual duties of States and EU countries will also lead to a slowdown in the growth of the world economy, the EU economy.

Today, December 4, in the European Union and the States, indices of business activity in the service sector will be published. It is expected that in Europe and America, these indicators will remain above the critical mark of 50.0, that is, the decline in this industry will not be recorded. Also, the ADP report on private-sector employment for November with a forecast of 140,000 will be released in the States today. In general, we believe that today's macroeconomic statistics will not help the European currency.

From a technical point of view, the indicator Heiken Ashi turned down, so it is expected to start a downward movement with a minimum target Murray level of "2/8" - 1.1047. We believe, as before, that the euro has no special prospects for growth. However, we recommend not to lose sight of the technical picture, which continues to indicate an upward trend, and to return to sales not earlier than the consolidation of traders below the moving average.

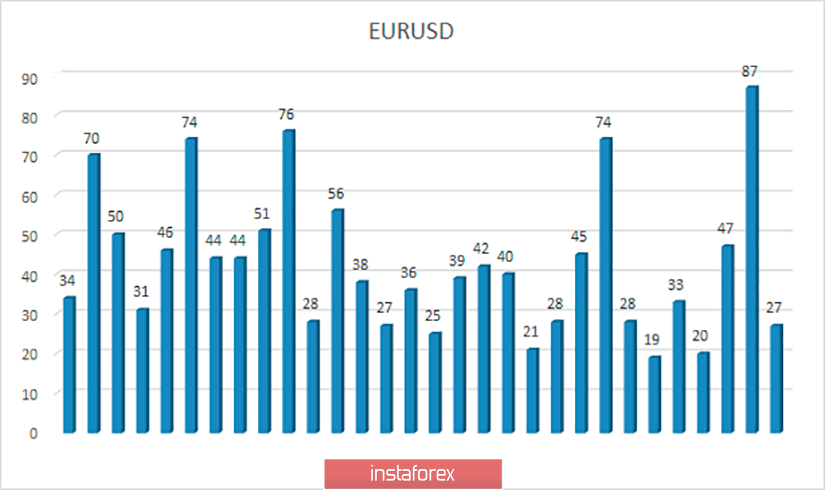

As for the average volatility of the euro/dollar pair, it is now 43 points. Thus, in the maximum case, we can expect today to move between the levels of 1.1037 and 1.1123. In the last 30 trading days, volatility above 60 points has been recorded only five times. Thus, without a strong fundamental background, it is unlikely to expect more serious movements.

Nearest support levels:

S1 - 1.1078

S2 - 1.1047

S3 - 1.1017

Nearest resistance levels:

R1 - 1.1108

R2 - 1.1139

R3 - 1.1169

Trading recommendations:

The euro/dollar pair began to adjust against the continuing upward trend. Thus, euro currency purchases remain formally relevant now, however, it is recommended to open them no earlier than turning the Heiken Ashi indicator back up with goals between 1.1100 and 1.1123. It is recommended to return to selling the pair not earlier than the reverse consolidation of bears below the moving average line.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română