At the moment, I must admit that macroeconomic statistics alone is clearly not enough to somehow revive the market. This is clearly seen in the reaction to data on producer prices in Europe, the decline of which increased from 1.2% to 1.9%. In fact, there was no reaction. However, this indicates that the recent increase in inflation in Europe is more likely temporary, and we will see its next slowdown in the near future. Thus, in addition to commonplace statistics, additional factors are also necessary, which is usually in the form of political events. But due to the fact that it was somehow boring yesterday in this regard, the single European currency, in fact, stood still.

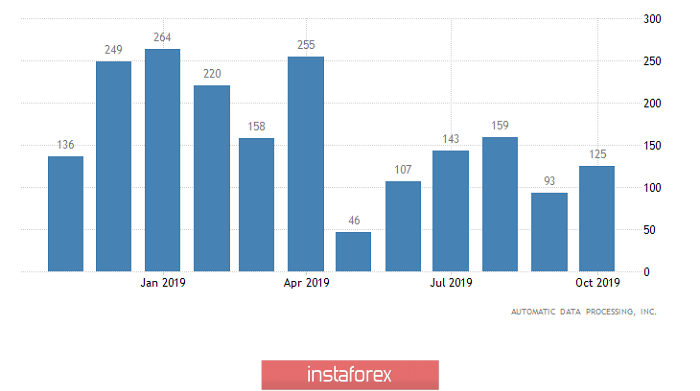

Therefore, we can safely assume that if there are no high-profile political statements or events today, the market will not particularly respond to ADP employment data. Nevertheless, they are still extremely interesting, especially when you consider that employment should increase by 140 thousand, against 125 thousand in the previous month. In addition, do not forget that these data precede the publication of the report of the Ministry of Labor, which will be held this Friday. And if employment forecasts are confirmed, then the Ministry of Labor will report on the improvement of the situation on the labor market. In other words, this is extremely significant data, but if there are no additional factors, the dollar will continue to stand still.

Employment Change from ADP (United States):

In terms of technical analysis, we see a multi-day slowdown within the psychological 1.1000, which has gotten results. The control level, in turn, was developed by the quote, and the cluster gave acceleration. As a result of which, we saw an inertial upward movement up to the next level of 1.1080. After that, the upward movement began to decline, and a pullback / stagnation formed along the level of 1.1080.

In terms of a general review of the trading chart, we see that the recovery process, relatively elongated correction, which is at the development stage 66%, returned to the region of 30% and was punctured again.

It is likely to assume that the oscillation along the level of 1.1080 will remain for some time, where the boundaries of the oscillation are 1.1070 / 1.1090. A characteristic overbought is felt in the market, but it is better to work on the breakdown of conditional boundaries.

Concretizing all of the above into trading signals:

- Long positions are considered in case of price fixing higher than 1.1090 / 1.1100.

- Short positions are considered in case of price fixing lower than 1.1070, not a puncture shadow.

From the point of view of a comprehensive indicator analysis, we see that the indicators turned around and unanimously took the upside, due to the price increase. In the case of movement along the level of 1.1080, indicators on the minute and hour intervals can be multidirectional.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română