From the point of view of a comprehensive technical analysis, we see a characteristic stagnation within the range of 1.2885 and 1.2950, where the lower boundary is a mirror level, and the upper is a reflection from the resistance area of 1.2955 / 1.3000. In fact, we were faced with another freeze, which was already two weeks ago, but in this case, stagnation shifted slightly lower. Thus, a remarkable moment is that the cycle November 22 to December 3 is a kind of return of the quote from the defective working out of the lower border, where the quote felt support already in the region of 1.2823. That is, the buyers inside the flat [1.2770 / 1.3000] were inspired by the possible victory of the Conservative Party of Britain in the early parliamentary elections and they were also able to change their current mood coupled with low volatility. Say that key level 1.3000 will soon be broken very early, since we have many factors, and it's not only fundamental that the quote may step down. So let's start with the fact that the global trend is downward, and the current structure has drawn an unjustifiably strong inertial move [October 10-21], where a flat of 1.2770 / 1.3000 was formed to align the trading forces.

In terms of volatility, there are no obvious improvements yet, we are still at a low level in relation to the average. However, the emotional mood of market participants, on the contrary, is improving, which is confirmed by the structure of hourly candles.

As discussed in the previous review, many speculators were counting on the recovery process after strengthening from the gap, but it never happened, although alternative positions were worked out. Thus, fixing the price higher than 1.2925 led to the opening of long positions in the direction of the subsequent point of resistance [November 28], the profit is small, but still.

Considering the trading chart in general terms [the daily period], we see the stubborn following of the price inside the flat channel [1.2770 / 1.3000], where the price fluctuates in its upper part 1.2885 / 1.3000.

On the other hand, the news background of the past day had an index of business activity in the manufacturing sector of the UK, where they recorded a decrease from 49.6 to 48.6 with a forecast of 48.3. Meanwhile, a similar PMI indicator was released in the United States, where it recorded an increase from 52.2 to 52.6.

But unfortunately, the reaction of the market to statistics was virtually absent.

In terms of a wide information background, we had considerable pressure on the market from the two Great Powers of China and the United States. So, after a short pause, Beijing responded with sanctions to the bill on the protection of human rights and democracy in Hong Kong passed in the United States. This kind of step further complicates US-Chinese relations and the fact of concluding a trade deal. After that, Washington reintroduces customs duties on aluminum and steel imported from Brazil and Argentina, citing the fact that these two countries are extremely unfair to US producers. From the point of view of the head of the White House, Brazil devalued its currency very significantly, by approximately 10%, and Trump criticized his Central Bank again in the face of the Fed, which are inactive and keeping the national currency [USD] rate very high.

Naturally, against such a background the dollar is under pressure and cannot fully recover in relation to the pound. Moreover, the reaction to the information background of China and the USA is clearly visible on the EUR/USD currency pair.

In terms of intra-British background, we continue to observe the bustle of the pre-election race, where each party is trying to show its best side, but the real problems of Brexit pass through the fingers. So, the problem of the outflow of investments from the United Kingdom is already known to everyone, although the outflow of "brains" is not yet released in the media. According to preliminary estimates, more than 11 thousand scientists left the country after the 2016 referendum, and these are not exact figures, they suggest that the numbers are much larger.

In turn, today, US President Donald Trump is heading to London for a NATO summit, and his "friend" Boris Johnson is frankly embarrassed by him due to such a loud noise that his opponent Jeremy Corbyn raised him. Therefore, bilateral meetings are not planned for honey leaders, as well as contacts, so as not to harm the election race.

Today, in terms of the economic calendar, we have an index of business activity in the construction sector, where they expect a slight increase of 44.2 ---> 44.5.

Further development

Analyzing the current trading chart, we see the concentration of quote within the lower boundary of the resistance area of 1.2955 / 1.3000. In fact, the quote had a local stop, where the focus of attention was the maximum of November 28 [1.2950]. In addition, there was an almost fleeting acceleration after the value of 1.2950 decline.

In terms of volatility, we got acceleration, as described above. However, it is still not enough to state high volatility. The emotional mood of speculators clearly reflects the desire to accelerate, but so far, only local bursts.

Detailing the constantly moving movement, we see that there was a sluggish but upward move almost every morning. The main acceleration came to the Europeans entering the market.

In turn, speculators analyzed the breakdown of the maximum on November 28 [1.2950], which provoked a local surge in long positions.

Having a general picture of actions, it is possible to assume that the area of 1.2955 / 1.3000 will try to play the role of resistance again, slowing down the quote and as a fact setting downward interest. That is, our logic is based on the image of the theory "History repeats itself", which in this case, has been repeatedly confirmed in the market. Thus, it is enough to analyze the existing flat.

Based on the above information, we derive trading recommendations:

- There have already been buy positions in terms of local deals, and now, they may already be closing. On the other hand, entering the market for a move to the value of 1.3000 does not make much sense in terms of profitability and high risk.

- Sales positions are considered in the case of a development in the area 1.2955 / 1.3000.

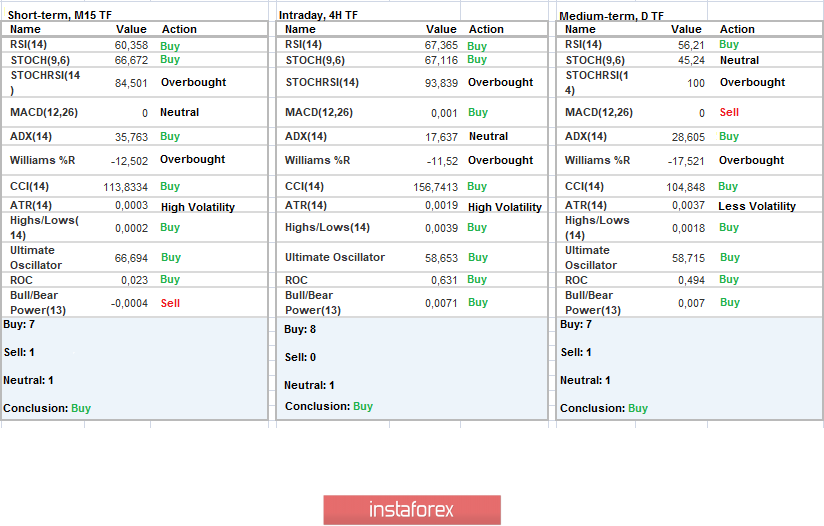

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that indicators took a buy position due to fluctuations in the upper part of the flat. It is worth considering that short-term and intraday intervals can also quickly change their mood in the event of another development of the 1.2955 / 1.3000 area, so be prepared.

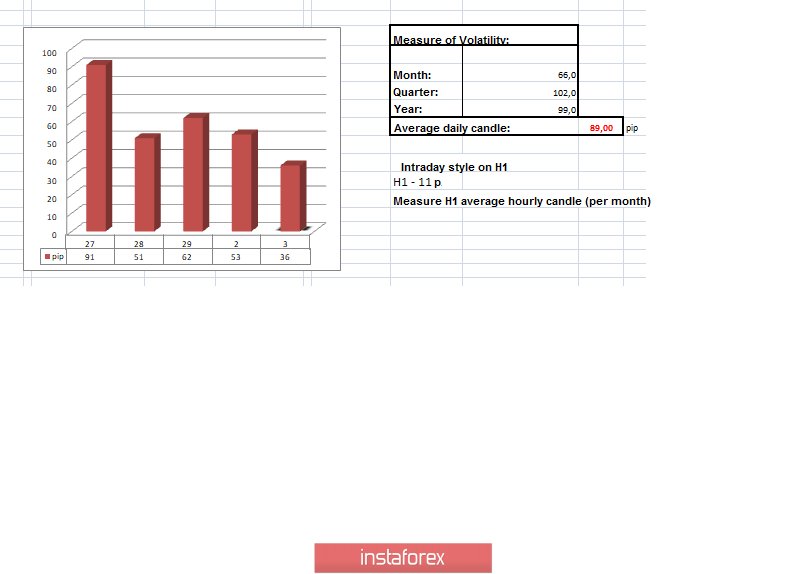

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(December 3 was built taking into account the publication time of the article)

The volatility of the current time is 36 points, which is still a low value for this time section. It is likely to assume that acceleration of volatility is possible just in the case of the development the upper boundary.

Key levels

Resistance Zones: 1.3000; 1.3170 **; 1.3300 **.

Support Areas: 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** The article is built on the principle of conducting a transaction, with daily adjustment

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română