4-hour timeframe

Technical data:

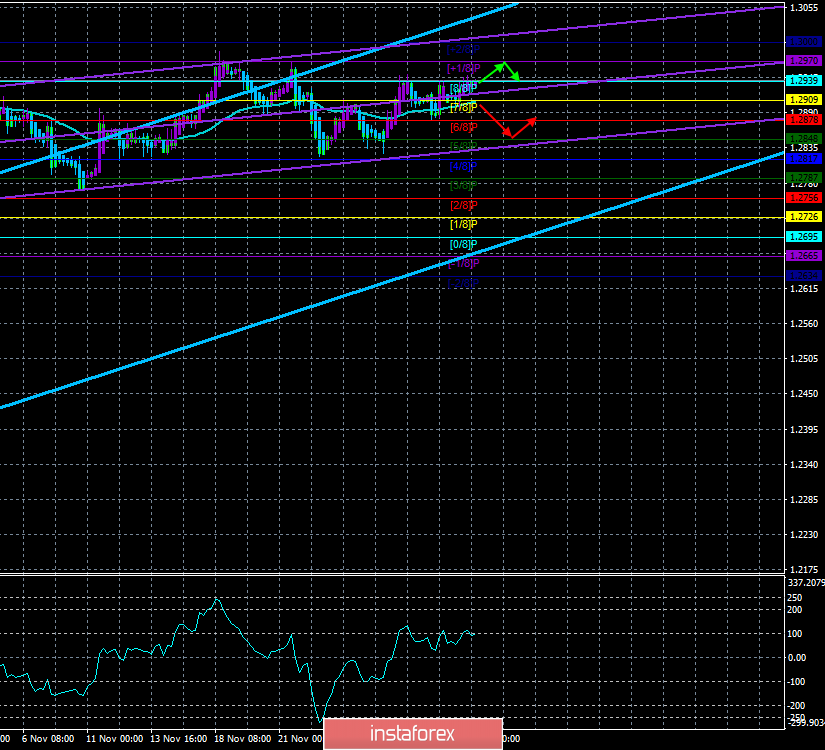

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - up.

CCI: 100.5554

The GBP/USD currency pair continues to trade inside the side channel, limited by the levels of 1.2970 and 1.2780, near its upper border. Given the reluctance of traders to start a round of downward movement in this side channel, there is a feeling that there will be several attempts to overcome the level of 1.2970, or rather the resistance area of 1.2970-1.3010. However, until this happens, it is the side channel that remains in action and continues to hold the pair's quotes inside itself. The fundamental background for the pair is present, but what good is it if traders do not pay any attention to it. During yesterday's day, the US dollar sank significantly against all major currencies, against the euro, the franc, and the yen. Only the pound was watching from the sidelines. The index of business activity in the manufacturing sector of the UK showed a positive trend, as in many other EU countries, however, traders did not pay attention to this event. Thus, today we do not expect sharp movements or exit from the side channel from the pound/dollar pair. Volatility is likely to remain unchanged. As for the macroeconomic reports scheduled for Tuesday, December 3, there will be quite a few of them - one is the index of business activity in the construction sector, which is also very deep relative to the critical mark of 50.0-44.2. It is expected that by the end of November, this figure may rise slightly, but we all understand that we are talking about an increase of 0.2-0.5 points, no more, which will not exactly allow us to declare the end of the recession in the construction sector.

Thus, we have to state the fact: traders continue to wait for the results of the parliamentary elections, which will be held in 9 days, and until that moment they still do not want to risk and actively trade the pound/dollar pair. Many media, experts, political scientists, and analysts have repeatedly written about the probability of a conservative victory, about sociological studies modeling the election results, but even this information does not have any special impact on the pair now. Thus, we believe that we should stop guessing on the coffee grounds about who will win the election and by what margin. It is best to wait for the moment when the pair leaves the side channel and completes the flat, and volatility will rise to the values usual for the pound. In the case of elections, it is best to wait for the official results and only then begin to draw any conclusions and build trade plans on their basis.

We still believe that even if the conservatives win, led by Boris Johnson, who for the sake of winning the election does not hesitate to even use such a deplorable event as the terrorist attack on London Bridge, to once again "stab" the Labor Party and accuse them of what happened, then, in the long run, the pound will still be prone to fall against the US currency. Even if Brexit is completed before the end of January 2020, in the future, the country and its government will face long negotiations with the European Union, America and other partners on trade agreements. And they can last for several years. All the while, the UK economy will be under pressure. And the more the geopolitical situation in the world escalates, the greater the negative impact will be on the UK economy.

From a technical point of view, a weak upward movement inside the side channel continues, and all trend indicators are directed upwards. However, volatility remains quite weak, and the pair cannot leave above the level of 1.2970. Thus, we do not expect the flat to be completed yet, accordingly, any positions, from our point of view, are now associated with increased risks.

Nearest support levels:

S1 - 1.2909

S2 - 1.2878

S3 - 1.2848

Nearest resistance levels:

R1 - 1.2939

R2 - 1.2970

R3 - 1.3000

Trading recommendations:

The GBP/USD pair continues to trade inside the side channel. Formally, an upward trend is now maintaining, since not only the price is above the moving average line, but both channels of linear regression are directed upwards. However, the area of 1.2970-1.3010 remains unmet, so we do not expect the formation of a new upward trend. It is possible to trade inside the side channel. For example, from the level of 1.2970, a rebound is possible and a reversal of the Heiken Ashi indicator downwards can signal a round of downward movement. Buying the pound in the upper area of the side channel is not the most appropriate exercise.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română