From the point of view of technical analysis, we see a magical jump in quotes, which led us back to the first recovery level of 1.1080, where it slowed down its inertial movement, and as it was, we will analyze it sequentially. To begin with, the quotes moved sluggishly within the psychological level of 1.1000 for five consecutive trading days, having variable accumulation with a low-amplitude tap, where volatility dropped to 18 year lows. Such stagnation raised market interest on a daily basis, and thus, many traders wondered what will happen next. Of course, many expected further recovery, with the transition to the third stage [#3/1; # 3/2]. However, after such a long accumulation, there was no longer a big difference where the price would go, since the momentum was provided. So the day "X" came, the reference points were 1.0990 [Sell] and 1.1030 [Buy], the upper mark is triggered, and the quotes reaches all previously set forecasts on the inertial course which were 1.1055-1.1060-1.1080, from which we all come out for a good profit.

The key question is what to expect next? But, we will return to it a little later.

Analyzing the past hourly hour, we see that the impulse jumps came at a period of 11:00-15: 00 [UTC+00 time at the trading terminal]. After that, the quotes reached the subsequent control level of 1.1080 and moved to the deceleration stage, where a small pullback was formed.

As discussed in the previous review, traders have long been monitoring the values of 1.0990 [Sell] and 1.1030 [Buy], being outside the market. The wait did not go in vain since everyone had the opportunity to earn good profit with relatively low risk.

Considering the trading chart in general terms [the daily period], we see that the recovery process was hit once again and step #2 represented by the psychological level of 1.1000 played a supporting role, returning us back to 1.1080, as it was in the time interval 11/14/19 - 11/18/19. Thus, an oblong correction in the structure of the global downward trend continues to exist.

On the other hand, the news background of the past day contained data on the index of business activity in the manufacturing sector of the Eurozone, where expectations were confirmed and we saw an increase from 45.9 to 46.9. After that, similar PMI data came out in the United States, where they also recorded growth from 52.2 to 52.6. In addition, the ECB's President Christine Lagarde spoke before the European Parliament during the evening. She announced her intention to reach the inflation target in the eurozone, as well as noting that the forthcoming assessment of the Central Bank's strategy will address a wide range of issues, including climate change.

Therefore, the market did not react to the statistics due to the strong information background.

In terms of information flow, we had a flurry of sanctions and tariffs, and thus, China began its marathon, which imposed sanctions on a number of US non-governmental organizations in response to the Law on the Protection of Human Rights and Democracy in Hong Kong. More so, they suspended the consideration of American requests for visiting Hong Kong's warships and aircraft. After that, US President Donald Trump reintroduced customs duties on aluminum and steel imported from Brazil and Argentina, referring to the fact that these two countries are extremely unfair to manufacturers in the United States.

"I gave them a considerable respite from duties. Now I stop, because this financial policy of Argentina and Brazil is extremely unfair to our producers, our farmers. Our steel companies and our farmers will be very pleased with my move." said the head of the US administration.

At the same time, Mr. President recalled his beloved Central Bank [Fed], criticizing his actions again.

"The Fed should lower the rate (inflation is practically absent) and weaken, which will make us competitive with other countries, and production will grow! The dollar is very strong against others."- twitter @realDonaldTrump

Finally, at night, the information that the United States could introduce duties on French goods in connection with the introduction of France's digital tax on US US companies became known.

"The US representative's office completed the first phase of the investigation under article 301 of the 1974 Trade Act [provides for possible sanctions on" unfair trading partners "] and concluded that France's digital tax discriminates against US companies like Google, Apple, Facebook and Amazon. The decision of the apparatus sends a clear signal that the US will introduce measures against those digital tax regimes that discriminate or burden US companies. Under article 301, investigations into taxes on digital services are launched in Austria, Italy and Turkey. " said in a statement.

Regarding the alleged duty, it turns out that French goods may be subject to tariffs of approximately $ 2.4 billion.

Now, you can already see the reaction of the market to the entire information background on the trading chart.

Today, in terms of the economic calendar, we do not have statistical data worthy of attention. Thereby, the market will continue to work against an information background.

Further development

Analyzing the current trading chart, we see a literally vertical move, which certainly has overheated long positions, and thus, it is completely normal to expect a recovery in terms of technical analysis. In fact, the stagnation that we have now is the ambiguity of market participants who see an array of information flow and overbought, but do not know how best to proceed and not to omit the possible profit at the same time. In terms of volatility at this time, we still have a characteristic restraint, but speculators are at a low start, thus acceleration is possible.

By detailing the available time interval, we see a fluctuation in the region of 8 points in the structure of stagnation/retracement, where another surge is possible when Europeans enter the market.

In turn, traders fixed long positions as soon as the quotes reached the control level of 1.1080. Now, speculators are considering recovery positions lower than 1.1065. Alternative transactions are considered if the inertial course is maintained and the price is fixed higher than 1.1090 / 1.1100.

It is likely to assume that the quotes will try to partially recover, but it is better to look at both the values of 1.1065 and the area of 1.1090 / 1.1100 due to the high background, thereby working both to increase and decrease.

Based on the above information, we derive trading recommendations:

- Buying positions are considered in case of price fixing above the area of 1.1090 / 1.1100.

- Selling positions are considered in case of clear price fixing lower than 1.1065.

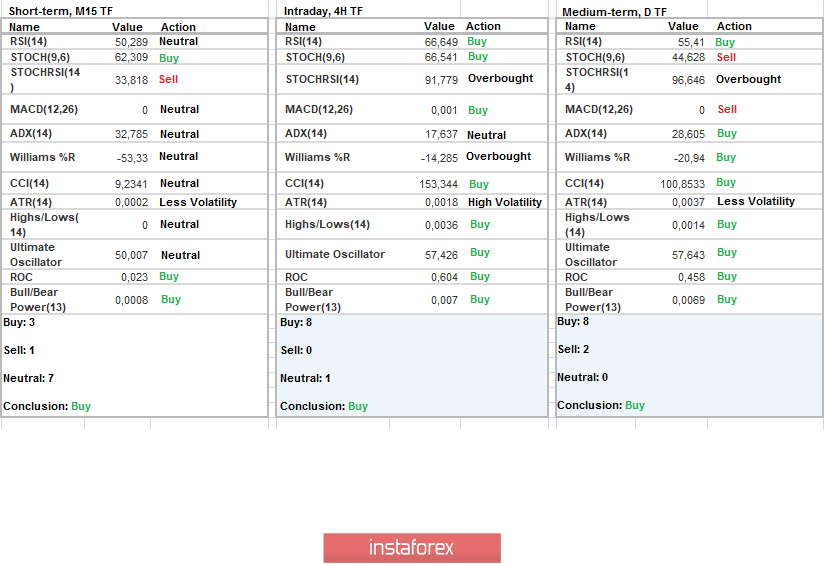

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that the indicators turned upward by default due to the inertial jump in the price, signaling purchases. Thus, it is worth considering that indicators in the short-term and intraday areas can be versatile in the event of a hang within 1.1080.

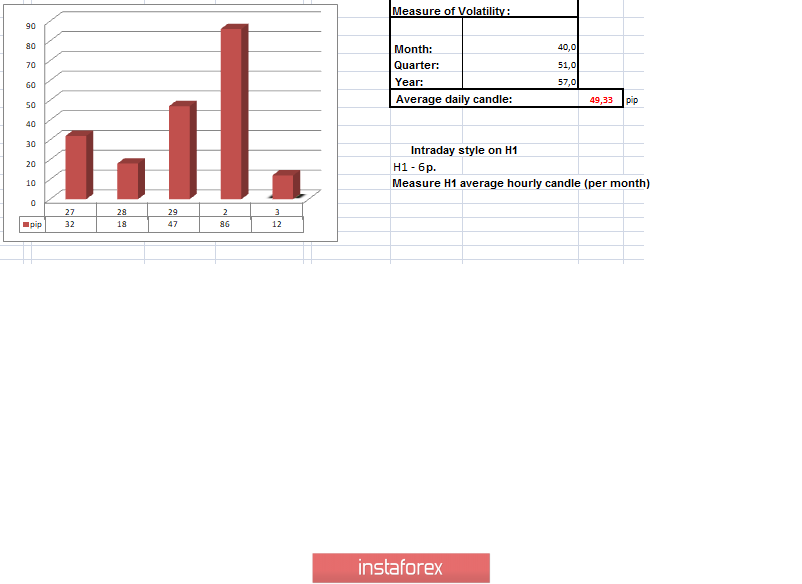

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(December 3 was built taking into account the publication time of the article)

The volatility of the current time is 12 points. It is likely to assume that the acceleration of volatility can still be just in the background of the flow if there is no stagnation within the level of 1.1080.

Key levels

Resistance zones: 1.1080 **; 1,1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100

Support Areas: 1,1000 ***; 1.0900 / 1.0950 **; 1.0850 **; 1,0500 ***; 1.0350 **; 1,0000 ***.

* Periodic level

** Range Level

*** Psychological level

***** The article is built on the principle of conducting a transaction, with daily adjustment

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română