Economic calendar (Universal time)

The most important in the economic calendar today is the block of statistics from the Eurozone, which is expected around 12-13 hours of the day. The main indicators in the total amount of reporting information are data on the number of unemployed in Germany and the change in the consumer price index for November.

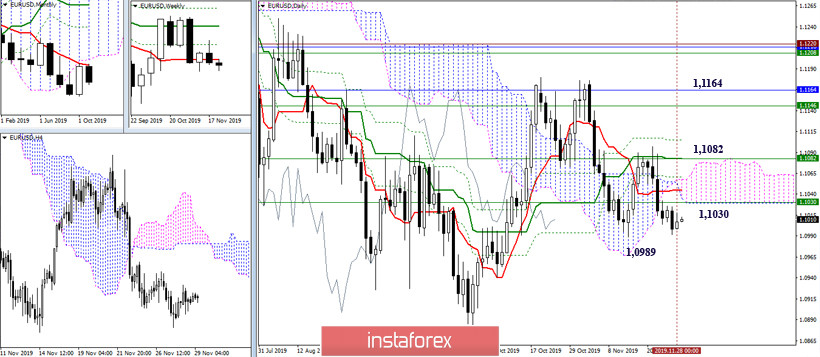

EUR / USD

This week has not added to the players to lower certainty. Their potential opportunities remained unrealized, since it was not possible to restore even the daily downtrend of 1.0989. Today we close for the week and for the month of November. If the downside players are able to move to December with the Penetrating Lines, candlestick model formed on the rebound from the monthly short-term trend, then thanks to this, the bearish potential in December will be preserved and would possibly develop. If at the closing today, players win by increasing, the uncertainty will shift to the monthly time. As a result, upward players in December will most likely make new attempts to continue the upward correction, through a breakdown of the monthly short-term trend of 1.1164.

In the lower halves, there is no full support from all the analyzed technical instruments on either side. The pair is in the correction zone, and the most significant level now is the resistance to the weekly long-term trend of 1.1016. Fixing above will allow you to count on a change in the slope of the movable, which means a further increase in bullish sentiment. Classic Pivot levels are located today at 1,1017 - 1,1028 - 1,1037 for the resistance, and 1,0997 - 1,0988 - 1,0977 for the support.

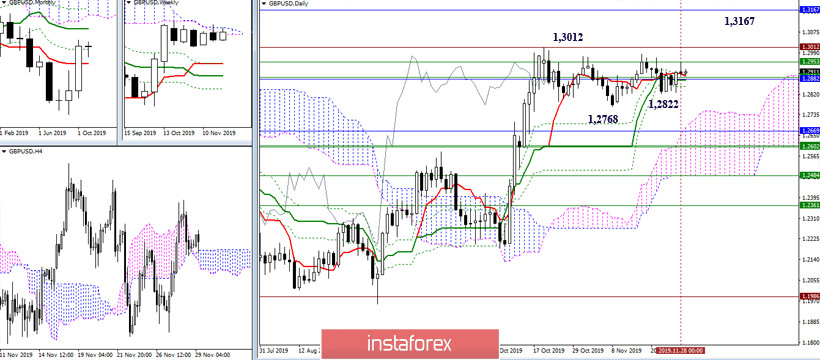

GBP / USD

Downgrade players during the current week were not even able to update the minimum of the last working week, not to mention the implementation of the prerequisites formed earlier. Today we close not only the week but also the month. The November monthly candle of uncertainty, without updating the October high, will only increase the chances that players will increase their efforts to leave the zone of confrontation with the winners. The primary upward benchmarks in this situation remain at the maximum extremum of 1,3012, consolidation in the bullish zone relative to the weekly cloud and effective interaction with the monthly medium-term trend of 1,3167. For players to lower, the immediate task is to update the lows of 1.2822 - 1.2768 and consolidate below.

In the lower halves, the upside players took hold of the weekly long-term trend, but despite this, they now have no clear and complete advantage, since the central Pivot level is lost at 1.2918. Fixing below 1.2883 will deprive bulls of support for the long-term trend while maintaining uncertainty, and updating the low of last week with 1.2822 will increase the chances of players to lower to further strengthen their moods. The transition to the side of the bulls of the central Pivot level of 1.2918 will form for the latter good chances for an optimistic close of the current week and month.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română