Following a short period of weakness, the pound returned to the area of the 29th figure, demonstrating invulnerability to a stronger dollar and external fundamental factors. The British currency grew after the publication of data from YouGov, which were in favor of the Conservatives. Let me remind you that earlier this week the pound fell also due to opinion polls - other research agencies announced a decrease in the rating of the Tories and the strengthening of the position of the Labour Party. But for traders, the poll from YouGov was important - their calculation methodology is slightly different, more adapted to the British electoral system. Therefore, the figures published on Wednesday returned to traders the hope of a "soft" Brexit, since Conservatives, by all appearances, will nevertheless take the majority in Parliament.

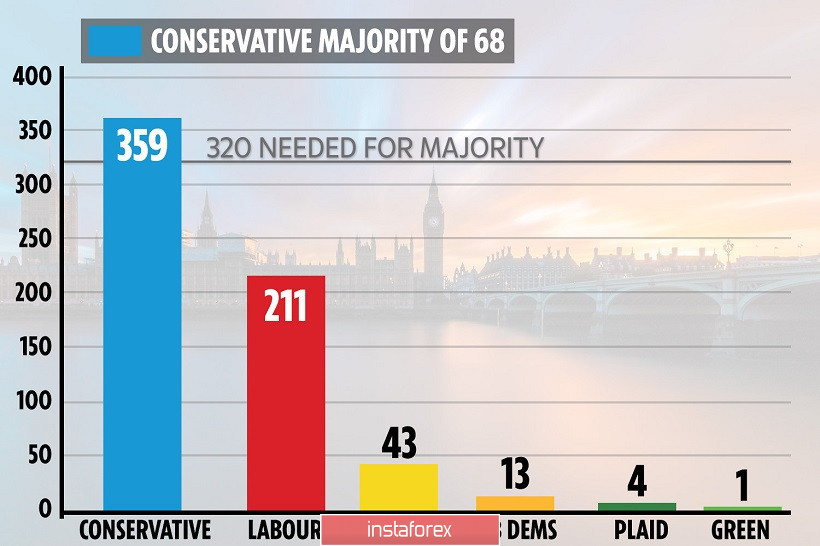

According to YouGov, the Conservative Party will receive strong support in early parliamentary elections on December 12. According to preliminary estimates, the Tories will be able to form an independent majority in the House of Commons with a substantial margin of almost 40 votes. This will be the best result for the Conservatives since 1987, that is, from the time of Margaret Thatcher. In turn, the Labour Party will be able to get no more than 210 seats, while now Corbyn "owns" 262 votes in the House of Commons. Scottish Nationalists can count on 43 seats, while ardent opponents of Brexit - the Liberal Democrats - are forecasting only 13 seats in Parliament. It is noteworthy that the Brexit Party by Nigel Faraj, according to surveys, does not go to the House of Commons at all.

On the other hand, this is not surprising, since Faraj announced a few weeks ago that he would not stand for election in those districts where Conservatives won in the previous elections. By the way, it was after this decision that the Conservatives "left the gap" from the Labour Party: The Brexit Party and Boris Johnson's party played on the same electoral field, drawing their voices apart. Now, those Britons who are focused on the scenario of a country's exit from the EU have somehow approached the orbit of the Conservative Party (even if they did not support them earlier), considering Johnson as the only political leader who can put an end to the protracted negotiating epic. Experts recorded the greatest support for Conservatives in those regions that unequivocally voted to leave the European Union three years ago.

Why is this opinion poll important for the market? As mentioned above, YouGov experts used a methodology that is more adapted to the British electoral system and with a larger sample of respondent voters. This methodology predicted the collapse of Theresa May in 2017. Two years ago, she initiated early elections to strengthen her position in Parliament, and preliminary ratings from other research agencies predicted her victory (Tory rating was at 40-45%). And only YouGov in a similar poll said that May will lose the majority in the new Parliament. As a result, this happened: the Conservatives received only 317 mandates and were forced to enter into a coalition alliance with the Democratic Union Party. Unionists, having only ten votes in the House of Commons, dictated their terms to the Conservatives (including Brexit issues) in many ways, negatively influencing the negotiation process with Brussels. I repeat - only YouGov specialists were able to predict this scenario in 2017, although during the election campaign it seemed unlikely.

In addition, even taking into account the inevitable errors of this survey, Johnson's party will still be able to form a majority that is quite comfortable for himself. Even if some of the newly elected Conservatives turn out to be dissidents, Johnson will be able to calmly conduct the deal through the millstone of the House of Commons, having a margin of several tens of votes in reserve. By the way, according to the prime minister, all Conservative candidates signed an obligation, according to which, if elected, they will support the deal with Brussels.

Thus, the pound got rid of pessimistic sentiment, and entered the 29th figure when paired with the dollar. However, the pair's growth is also limited: less than two weeks left before the election, and tension is growing every day - even despite the published ratings. Therefore, the GBP/USD pair has its own price ceiling at the moment in the form of 1.2970 - this is the upper line of the BB indicator on the daily chart. To enter (and even more so to gain a foothold) within the framework of the 30th figure, the pair needs a fairly powerful informational occasion. In other words, traders, on the one hand, believed the latest sociological survey, but on the other hand, they do not risk opening large positions until preliminary ratings from YouGov turn out to be a reality.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română