To open long positions on EURUSD you need:

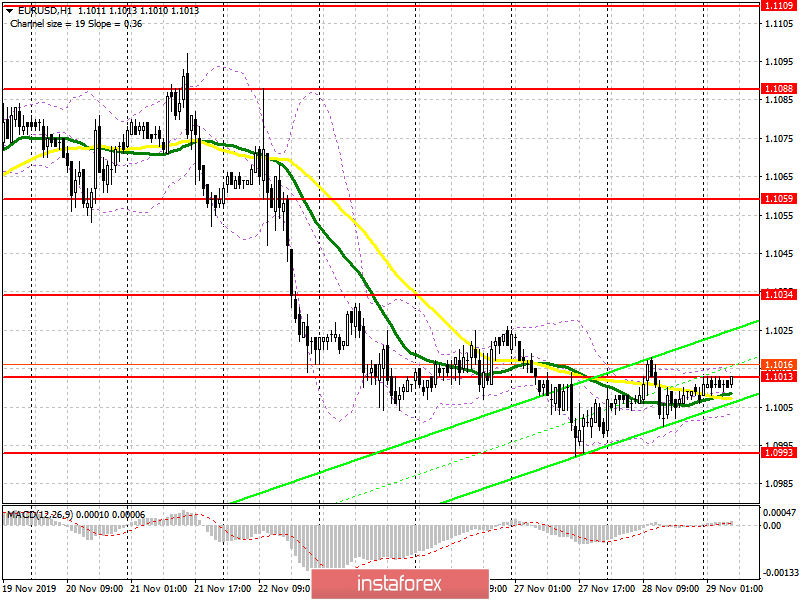

A number of important fundamental data on eurozone countries are expected to be released in the first half of the day. This includes inflation, which could harm the European currency and prevent it from breaking above a resistance of 1.1013, which could not be done yesterday. An important task for buyers is the 1.1013 level, since only a return to it will allow us to talk about a more powerful upward impulse to the area of highs 1.1034 and 1.1059, where I recommend profit taking. If the reports disappoint, in case the euro falls in the morning, purchases can be considered only after a false breakout is formed in the support area of 1.0993, or you can buy the euro immediately to rebound from a low of 1.0972.

To open short positions on EURUSD you need:

Sellers are struggling to maintain a downward momentum in the pair, but many market participants are waiting for the US and China to sign the first phase of a trade agreement, which will limit demand for the US dollar as a safe-haven asset. The next formation of a false breakout in the resistance area of 1.1013 will be a signal to open short positions in the pair. However, a more important task is to break through and consolidate below the support of 1.0993, which will lead to updating lows in the areas of 1.0972 and 1.0943, where I recommend profit taking. Bears can also take advantage of the moment after the release of weak data on inflation in the eurozone, which indicates the need for additional stimulus by the ECB. If sellers miss the resistance of 1.1013, then it is best to count on new sales after an upward correction from the level of 1.1034, or sell immediately on the rebound from a high of 1.1059.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving average, which indicates the lateral nature of the market.

Bollinger bands

Volatility is very low, which does not provide input signals.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română