The actions of the US president and the signing of the Hong Kong Democracy Support Act could be detrimental to US-China relations. However, the US dollar did not lose much of its position, even after the demand for risky assets, including the yen and the franc, increased. As it became known, the new law amends the 1992 United States Policy on Hong Kong Act. It more clearly clarifies the US position on Hong Kong and provides an assessment of the political events taking place in Hong Kong. During his speech, Donald Trump said that he signed these laws out of respect for President Xi, China and the people of Hong Kong. The American president also stressed that the leaders and representatives of China and Hong Kong will be able to peacefully resolve their differences, which will lead them to long-term peace and universal prosperity.

Immediately afterwards, the Chinese Foreign Ministry condemned the signing of the new law and threatened to take retaliatory measures. The ministry did not specify what specific measures are in question.

As for the fundamental data, the market calmly accepted reports on growth in lending to households, which will support the economy in the future.

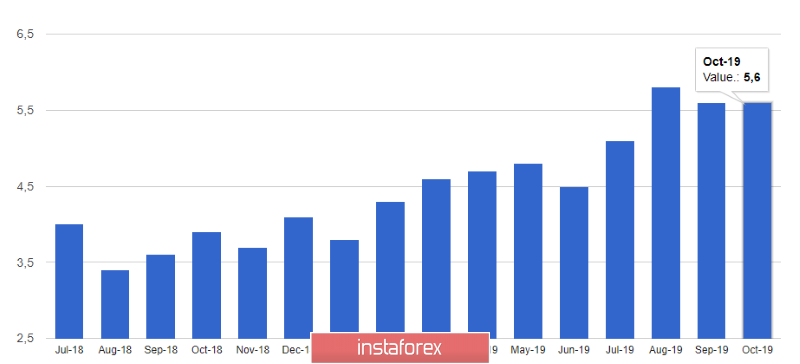

According to data, lending to households in the eurozone increased by 3.5% in October of this year against 3.4% in September. As for companies, there was also a growth in lending by 3.8% against 3.6% in September. The eurozone M3 monetary aggregate grew by 5.6% in October compared to last year with a forecast of 5.5%, and the moving average of the monetary aggregate from August to October increased by 5.6% against the forecast of 5.5%.

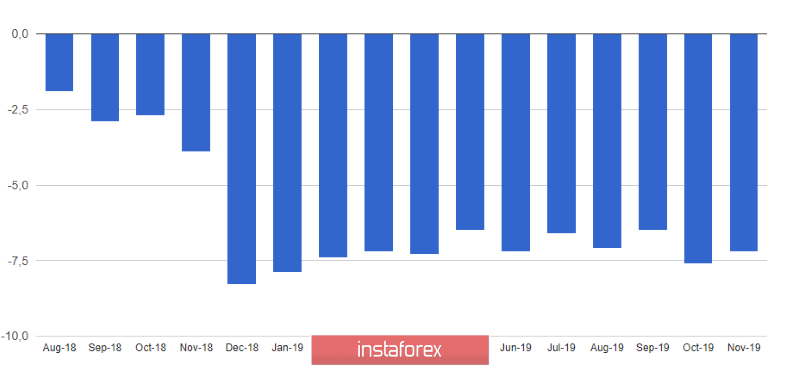

The euro also ignored data on the consumer confidence index in the eurozone, which completely coincided with the forecasts of economists. Despite the improvement of the indicator, the value remains in the negative zone, which indicates restrained confidence. According to the data, the consumer confidence index rose to -7.2 points against -7.6 in October this year. The confidence index in the eurozone industry rose to -9.2 points in November, while the confidence index in the service sector increased to 9.3 points in November against October 9.0 this year.

The technical picture of the EURUSD pair remains unchanged. The market continues to continue to be in a "suspended" state, relying either on data on the US economy, or on the news of US-Chinese trade negotiations. The demand for the euro may return if the bears miss the resistance of 1.1015, which will quickly lead to the renewal of the highs of 1.1040 and 1.1060. An unsuccessful attempt to return to a resistance of 1.1015 can maintain pessimistic views on the purchase of the euro, which will pull down the pair to a low of 1.0993 and lead to its breakout, making it possible for the bears to reach support at 1.0970.

The British pound is falling against the US dollar after the euphoria that surged into the market in connection with the results of an election poll in the UK by YouGov. In the morning, I noticed that the report indicated the advantage of the Conservative Party following the results of the general early election, which could get 359 out of 650 parliamentary seats. Such a market reaction is not surprising, since the polling model used by YouGov allowed the company to correctly predict the results of the 2017 elections of the year.

However, the elections themselves are still two weeks away, so it's still too early to talk seriously about the advantage of any party.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română