On Tuesday, US stock indices made an attempt to update historical highs. The growth was due to both higher-than-expected corporate reporting results and exceeding the results of the 3rd quarter relative to forecasts, as well as a noticeable infusion of liquidity into the US financial systems. Along with $ 60 billion from the Fed, the Treasury adds, which plans to add 90 billion to the banking system by December 12.

As soon as the planned measures to support liquidity are implemented, US stock indexes will be ready for a reversal, and the pendulum will swing in favor of bonds and other protective instruments. Thus, these expectations will be realized as the date approaches December 12, when liquidity provision measures are completed.

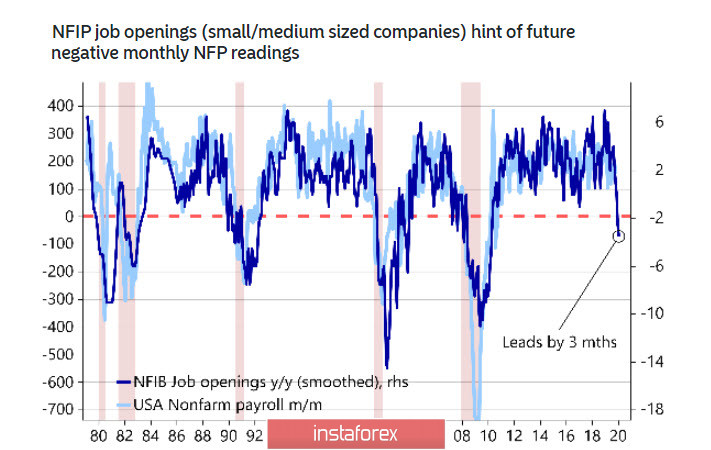

At the same time, there is no reason to consider the current stage of short-term optimism as the beginning of a way out of the economic downward turn. The situation on the labor markets of the G10 countries synchronously begins to deteriorate, while data on open vacancies NFIP warn of a high probability of a reversal.

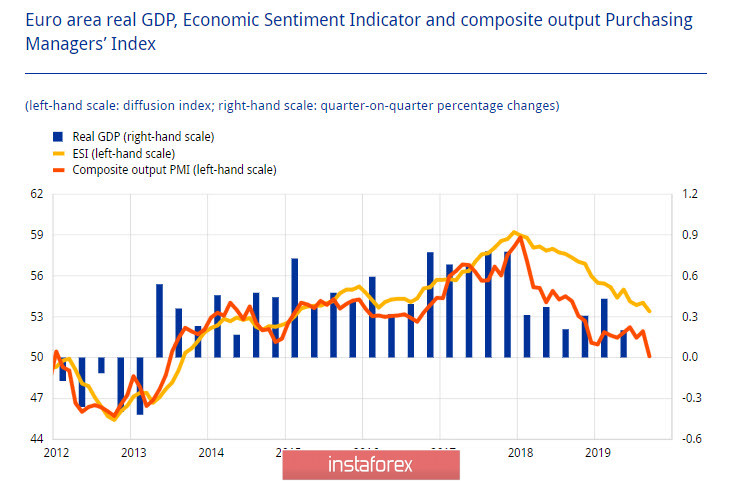

Fears are growing that, following the slowdown in production in the 1st quarter of 2020, the slowdown phase will come to the services sector.

On the other hand, the current increase in demand for risky assets is most likely the last opportunity to sell them at a good price. A confident reversal in favor of bonds, gold and protective currencies should be expected in the coming weeks.

EUR/USD

Despite a sharp decline in business activity in 2019, GDP is still in positive territory, and if the bottom of the recession is reached, then the threat of a recession in the eurozone becomes minimal. The only question is whether the bottom has really been reached, or are we just seeing a pullback against the backdrop of the plans announced by most central banks to stimulate the economy.

On Wednesday morning, the euro is stable after a three-day growth, and thus, speculation on the reduction of deposit rates is gradually disappearing. In the markets, it is increasingly believed that the ECB is close to the threshold of monetary stimulation. Similar estimates were simultaneously expressed, for example, by DanskeBank, Scotiabank, and Nordea Bank is taking a more cautious position and suggests that by March 2020, another softening package will be needed, such as doubling QE procurement and lowering the base rate by 10p.

On Friday, Christine Lagarde will speak before the publication of the PMI for November in Frankfurt, perhaps she will give some guidance on her next actions. While the euro is moving in a wide range, the medium-term trend is downward trend with the support of 1.0980 / 90 and the target of 1.0949, with the intermediate target of 1.1028. If the euro manages to stay above 1.1070, then a test of the boundary of the channel 1.1090 / 1.1100 is possible with a subsequent increase to 1.1178.

GBP/USD

The production in the UK, according to CBI, continues to fall. The November -26p index is slightly better than the 9.5-year low of -37p a month earlier, but continues to be well below the long-term average.

Moreover, NIESR has a pessimistic view of the future of the UK economy. According to the institute, the conclusion of an agreement with the EU will lead to a reduction in production by 3-4%, if compared to those as if Britain remains in the EU. Irrecoverable losses will amount to 70 billion pounds, and NIESR does not share the opinion that Britain will be able to take advantage of free trade opportunities with other countries when it frees itself from the restrictions associated with EU membership.

It seems quite suspicious that the Johnson government categorically evades any assessment of the agreement. Officially, the motives for such strange behavior are the reluctance to influence voters on the eve of the election, but rather, the situation looks different - the government also understands that the UK economy will lose more than it gains and therefore remains silent.

As a result, the pound grew earlier this week on political news - the Brexit party announced that it was clearing the way for parliament for the Tories, while Polls show that the Conservative Party has strengthened its leadership. At the same time, the resistance zone 1.2975 / 3000 has survived and the consolidation range of 1.28 / 1.30 is confirmed. An attempt to break through is more likely, but the momentum is not confirmed by the economy. Therefore, if the pound does not receive a new portion of political support, it will drop to 1.29 and continue further to 1.2840 / 50 in the next day.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română