4-hour timeframe

Amplitude of the last 5 days (high-low): 36p - 25p - 39p - 42p - 40p.

Average volatility over the past 5 days: 36p (low).

The EUR/USD currency pair spent the second trading day of the week in sideways movement with the same low volatility that we have recorded over the past weeks. Thus, from a technical point of view, the picture for the EUR/USD currency pair has not changed at all compared to the previous day. However, there are a couple of interesting points that we should pay attention to. First, the pair came close to the upper boundary of the Ichimoku cloud. This line is quite strong resistance, therefore, a high probability of a rebound from it. A rebound from this line can with a high degree of probability mean the completion of a hike up and the resumption of a downward trend. We have already written more than once that, from our point of view, there are no particularly good fundamental reasons for strengthening the euro currency, and the only thing that saves the euro from a new fall against the US dollar is the bearish desire to sell the pair when it is near its two year lows. Secondly, all the same foundation, which is practically absent this week. There will be literally a couple of interesting macroeconomic publications on Friday, as well as a speech by Christine Lagarde that day. However, if the head of the ECB does not say anything shocking and unexpected, then again the traders will have nothing to react to. Thirdly, traders have already ignored information from several ECB members at once, who in one way or another, but hinted at the central bank's readiness to cut rates in the future. True, some of them announced that they should wait for the results of the stimulus package that the central bank introduced in September, so at the next meeting of the ECB, which will be the first at the helm for Christine Lagarde, it is hardly worth expecting a reduction in the key rate. Fourth, we are now dealing with weak volatility, so it doesn't even matter if bears or bulls want to enter the market and at what price levels, there are very few traders on the market now, so it does not make sense a priori to expect strong growth or decline in such conditions .

What do we have today? In the United States, the number of approved building permits increased by 5% compared with September, but the number of started construction of houses amounted to 1.324 million, although forecasts predicted the figure of 1.32 million. However, these reports are of secondary importance and have no effect on the movement of the currency pair. Meanwhile, hearings on the impeachment case of Donald Trump in the United States are ongoing, and more attention is being drawn to this event not just from the U.S. residents, but from the electorate in the 2020 presidential election. According to opinion polls, about 70% of respondents condemn Donald Trump for talking with Ukrainian President Vladimir Zelensky, in which the US leader demanded to investigate the activities of his main rival for the presidency in future elections in exchange for military assistance worth $400 million. About 50% believe that all the charges against Trump are fair and the president deserves to be removed from office. What does this mean? This means that the potential number of Trump voters in 2020 is declining. We already wrote that Trump lost part of his electorate due to the trade war with China, which he now cannot or does not want to finish in fact. Ordinary Americans are faced with an increase in prices for Chinese goods by 15-30%. Given the fact that Chinese products are famous for their cheapness, the rise in prices for these categories of goods is unlikely to please Americans. If Trump manages to end the war before November 2020, then the situation may change in his favor, but China also understands that the longer the trade war lasts, the less chance Trump has to extend his presidential term. Thus, it is possible that China is even intentionally prepared to wait out the last year of Trump's presidency in order to negotiate with a more loyal president. Of course, they will not announce the impeachment to Trump, the investigation of this case may continue for several more months, and removing the president six months before the election does not make much sense. But all these investigations continue to cast a shadow over the US leader, which can be enough to lose the election to Joe Biden. Thus, the Democrats now simply need to "toss firewood into the fire."

From a technical point of view, it is now best for traders to wait for a rebound from the Senkou Span B line or to overcome it, which will determine the vector of further movement of the euro/dollar pair. We believe that it will be very difficult for traders to go above the resistance level of 1.1101, so we recommend that you carefully handle long positions.

Trading recommendations:

The EUR/USD pair continues the upward movement. Thus, now it is possible to consider purchases of the euro currency, but only in small lots, since the current movement is still identified as corrective. We recommend that for euro purchases wait until the level of 1.1101 is overcome. It is recommended to return to purchases of the US dollar no earlier than the reconsolidation of the euro/dollar pair below the critical Kijun-sen line with the aim of the support level of 1,1008.

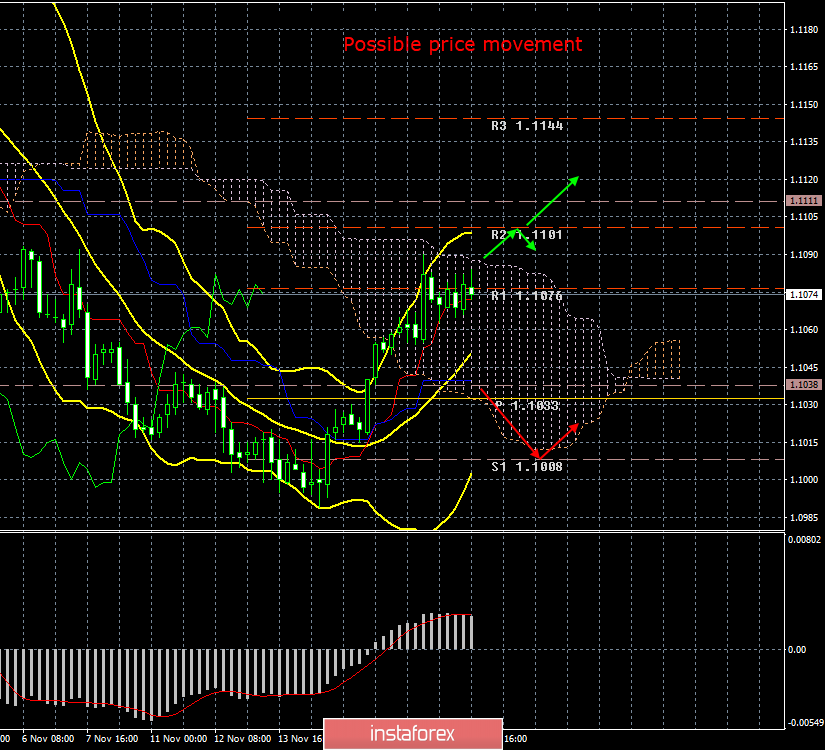

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română