The Reserve Bank of New Zealand is able to surprise. Although this quality does not characterize the central bank on the positive side: a weak level of communication with the market is fraught with sad consequences. Here it is worth recalling the events of this summer, when the RBNZ immediately reduced the rate by 50 basis points without any clear warning. The echoes of this decision were felt far beyond the borders of New Zealand - many experts suggested that the central banks of other leading countries would follow this example and resort to aggressive measures to mitigate monetary policy. Not only the New Zealand dollar, but also the Australian one suffered, as not without fears, traders of the AUD/USD pair feared similar steps from the RBA.

In the following months, central banks of the leading countries of the world really lowered interest rates, but, firstly, not so aggressively, and secondly, ahead of time warning the markets about planned actions. Unfortunately, the level of communication in the Reserve Bank of New Zealand leaves much to be desired: contrary to the general expectations of traders, the regulator unexpectedly paused the process of easing monetary policy in November, demonstrating quite irrational optimism regarding the growth of the national economy at the last meeting this year.

On the eve of the November meeting, the probability of a rate cut to 0.75% was almost one hundred percent. This fact has already been largely taken into account in current prices. Analysts mainly discussed another dilemma, which was to determine the future prospects of monetary policy. According to some analysts, the central bank will not rule out a reduction in the rate to 0.5% at the beginning of 2020; according to others, the regulator will limit itself to the November decrease, then putting the issue of easing monetary policy on hold. In general, everyone was mistaken: according to the Reserve Bank of New Zealand, the situation in the country's economy after the August meeting did not require changes in the parameters of monetary policy.

At the same time, the regulator ignored many alarms. The latest data on New Zealand's GDP growth indicates a slowdown in the national economy: in the second quarter, the key indicator grew to only 2.1% in annual terms, and in quarterly terms - by 0.5%. Published figures indicate that New Zealand's economy has slowed to its lowest level in five years. New Zealand labor market data also turned out to be weak. After falling to 3.9%, in the third quarter the unemployment rate jumped immediately to 4.2%. The increase in the number of employees likewise showed a negative trend. If in the second quarter this indicator reached 0.6% q/q, then in the third quarter it dropped to 0.2%. In annual terms, the picture is not better - the indicator has been steadily decreasing since the third quarter of 2018, having decreased from 3.7% to the current 0.9%. The level of wages in the private sector also decreased.

These trends eloquently indicate the negative consequences of the global trade conflict. It is likely that the New Zealand regulator decided to take a break, while maintaining the hope of signing a historic deal between the US and China. However, the news background regarding the prospects of the negotiation process is quite pessimistic. Neither Washington nor Beijing are going to make significant concessions. Trump again threatens with duties, while representatives of China "hold the defenses", while maintaining eastern calm. At the same time, barriers continue to operate, and global economic activity continues to weaken. The head of RBNZ has repeatedly repeatedly focused on this - according to him, the global trade conflict ricocheting reduces the demand for goods and services in New Zealand. Taking into account the voiced position, it can be assumed that the issue of reducing rates has not been completely removed from the agenda.

Actually, at the last meeting, members of the New Zealand central bank did not exclude this scenario: according to them, the regulator is open for further additional incentives "if necessary."

But it is worth noting that the next RBNZ meeting will take place only in February next year, so until that time the fluctuations of the NZD/USD pair will depend on current macroeconomic statistics, the external fundamental background and the behavior of the US currency. The New Zealand central bank did not put an end to the cycle of easing monetary policy - now everything depends on the current situation. According to some experts, the RBNZ will return to this issue in May, according to others - much earlier, literally at the first meeting of 2020.

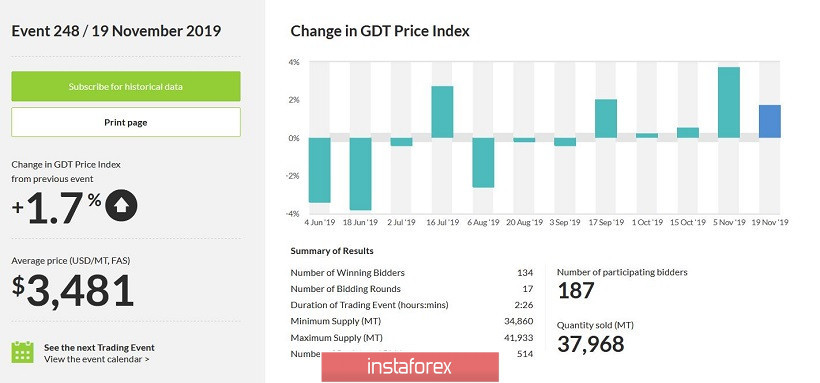

Today's upward dynamics of the NZD/USD pair is explained by the increase in the price index for dairy products. Recent Global Dairy Trade auctions (which are held once every two weeks) have shown that the cost of basic dairy products is growing, despite the general weak demand from China and general overproduction. Nevertheless, since early September, the indicator has been above zero, and today it reached 1.7%. This fact provoked interest in the New Zealand dollar, after which the kiwi again entered the 64th figure.

But this price dynamics must be treated with caution. The pair approached the resistance level of 0.6450 - this is the upper line of the Bollinger Bands indicator on the daily chart. Buyers have repeatedly tested this level, but to no avail. Therefore, long positions in a pair are relevant only if the price consolidates on the above target (in this case, the Ichimoku indicator will generate a bullish Parade of Lines signal). The support level is the price 0.6310 - this is the lower line of the Bollinger Bands, which coincides with the lower boundary of the Kumo cloud on D1.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română