Yesterday's news that D. trump met with the head of the Federal reserve J. Powell, which discussed the topic of monetary policy of the regulator, excited investors.

According to media reports, the American president raised the topic of negative interest rates at the meeting, citing the need to stimulate the American economy through them and make its exports more competitive in world markets. As usual, Trump also highlighted his view of the meeting on Twitter, calling it good.

Against this background, the dollar went down sharply in the currency exchange markets, but a press release was issued on behalf of the Fed, which showed that the head of the Central Bank of the United States did not discuss his expectations on monetary policy with the president and that the regulator would act carefully based on the current situation in the economy and financial markets, objectively, excluding political winds. Already on the background of this news, the markets began to win back by buying the dollar.

Again, this situation does not demonstrate any clear, concise, and coordinated policy between the president and the Federal Reserve regarding the monetary rate. This is an important destabilizing factor that does not allow investors to understand what can be expected in the near and distant future from the monetary policy of the Central Bank. To the situation of uncertainty that exists around the prospects for a trade negotiation process between Washington and Beijing, the risks of pressure from Trump on the Fed are added. All this together leads to the fact that high volatility remains in the financial markets and the markets will fall or grow in the near future on any meaningful and not very news or gossip around negotiations on trade or the monetary rate of the regulator.

In this sense, it will be interesting to publish the minutes of the last meeting of the Federal Reserve, which will be presented this Wednesday. In it, investors will seek confirmation of maintaining the previously chosen rate for a pause in raising interest rates or not. In the meantime, we expect the consolidation period to continue in the markets, including currency exchange.

For the euro currency, the ECB President C. Lagarde will make an important statement, from which they will expect commentary on the bank's course, whether it will follow the precepts of M. Draghi or whether it will follow the lead of a number of Central Banks of economically strong countries of the Eurozone and will not follow the path of continuing the course super soft monetary policy. In the meantime, in anticipation of this euro currency, it can continue the local ascent, overcoming some levels that are technically important.

Forecast of the day:

The EUR/USD pair is trading near the level of 1.1075. Fixing the price above this level in the wake of the local weakness of the dollar and expectations of Lagarde's performance may lead to further limited growth of the pair to 1.1175.

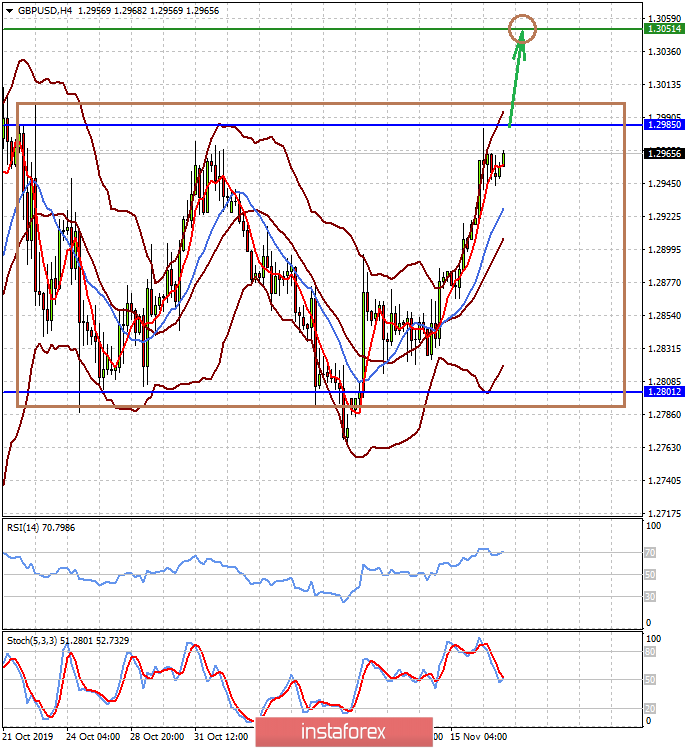

The GBP/USD is consolidating in the range 1.2800-1.2985 in the wake of the lack of clear prospects for Brexit's future. It is likely that the pair will continue to grow to 1.3050 amid the weakness of the dollar after crossing the level of 1.2985.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română