The euro-dollar pair is trading on Monday amid conflicting fundamental factors. Weak position of the US currency, as well as positive news flow regarding Brexit's prospects push the pair up, while the Bundesbank's pessimistic report and the dovish comments of the ECB representatives are holding back the pair's growth. Such a system of "checks and balances" retains the flat, although the general market sentiment is still in favor of the euro. There are several reasons for this.

The Bundesbank monthly economic report published today was indeed negative. The experts of the German central bank admitted that it is quite likely that the country's economy will slow down in the fourth quarter of this year. According to them, the German economy may enter a state of stagnation "to some extent". Such forecasts put background pressure on the euro, holding back the EUR/USD growth. But at the same time, the report of the German central bank could not deploy the pair. Firstly, the members of the Bundesbank noted that in the implementation of the worst-case scenario, the economic slowdown in Germany will be short-term and restrained. Secondly, the economists of the central bank urge not to worry about the onset of the recession. Thirdly, domestic demand remains high, and this fact is likely to maintain the momentum of economic growth in the country.

In addition, the report released today was viewed by the market through the prism of recently released data on German GDP growth in the third quarter. Let me remind you that in annual terms, the German economy immediately grew by 1%, while experts expected a decrease of 0.1%. The German economy not only avoided the recession, but also showed the strongest growth dynamics over the past year. In addition, good data on the growth of the eurozone GDP were published last week - a key indicator in annual terms came out slightly better than expected.

In other words, one of today's central reports frighten EUR/USD traders, but, on the other hand, played the role of a deterrent. Also, investors drew attention to the dovish comments by member of the ECB Board of Governors Bostjan Vasle (head of the central bank of Slovenia). He said that the European regulator still retains the potential to further lower rates "in case of a change in the situation." Vasle also noted that he does not see any clear reasons for changing economic forecasts for the eurozone, especially amid weak industrial pace. However, he acknowledged that the service sector and the labor market show a "more positive picture." In turn, the head of the Bank of Spain, Pablo Hernandez de Cos, assured reporters that interest rates would remain at low levels "for a longer period." He also noted that geopolitical uncertainty could affect the financial stability of Spain.

Another ECB spokesman, Philip Lane, unexpectedly focused his attention on Brexit's prospects during his speech today. The chief economist at the European Central Bank admitted that the likelihood of a "hard" scenario has declined, although he is personally concerned about the effect of the "divorce proceedings" on Ireland. At the same time, he called on European countries to take appropriate steps with fiscal measures and structural reforms. Similar rhetoric was recently voiced by Christine Lagarde, for the first time acting as the head of the ECB. On the sidelines, she exerted verbal pressure on Germany and the Netherlands, urging them to use the surplus of their budgets.

Returning to today's events, it is worth noting that it was Brexit that provided indirect support to the European currency. The likelihood that Conservatives will win early elections to the House of Commons is growing every day, and so the likelihood of approval of a historic deal is growing. Today, Boris Johnson announced that each candidate from the Conservative Party signed a written pledge that, if elected, he would vote for the draft deal proposed by the prime minister with Brussels. According to the latest survey, almost 43% are ready to vote for Conservatives, only 28% for Labour, and 13% of the polled for Liberal Democrats. The growing likelihood of approval of the deal not only supports the pound, but also the European currency.

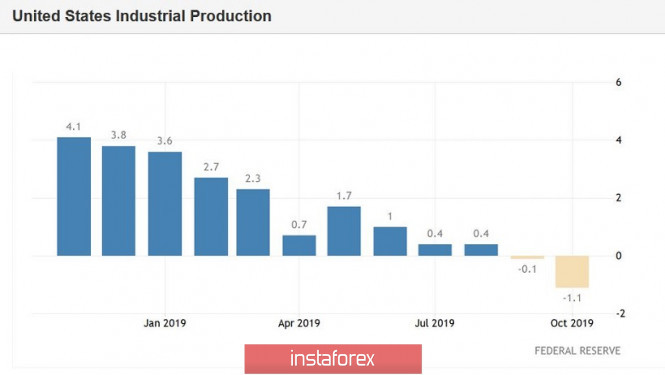

But the dollar is still under pressure. The crushing figures published last week on the growth of industrial production in the United States returned pessimism about the prospects for the US currency. In addition, recent events indicate that negotiations between the United States and China are quite difficult. The December meeting of superpower leaders is again in question. Donald Trump made it clear that he was not ready to satisfy Beijing's ultimatum (the abolition of September duties and the refusal of December), and China, in turn, said it was not going to commit itself to the annual acquisition of US $50 billion worth of agricultural products. If the parties can't find a compromise, the issue of reducing the Fed rate will return to the agenda again. At least Jerome Powell last week did not rule out this scenario.

Thus, conflicting events for the pair still hold it within the range of 1.0980-1.1090. At the moment, the pair is heading to the upper boundary of the range (the option of testing the 11th figure is not excluded), but it will be difficult for the bulls to stay above the 1.1090 mark without appropriate support from the fundamental background.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română