The new week in the markets begins with the continuation of the weakening of the US dollar in the wake of some demand for protective assets.

Last week, after reaching a local maximum, the dollar turned down against a basket of major currencies, where the single European currency plays the first fiddle. This dynamics can be explained, on the one hand, by investors' expectation of a speech this week by C. Lagarde, President of the ECB, from whom they are expected to clarify her personal position regarding the prospects of the monetary policy of the European regulator, and on the other, the lack of fresh news on the topic of negotiations between the US and China on trade. This, in our opinion, became the basis on the wave of technical overbought to the weakness of the dollar.

An additional negativity for it was the correction of the yield of American treasuries, which is also after growth to local levels. Thus, the benchmark yield of 10-year-old traders after testing the maximum of 1.973% on October 7 at electronic trading is at around 1.827% today.

Today, important economic data is not expected to be published, as well as any events that could significantly affect the dynamics of the currency exchange market. Therefore, we believe that the growth of the euro against the dollar will be limited. Its increase can also be explained by the closure of a number of short positions just in anticipation of Lagarde's speech, and not a change in the general paradigm regarding the prospects for the single currency rate.

At the same time, we believe that the new president of the ECB is likely to confirm the previous course taken by the bank by the previous leader M. Draghi. Previously, she made it clear in the comments that we consider it the most acceptable, especially since, according to published data, the European economy does not show a noticeable change in the situation towards improvement.

In general, we think that the currency exchange market, as well as gold, will consolidate in anticipation of Lagarde's speeches again and news on the negotiation process between Washington and Beijing.

Forecast of the day:

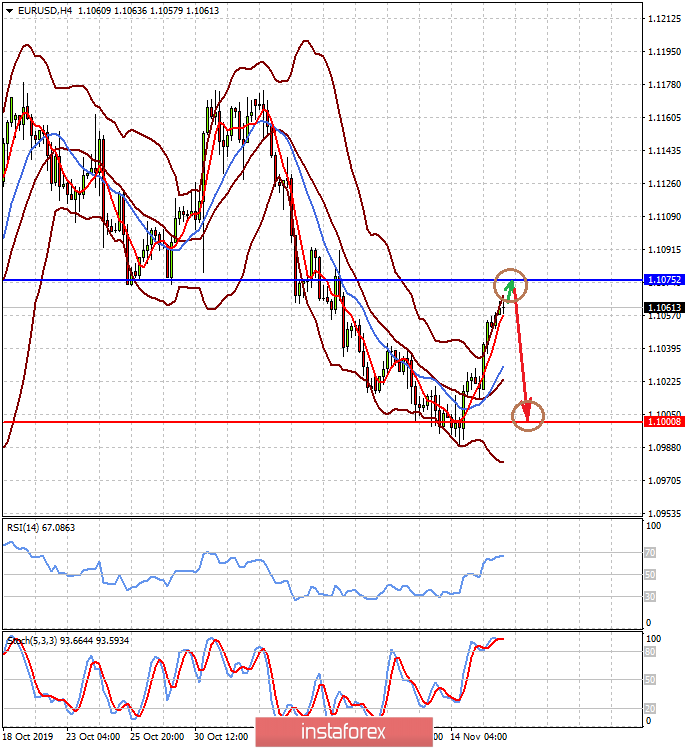

The EUR/USD is trading below the level of 1.1075. We do not expect its growth above this level. We consider it possible to sell the pair on growth from this level with the target of 1.1000.

The NZD/USD pair has limited growth potential to 0.6425, while it is likely to remain in the range 0.6330-0.6425. If the pair breaks out of it, we consider it possible to sell it with a local

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română