The Australian dollar paired with the US currency showed an upward impulse during the Asian session on Thursday. Blame everything - the release of data on the labor market in Australia. The September figures were mostly good, and this fact made it possible for AUD/USD bulls to strengthen the pair by several tens of points. However, the pair's growth was limited: the fact is that today (at 20:00 London time), the Reserve Bank of Australia Chairman Philip Lowe is expected to deliver a speech at the IMF. He will comment on the general situation for the first time after the conclusion of the US-Chinese negotiations, which, as you know, ended on a major note. In anticipation of this event, traders are in no hurry to open large positions, although the data released today allow us to count on a broader correctional growth of the aussie.

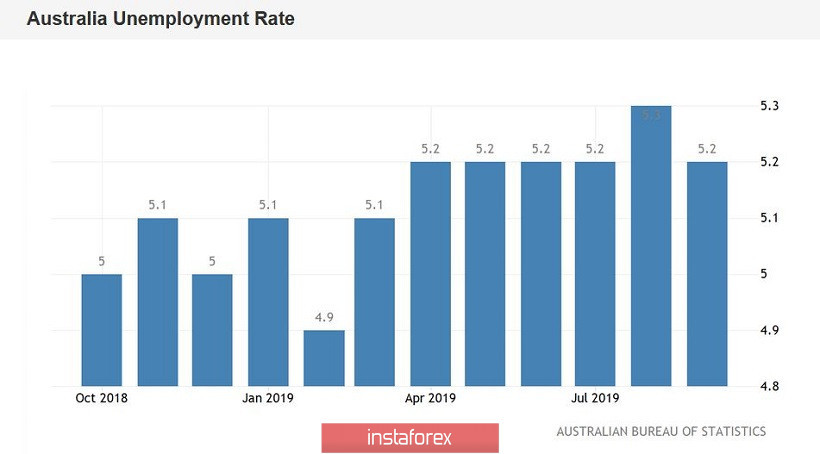

For four months - from April to July - the unemployment rate exceeded 5.2%. In August, this figure rose to 5.3%. And although the negative dynamics was low, this fact alarmed traders, since most analysts did not expect the growth of this indicator on the eve of the release. Many market participants expressed concern that further growth in unemployment would be negatively perceived by RBA members. In one of his speeches, the head of the Australian regulator expressed the opinion that the unemployment rate should ideally be reduced to 4.5% - only in this case, according to Low, the labor market will put upward pressure on wages. In other words, the results of the last RBA meeting made it clear that Australian labor market indicators will play a special role for the Australian currency.

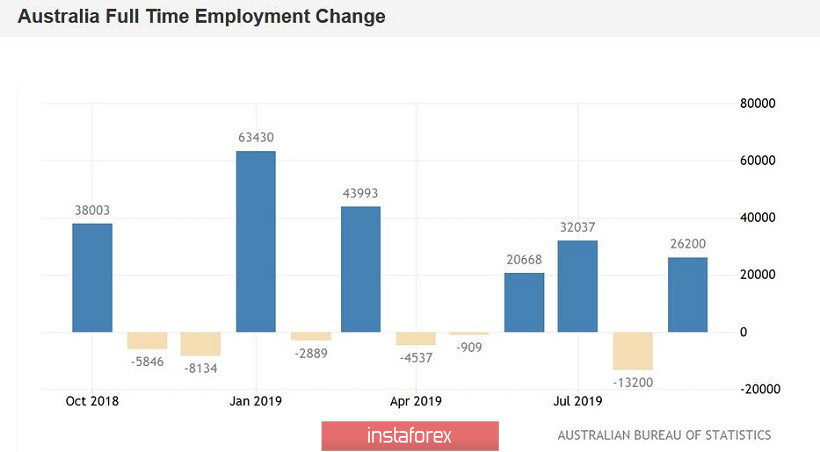

That is why today's numbers have had a positive effect on the aussie. Firstly, the unemployment rate returned to 5.2%. Secondly, the number of employment growth increased by 14.7 thousand. Although this is a relatively modest result (in the past months the release came out at the level of 36-37 thousand), it is separately necessary to dwell on the structure of this indicator.

The fact is that the positive dynamics of employment growth in September was mainly due to the growth of full employment - this component jumped by 26 thousand. But part-time employment, on the contrary, showed negative dynamics, decreasing by 11.4 thousand. This trend can have a positive effect on the dynamics of wage growth, as regular positions, as a rule, offer a higher level of wages and a higher level of social protection. In the context of recent statements by Philip Lowe, the data on the growth of the Australian labor market published today reduce the likelihood of aggressive measures to mitigate monetary policy by the RBA.

It is worth noting here that in early October, the head of the Australian central bank, Philip Lowe made it clear that the regulator is ready to continue to respond to the decline in key indicators, "playing ahead of the curve." He did not talk about any temporary guidelines, but the market then expressed confidence that by the end of the year the RBA would still lower the rate to 0.5%. In the framework of 2019, two more meetings will be held - November 5 and December 3. If the US-Chinese negotiations would have ended in failure, the regulator would probably have made the corresponding decision in November. But given the recent events, it is not worth rushing with these conclusions. Lowe is unlikely to ignore the good dynamics of the Australian labor market amid a "thaw" in relations between the US and China: with a high degree of probability, the RBA will take a wait-and-see position.

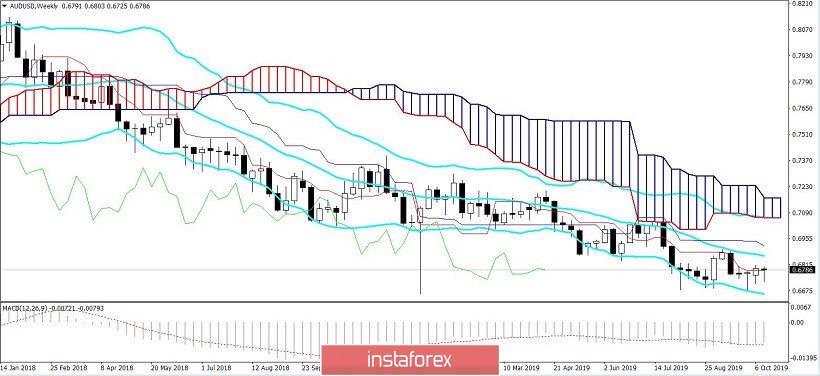

However, it is important for traders to hear the position of the head of the RBA. Over the past ten days, quite a lot of quite important events have occurred that can affect the position of members of the Australian regulator in general, and Philip Lowe in particular. Therefore, despite today's impulsive rise in the price of AUD/USD, the pair remained within the wide-range flat of 0.6705-0.6800. It's too early to talk about the turning point of the trend at all: for this, the aussie bulls need to overcome and gain a foothold above the key mark of 0.7000, confirming the strength of the upward movement. Until then, traders will be forced to trade within the above price range.

From a technical point of view, the AUD/USD pair has a growth potential to the midline of the Bollinger Bands indicator on the weekly chart, which corresponds to a price mark of 0.6850. If the pair overcomes this target, the Ichimoku indicator will generate a Golden Cross signal, which will open the way to the next resistance level of 0.7010 (the lower boundary of the Kumo cloud, which coincides with the upper line of the Bollinger Bands on the same time frame). However, for such a price spurt, a corresponding information line is needed related to the prospects for US-Chinese trade relations and the "hawkish" rhetoric of the RBA. Due to the weakness of the dollar, it will be difficult for AUD/USD buyers to reach similar price heights.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română