To open long positions on EURUSD, you need:

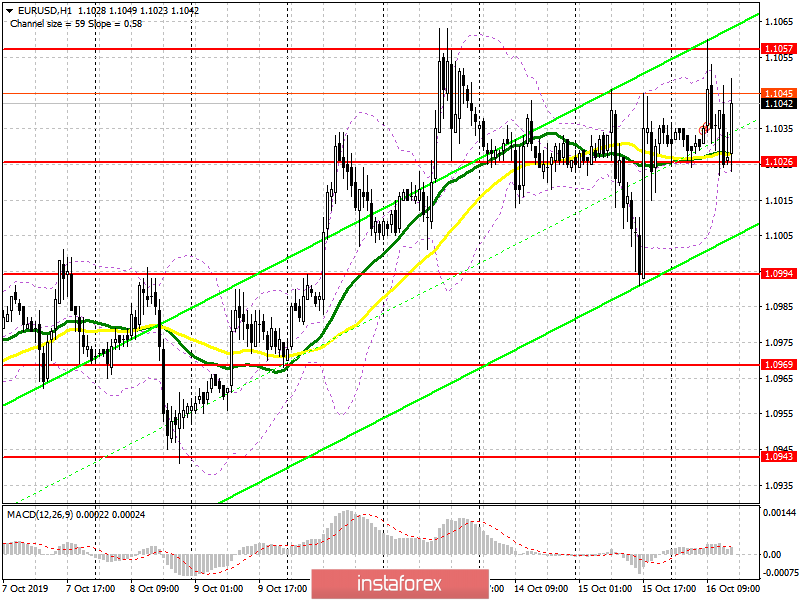

Inflation data in the eurozone were expected to be weak, but buyers of the euro managed to build support around 1.1025, and while trading is conducted above this level, there is a possibility of continuing upward correction. First of all, the bulls will be aimed at the resistance of 1.1060, above which they failed to get out in the first half of the day. Its breakthrough will provide EUR/USD with new buyers capable of driving the pair to the highs of 1.1080 and 1.1109. Good news on Brexit could also support the euro. In a reduction scenario, only the formation of a false breakdown in the support area of 1.1026 will be a signal to buy EUR/USD. However, larger long positions are seen at a minimum of 1.0994 and 1.0969.

To open short positions on EURUSD, you need:

Sellers need to urgently return to the level of 1.1026, so all the attention in the second half of the day will be focused on it. The speeches of the Fed representatives, who recently talked about lowering the interest rate in the United States, are unlikely to help the market in the North American session. Therefore, only fixing below 1.1026 will be a signal to open short positions to further reduce the pair to the lows of 1.0994 and 1.0969, where I recommend taking the profits. With further growth of EUR/USD, only the formation of a false breakdown near the weekly maximum of 1.1057 will be a signal to sell. Larger short positions are seen in the area of 1.1080 and 1.1109 resistance.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates a market equilibrium.

Bollinger Bands

Volatility has decreased, which does not give signals to enter the market.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română